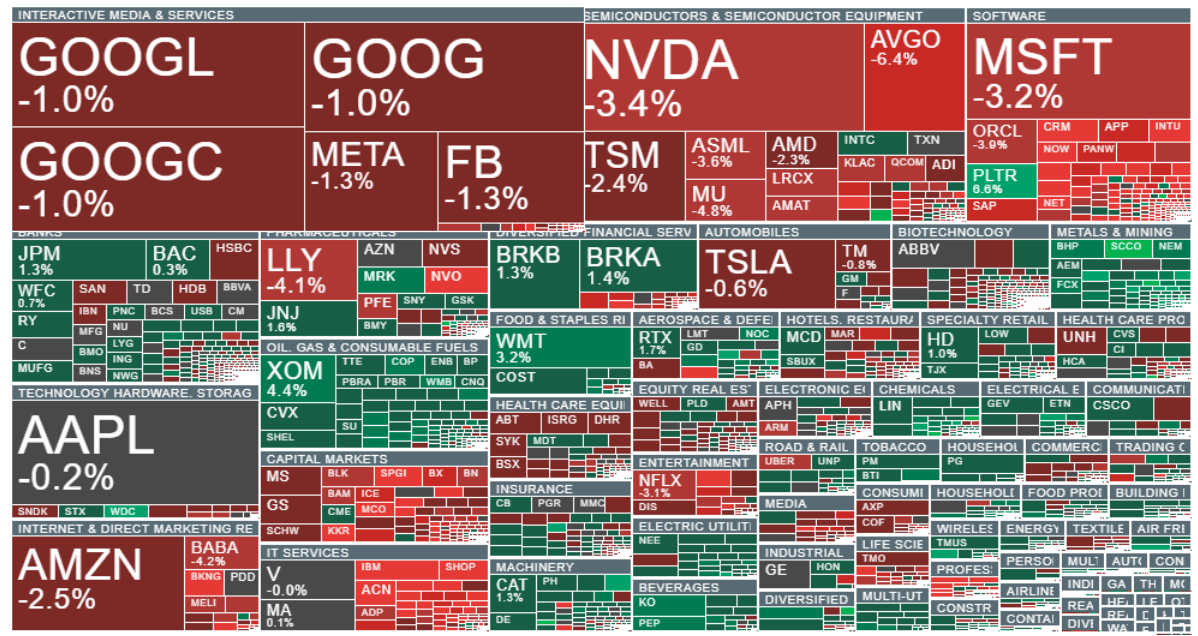

Anthropic enters legal tech: the market is reacting violently because this is a move into the application layer, not “just another AI model.” Traders are dumping software stocks across the space as fears build that artificial intelligence could materially undermine established business models.

- Anthropic’s announcement of a legal plug-in for Claude triggered an immediate and sharp reaction in equities. Not because investors have “suddenly discovered AI,” but because the private company Anthropic is no longer positioning itself purely as a large language model provider. It is stepping into applications and business workflows, which is where demand is actually monetized.

- The new plug-in is designed to support core legal tasks such as document review, risk flagging, NDA triage, and compliance tracking. This set of capabilities goes straight at the heart of many legal software products: tools embedded in the day-to-day workflows of legal departments, law firms, and compliance teams.

In practice, the market interpreted the news as an acceleration of disruption risk for traditional platforms. Part of the value could migrate from legacy data and workflow vendors toward a new AI-driven interface layer. Over recent months, “AI disruption” risk has been steadily rising across software, but Anthropic’s move into legal tech has several characteristics that amplify investor anxiety:

-

This is not a “chat” product. It is positioned as a tool for executing concrete operational tasks.

-

Plug-ins are a natural distribution mechanism because they allow the model to pull directly from a customer’s tools and data.

-

Legal is an industry where high margins and premium pricing are justified by time savings and risk reduction. If AI captures part of that value, valuation pressure could become meaningful.

An important backdrop is Anthropic’s earlier launch of Claude Cowork, a more accessible version of Claude Code. Claude Code is an agentic tool that runs in the terminal, while Cowork is a more “no-code” product that lowers adoption barriers. From a market perspective, the shift from engineer-focused tooling to business-user workflows typically implies a much larger potential adoption curve.

