The first trading day of a new week is marked with market calmness. This can be explained with market holidays in the United States and the United Kingdom, two of the world's most important financial hubs. However, there is a group of assets that stands out - precious metals. USD weakening today provides fuel for a recovery run on precious metals, following last week's declines.

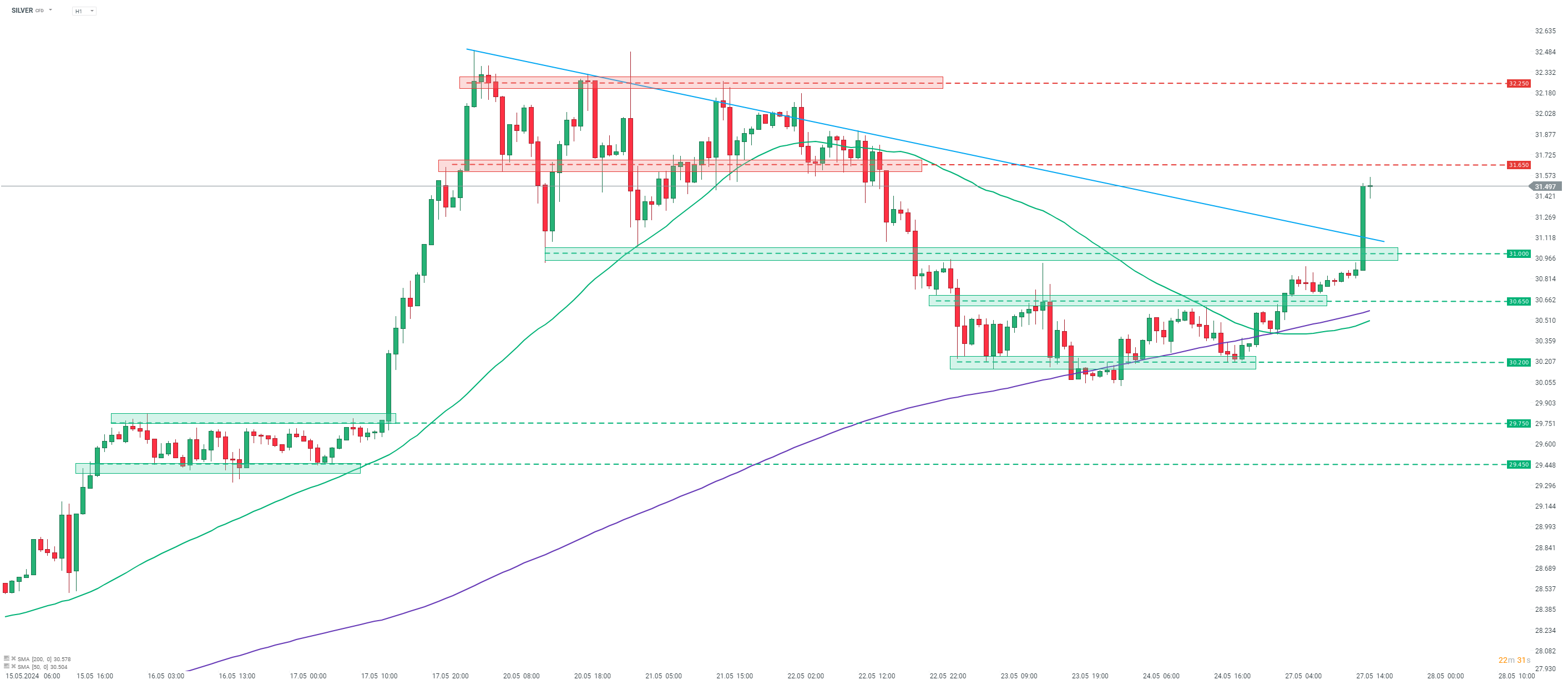

Gold is up 1% and trades above $2,350 per ounce, while SILVER rallies almost 4% and returns above $31.50 per ounce. Palladium surged around 3.5% and approaches $1,000 area. Platinum trades 2.5% higher near $1,050. The move higher may also be supported by ETF holdings data, which showed that ETFs continued to increase their holdings of silver, platinum and palladium last week. ETF gold holdings declined last week, what may be contributing to an underperformance of gold today, compared to other precious metals.

A point to note for traders is that trading on precious metals - GOLD, SILVER, PLATINUM and PALLADIUM - will close at 7:30 pm BST today due to US holiday.

SILVER is rallying almost 4% and returns to $31.50 area, recovering a bulk of last week losses. Source: xStation5

SILVER is rallying almost 4% and returns to $31.50 area, recovering a bulk of last week losses. Source: xStation5

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

BREAKING: Another strong increase of oil inventories. Oil WTI close to 74