CVS Health Corporation is a company that has been part of the daily lives of millions of Americans for years. Its pharmacies are present in almost every city, while its health insurance and medical services allow it to operate on multiple fronts simultaneously. Although often considered a defensive company, CVS is not standing still. The growing number of customers in need of healthcare and its ability to benefit from market dynamics make the company a stable presence in a world full of uncertainty. For investors, this represents an opportunity to combine safety with participation in a market that continues to grow alongside societal needs.

Business Profile

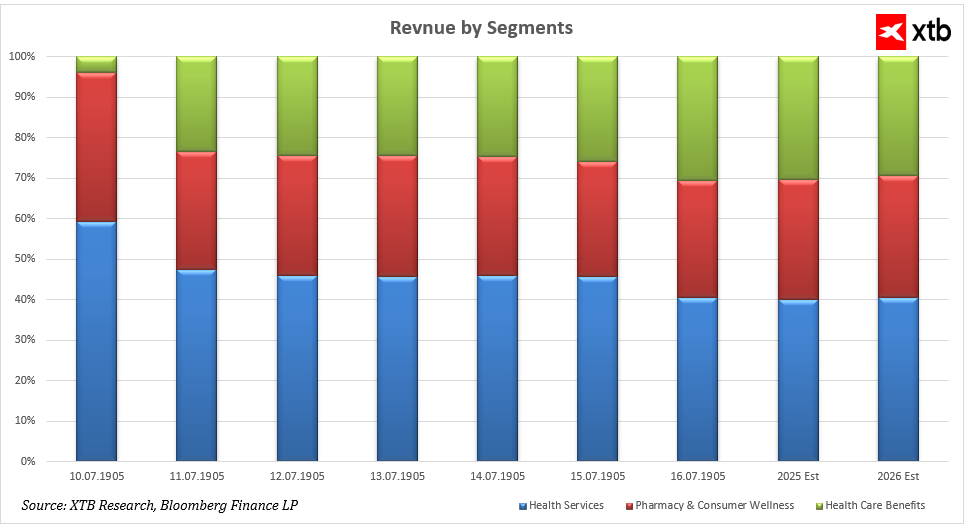

Historically, the main revenue driver for CVS has been the Health Services segment, which includes healthcare and retail pharmacy services, and in 2018 accounted for more than half of the company’s total revenue. Over time, however, its share of revenue gradually decreased, while the Health Care Benefits and Pharmacy & Consumer Wellness segments gained increasing significance. Since 2019, the Health Care Benefits segment, which includes both public and commercial health insurance, has grown significantly. This growth is driven by rising demand for private and government insurance, as well as the integration of new healthcare delivery models such as Oak Street Health and Signify Health.

At the same time, the Pharmacy & Consumer Wellness segment has steadily increased its role through investments in customer service technology, implementation of wellness retail formats, growing prescription drug sales including specialty therapies, and acquisitions of assets from the Rite Aid network. An analysis of revenue structure by percentage shows that by 2024, Health Services accounted for roughly one-third of total revenue, while Health Care Benefits and Pharmacy & Consumer Wellness contributed the remaining share in similar proportions. Forecasts for 2025 and 2026 indicate that all three segments will represent roughly equal portions of revenue, reflecting gradual diversification and balance across the company’s income sources.

While Health Services remains an important revenue engine, Health Care Benefits and Pharmacy & Consumer Wellness are playing an increasingly significant role. They are driven both by demographic trends, such as an aging population and higher healthcare spending, and by changing market needs that demand convenient and integrated healthcare solutions. CVS’s business model transformation demonstrates a shift from a traditional pharmacy toward comprehensive health and wellness solutions, diversifying revenue sources and increasing resilience to market volatility.

