Summary:

-

Chevron announced next year’s budget for capital projects

-

Company to increase capex for the first time in four years

-

Big investment in upstream business are on the way

-

Chevron holds a streak of over 25 years of consecutive dividend increases

-

Chevron (CVX.US) stock is trading within the consolidation range

The latest steep sell-off on the oil market raised questions whether prices did not fall so low to make a bulk of oil production unprofitable. However, most of the oil companies earn enough at periods of high prices to allow them survive oil price declines and even keep rising dividends. Chevron Corp (CVX.US) is one of such companies. In this analysis we will take a look at Chevron’s planned investments in 2019 as well as how the company compares with major rivals.

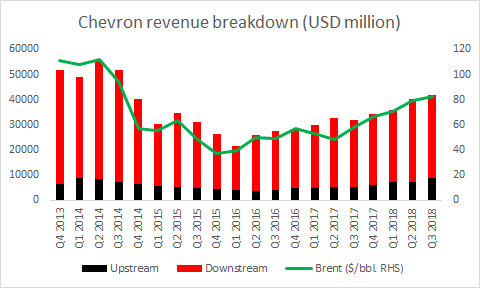

Most of Chevron’s revenue comes from its downstream business. Apart from that, overall revenue is to high degree correlated with oil prices. Source: Bloomberg, XTB Research

Most of Chevron’s revenue comes from its downstream business. Apart from that, overall revenue is to high degree correlated with oil prices. Source: Bloomberg, XTB Research

Chevron Corp (CVX.US) unveiled its budget for 2019 recently and a pleasing shift in comparison to previous years can be found in it. Namely, the company plans to spend as much as $20 billion on capital projects next year. While one may question whether this figure is big or not for a company of Chevron’s size, the important feature is that it will be the first capex budget increase in four years. The company announced that a bulk of capital spending next year will be on projects with high returns and short cycles that will realize cash flows within two years from investment. Over $17 billions will be spent on investments in upstream business while around $2.5 billion will be spent on projects related to downstream business. The budget breakdown is in line with general trend in the industry as upstream business, that includes exploration and extraction activities, consumes much more capital than the downstream segment, focused on refining and processing of crude.

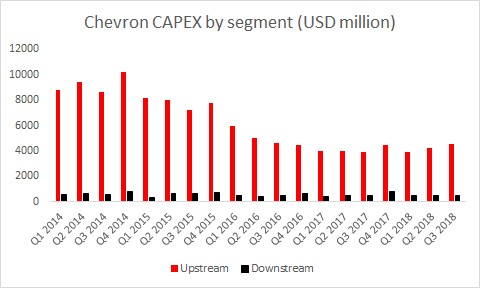

While upstream business generates significantly smaller revenue than downstream it also requires significantly higher capital expenditures. Source: Bloomberg, XTB Research

While upstream business generates significantly smaller revenue than downstream it also requires significantly higher capital expenditures. Source: Bloomberg, XTB Research

Out of $17.3 billion to be spent on upstream business as much as $7.6 billion will be invested in the US projects with the rest spent on international projects. A total of $10.6 billion will flow to projects aimed at growing capacity and maintenance of current production assets while over $5 billion is budgeted into major capital projects that are currently underway. The remaining portion of the upstream capex budget - around $1.8 billion - will be invested in early-stage projects with potential to boost future earnings. Among major upstream segment investments planned for 2019 one can find further expansion of the Future Growth Project in Kazakhstan as well as further investments in the US Permian Basin region. Planned investments in downstream business are aimed mostly at maintaining and sustaining current operations.

Chevron managed to improve most of its financial ratios in 2017 when oil prices rebounded. Source: Bloomberg, XTB Research

Chevron managed to improve most of its financial ratios in 2017 when oil prices rebounded. Source: Bloomberg, XTB Research

As depicted on the chart above Chevron did quite poorly in the 2013-2017 period. Margins, efficiency ratios as well as liquidity measures were all lower in 2017 compared to 2013. However, it should be noted that oil prices slumped during this period. Actually, when we compared 2017 to 2016 or 2015 we can see an improvement. With a bounce in the oil prices Chevron once again turned profitable and managed to decrease its leverage. Along with a pick-up in turnover ratios company’s operating and cash conversion cycles shortened. The company claims that as long as Brent price stays above $60 per barrel it can reach its cash flow breakeven. Brent price currently sits around the $60 handle but OPEC+ group recently agreed on production cuts in 2019 therefore there is a scope for a rebound on the oil market and in Chevron’s earnings along with it.