Source: xStation5

Scale of the reaction: selling pressure across legal software and data analytics

Following the plug-in news, the market sold off stocks tied to legal software, publishing, and data-driven business models. We saw declines in names such as Pearson, RELX (LexisNexis), Thomson Reuters, Wolters Kluwer, and Sage. From an investor’s standpoint, it is important to note that this was largely a basket-style reaction: capital reduced exposure to the entire “legal + data” segment without carefully differentiating business models or assessing company-specific sensitivity to technological change. That is typical behavior in the first phase of a narrative shock.

The most important takeaway is the shift in where value is captured across the stack:

-

A large language model provider sits in the infrastructure layer.

-

A plug-in that executes work and integrates with tools is part of the application layer.

-

The application that controls the user’s workflow has the greatest ability to capture budget.

In simplified terms, the market is pricing a scenario in which Anthropic not only supplies intelligence, but becomes the operational layer through which work flows. That layer tends to host the most resilient and defensible SaaS revenue streams.

What may be misleading in the market’s reaction

Despite the severity of the sell-off, it does not automatically mean that traditional legal tech providers are losing their relevance. This segment has durable advantages that are difficult to replace with “AI alone,” including:

-

trusted and high-quality sources,

-

citability and auditability,

-

version control, activity logs, and governance,

-

compliance with regulations and industry standards,

-

accountability and enterprise-grade data security.

Therefore, the key question is not “will AI replace legal software,” but rather: to what extent will AI commoditize functions that are currently monetized through subscriptions, and can incumbents defend pricing power by integrating AI into their own platforms?

The next phase will be about evidence. Markets will look for data that confirms or disproves the disruption thesis. The most important indicators to monitor include:

-

churn and retention trends in legal software,

-

discounting pressure during renewals,

-

the pace of AI module upsell,

-

changes in sales cycles (longer decision-making),

-

signals of user migration toward alternative solutions.

In parallel, investors should watch how Anthropic addresses legal-critical requirements: security, access controls, logging, source citation, integration into customer systems, and its go-to-market distribution model. Without these, adoption in large organizations may remain limited, even if the product is compelling from a feature standpoint.

Today’s sell-off is primarily a signal that investors are increasingly treating AI as a direct risk to certain software business models, especially those built more on “knowledge and access” than on deeply embedded workflows. Anthropic’s entry into legal tech matters because it represents expansion into the application layer, not merely another step in model development.

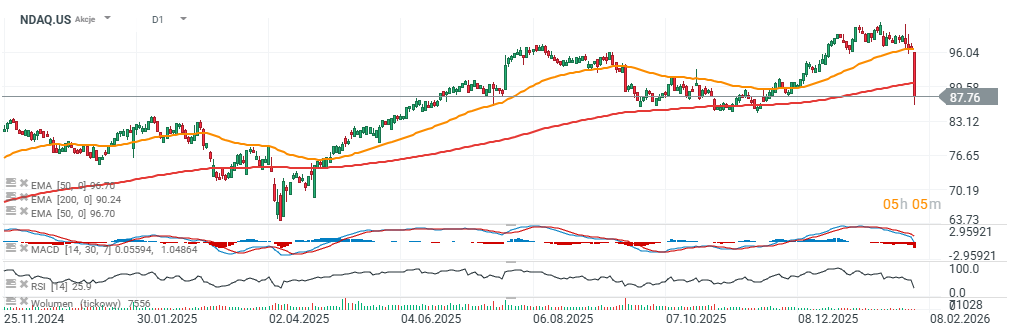

At this stage, the market is pricing risk in a simplified way, effectively selling “everything.” The next stage is selection. Companies that can turn AI into a workflow amplifier and defend pricing power will have a credible path to stabilizing, or even re-rating, valuations. Shares of US software & financial company Nasdaq (NDAQ.US) are falling below EMA200 today.

Source: xStation5

PayPal shares slide 5% as Semafor denies Stripe acquisition rumors📉

US100 loses 1% amid Nvidia weakness 📉Heico crashes 13%

D‑Wave Quantum: Concrete Results Today, Big Dreams Tomorrow

Will Nvidia’s report reignite optimism on Wall Street?