Financial Analysis

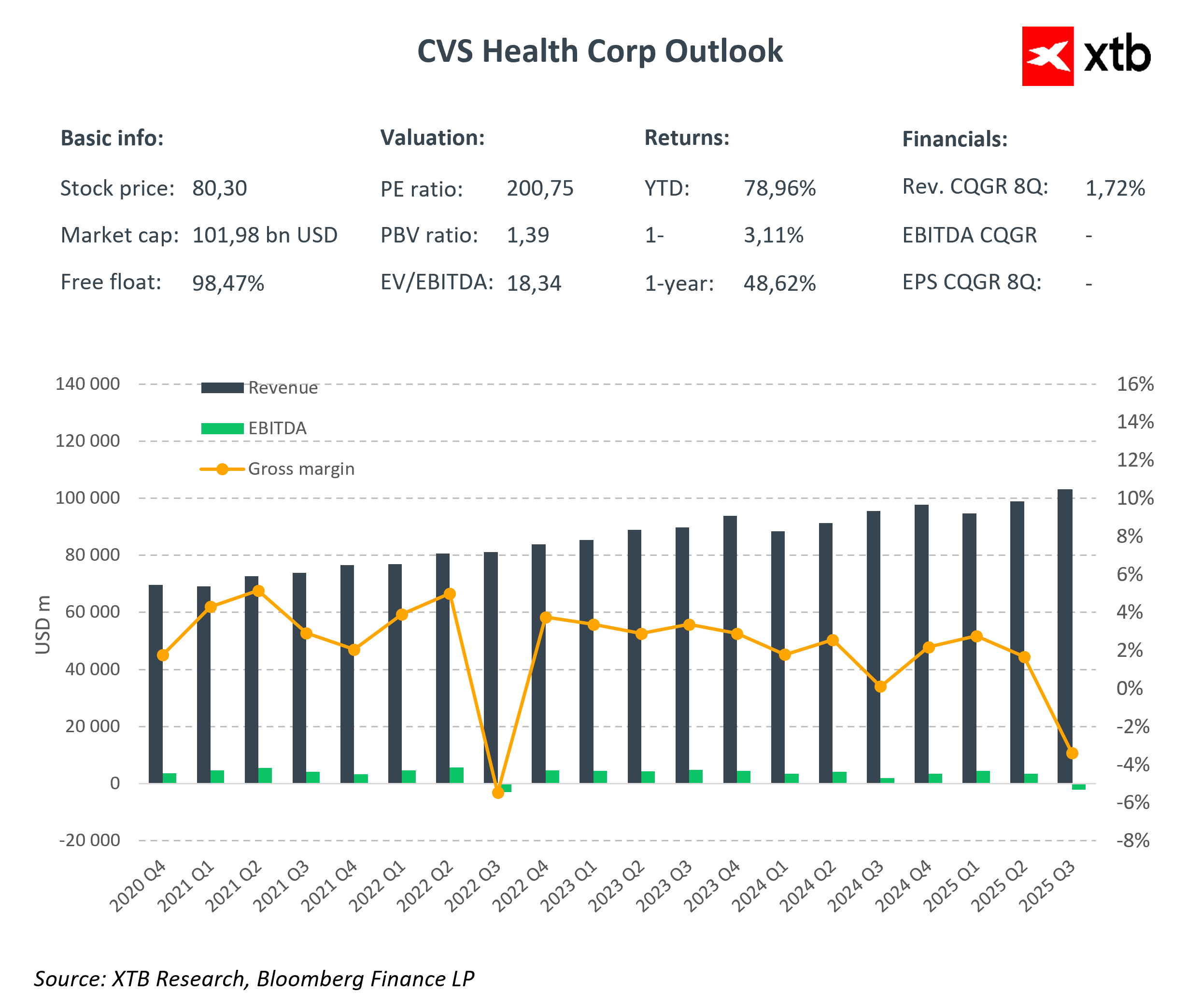

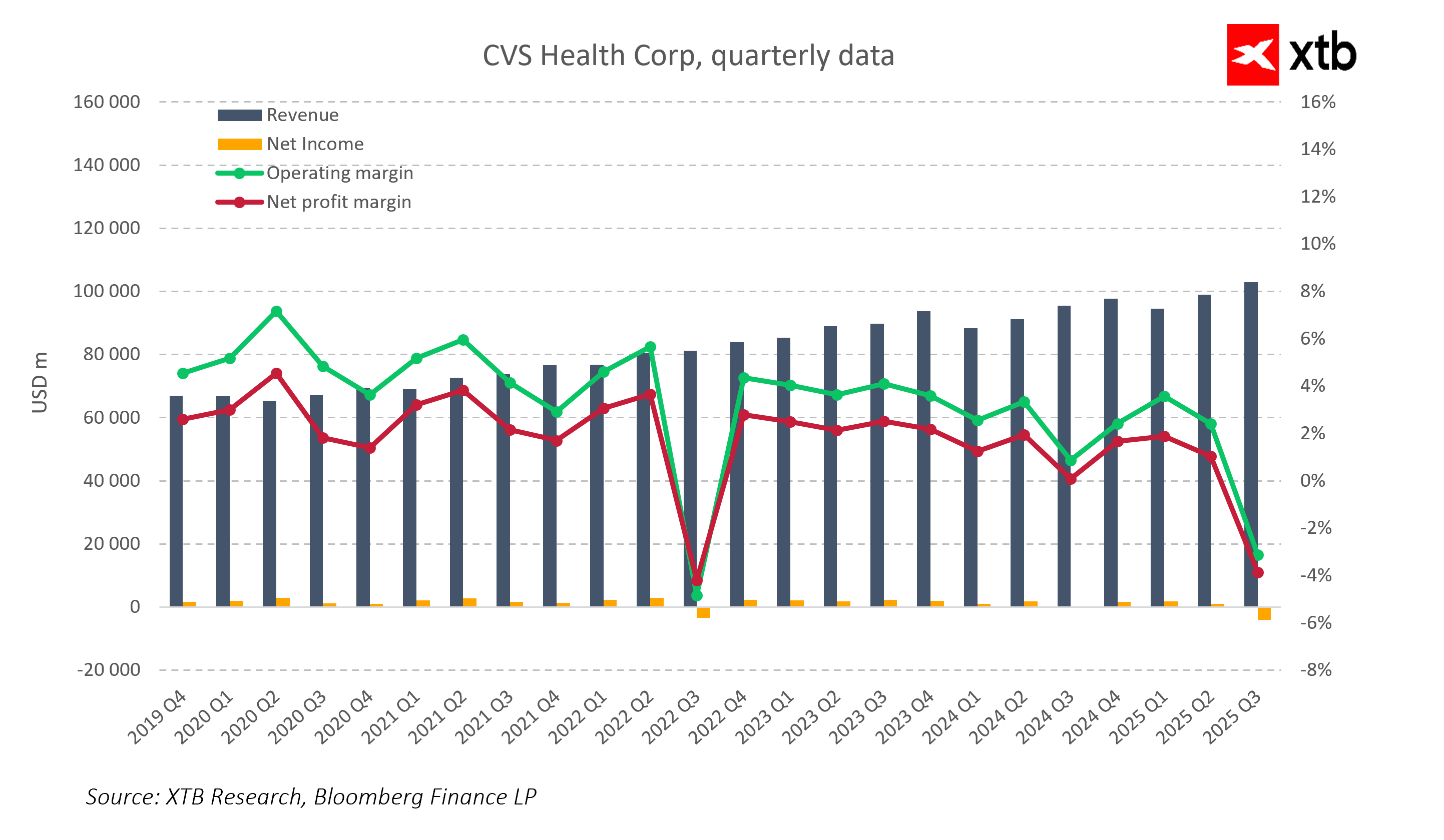

CVS Health’s recent quarterly results and forecasts through the end of 2025 confirm that the company maintains solid fundamentals and steady revenue growth despite temporary challenges. Revenues have consistently increased historically and are projected to continue rising, reflecting a strong market position and sustained demand for healthcare and pharmacy services. Periodic fluctuations are seasonal and do not disrupt the long-term growth trend.

A temporary decline in profitability in the third quarter of 2025 was due to one-time events rather than a deterioration in operational performance. The largest impact was a goodwill write-down of approximately $5.7 billion in the Health Care Delivery segment, which includes Oak Street Health and Signify Health clinics. Asset revaluation and scaled-back expansion in this part of the business were accounting measures, temporarily affecting EBITDA but not real operational efficiency. Additional smaller one-time items included restructuring reserves and the sale of Omnicare. Although these events temporarily lowered profitability, they support portfolio optimization and organizational efficiency in the longer term.