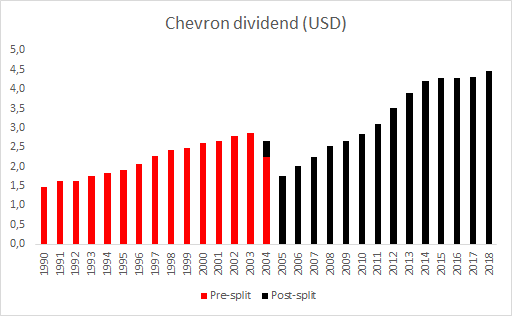

Chevron was continuously raising dividend payout since 1990. Drop seen on the chart in 2004 and 2005 was result of 2-for-1 stock split. Source: Bloomberg, XTB Research

Chevron was continuously raising dividend payout since 1990. Drop seen on the chart in 2004 and 2005 was result of 2-for-1 stock split. Source: Bloomberg, XTB Research

Despite operational ups and downs investment in Chevron is especially interesting from the long-term perspective. This is because the company has solid dividend policy that makes it regular member of the S&P Dividend Aristocrats index. Dividend Aristocrats are large-cap stock that increased dividend payout in each of the past 25 years. As depicted on the chart above this holds true for Chevron. Indeed, a drop can be seen in 2004 and 2005 but this resulted from a 2-for-1 stock split that took place in late-2014. Adjusting for the effect of a split Chevron’s dividend would kept rising in absolute values throughout the whole period.

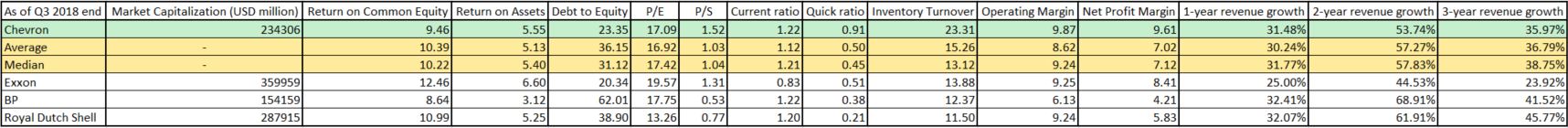

Selected financial data of Chevron and its main competitors. Source: Bloomberg, XTB Research

Selected financial data of Chevron and its main competitors. Source: Bloomberg, XTB Research

On the chart above one can find selected financial data from Chevron and its major competitors: ExxonMobil, Royal Dutch Shell and BP. Chevron is superior to its peers in terms of generating cash from its assets as presented by ROA higher than both industry average and median. However, the company seems to lag industry when it comes to return on equity what can be ascribed to smaller degree of financial leverage (Debt to Equity ratio significantly below industry median and average). Chevron’s earnings multiple (P/E) is inline with industry average and median while above-average sales multiple (P/S) may suggest that investors are expecting increase in revenues in the future. Chevron’s liquidity position seems to be superior to its peers as the company holds the highest quick and current ratios. Profit and operating margins also bode well for the stock and signal that the company is more efficient than its peers. One thing of concern could be a bit sluggish revenue growth in comparison to industry peers.

Chevron (CVX.US) reached $133.85 handle in mid-January 2018, the highest level since 2014 slump on the oil market. The stock saw some hectic moves since then but the price action settled as of late. Chevron share price is trading in a range marked by 23.6% and 50% retracement levels of the early-2018 slump. Source: xStation5

Chevron (CVX.US) reached $133.85 handle in mid-January 2018, the highest level since 2014 slump on the oil market. The stock saw some hectic moves since then but the price action settled as of late. Chevron share price is trading in a range marked by 23.6% and 50% retracement levels of the early-2018 slump. Source: xStation5