Snowflake (SNOW.US) stock jumped more than 14% during today's session after the cloud data company posted strong fourth-quarter guidance and solid third-quarter results bolstered by its international expansion. Snowflake reported a loss of 51 cents compared with a loss of $1.01 per share a year earlier. Analysts expected the data platform provider to report a loss of 60 cents. Snowflake stock does not break out adjusted earnings in its earnings releases. Company also reported quarterly sales of $334 million, a massive increase from $160 million a year ago, above market expectations of $306 million.

For the current quarter ending in January, Snowflake forecasts product revenue in a range of $345 million to $350 million, topping estimates of $316 million. That would represent year-over-year growth between 94% and 96%. For the full 2022 fiscal year the company expects revenue in the region from $1.126 billion to $1.131 billion, above Wall Street projections of $1.06 billion. That would represent year-over-year growth between 103% and 104%.

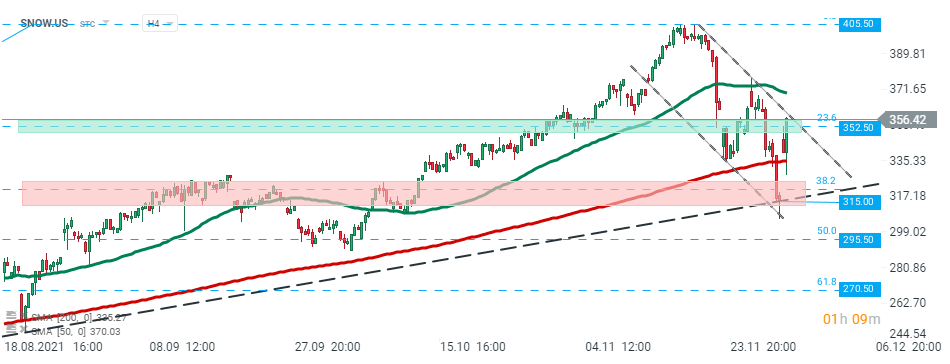

Snowflake (SNOW.US) stock fell sharply recently, however buyers managed to halt declines around the support zone at $315 which coincides with 38.2% Fibonacci retracement of the last bullish wave and upward trendline. Stock launched today's session higher and is currently testing upper limit of the local descending channel which is strengthened by 23.6% Fibonacci retracement. Should break higher occur, upward move may accelerate towards all-time high at $405.50. Source: xStation5

Snowflake (SNOW.US) stock fell sharply recently, however buyers managed to halt declines around the support zone at $315 which coincides with 38.2% Fibonacci retracement of the last bullish wave and upward trendline. Stock launched today's session higher and is currently testing upper limit of the local descending channel which is strengthened by 23.6% Fibonacci retracement. Should break higher occur, upward move may accelerate towards all-time high at $405.50. Source: xStation5

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Market wrap: European and US stocks try to rebound rebound 📈

Paramount Skydance shares under pressure after S&P warning