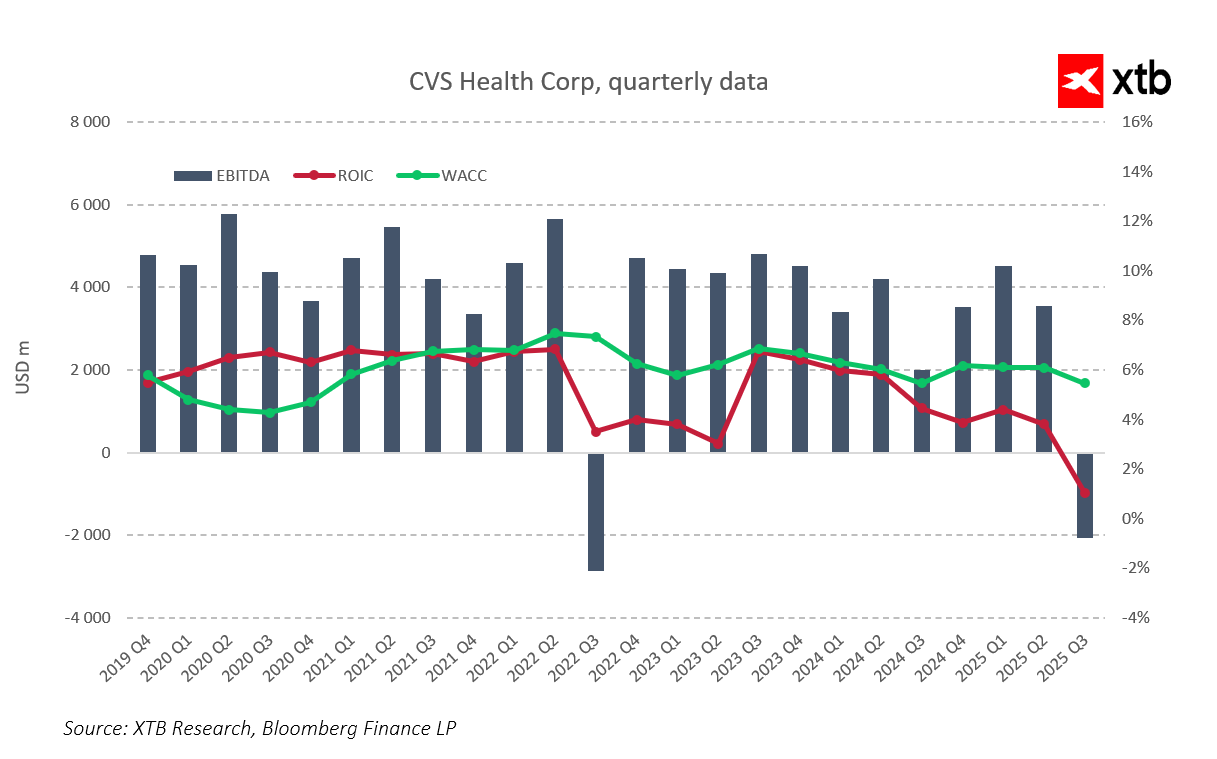

Segment-level analysis shows that the negative impact was concentrated in Health Services, while Health Care Benefits and Pharmacy & Consumer Wellness remained stable, recording year-over-year improvements in margins and revenues. EBITDA remained positive for most of the 2019–2025 period, confirming operational effectiveness. The negative EBITDA in the third quarter of 2025 was solely the result of goodwill write-downs. At the same time, the ROIC temporarily dropped near zero, while the WACC remained stable at 5–7 percent, indicating that the cost of capital did not increase despite the temporary decline in profitability.

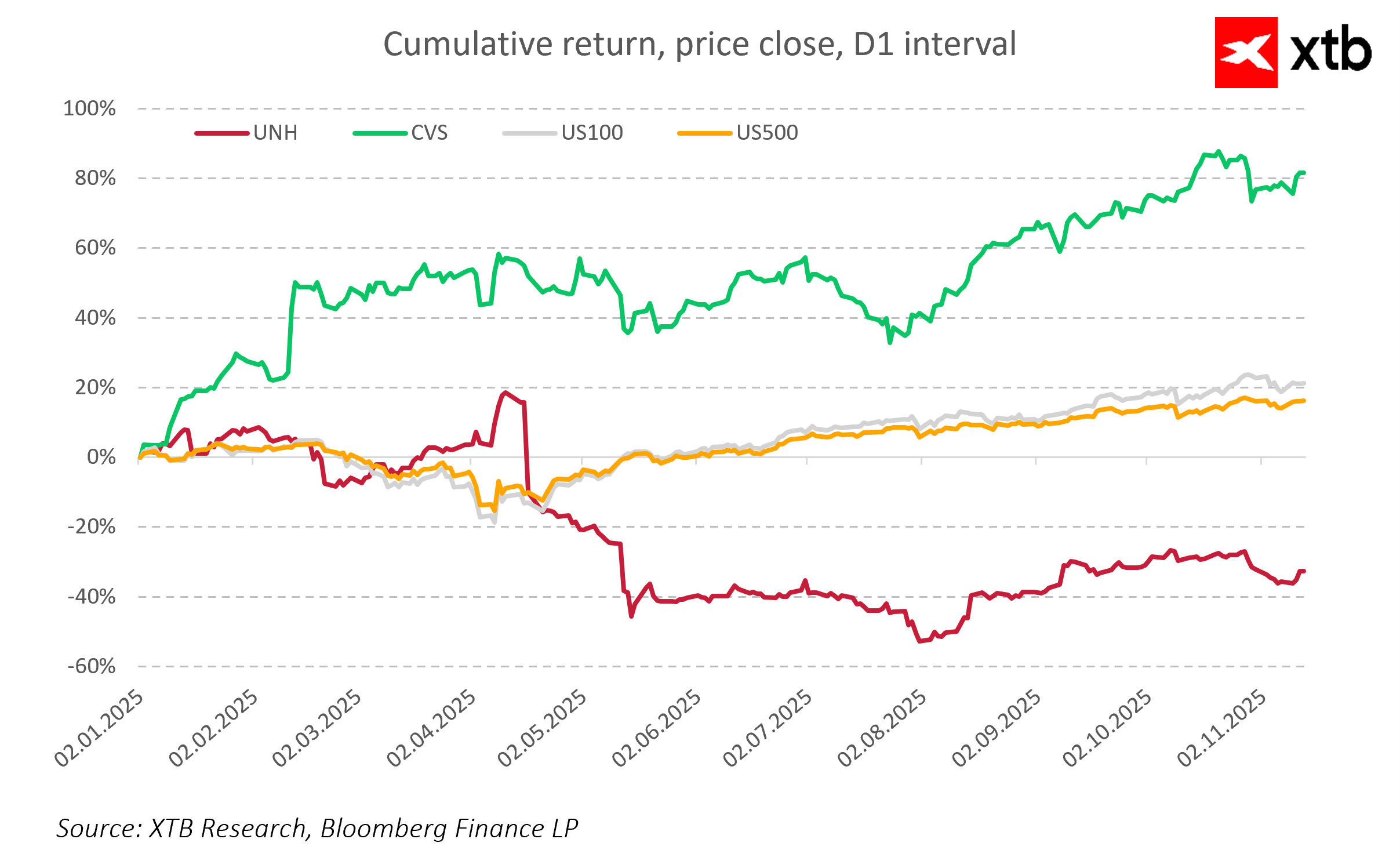

This temporary drop in results did not negatively affect market perception. From the beginning of 2025 through November, CVS stock increased by more than 80 percent, clearly outperforming the Nasdaq-100 and S&P 500 indices as well as competitor UnitedHealth Group, whose stock fell by nearly half. Such strong appreciation confirms that investors recognized the EBITDA decline as temporary and accounting-driven rather than a reflection of deteriorating business quality.

CVS’s financial fundamentals remain strong. The company maintains high liquidity and effectively executes a restructuring program aimed at improving efficiency in the Health Services segment. Forecasts indicate that EBITDA will return to positive levels by the fourth quarter of 2025, and ROIC will once again exceed the cost of capital, restoring full operational profitability. In the medium term, CVS is entering a stabilization phase with the potential for financial performance recovery and further strengthening its position as a leading healthcare provider in the United States.

Outlook

The U.S. healthcare market is entering a period of dynamic structural transformation. The U.S. population has surpassed 335 million and continues to grow. In this environment, CVS Health, with its integrated business model combining pharmacies, insurance, and healthcare services, remains one of the main beneficiaries of market trends. The company has a unique infrastructure that includes retail and clinic networks as well as proprietary insurance channels, enabling it to respond effectively to changing market needs. Financial forecasts through 2030 indicate that CVS is entering a new growth phase, combining stability with potential for further expansion.

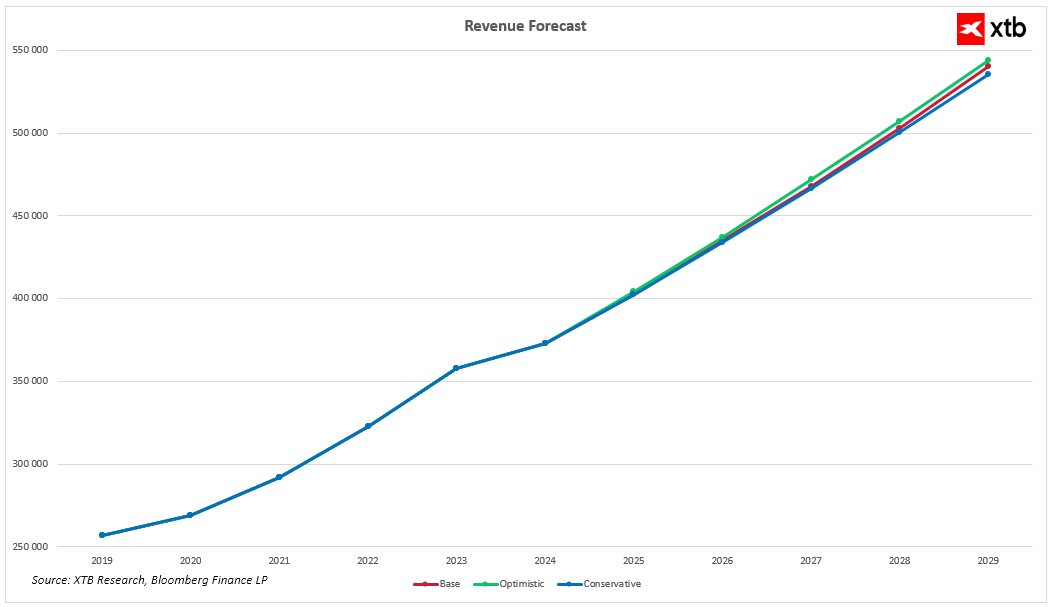

-

In the base scenario, the company’s revenues are expected to grow steadily over the coming years, reflecting solid growth compared to 2024 levels. This growth is supported by the strength of the Health Care Benefits and Pharmacy & Consumer Wellness segments, as well as the effects of restructuring and cost optimization in Health Services.

-

In the optimistic scenario, revenue growth is even higher due to expansion of insurance services, clinic network development, and the implementation of innovative retail formats focused on wellness. In this scenario, CVS strengthens its position as a leader in next-generation healthcare services in the United States.

-

Even in a conservative scenario, with higher cost pressures and slower expansion, the company maintains stable revenue growth. In a sector characterized by high entry barriers and low demand elasticity, this remains a very solid outcome, confirming the resilience of CVS’s business model and competitive advantage.

For investors, this means that CVS Health has a long-term growth trajectory based on strong fundamentals, rising demand, revenue diversification, and high operational efficiency. The company maintains revenue growth, high liquidity, and effectively executes its restructuring program aimed at improving efficiency in Health Services. Forecasts suggest that EBITDA margins will return to previous levels in the coming quarters, and profitability will gradually recover due to cost reductions and increasing revenues in key segments. In the medium term, CVS is entering a stabilization phase with potential financial performance recovery and further strengthening its position as one of the leaders in the U.S. healthcare market.

Valuation

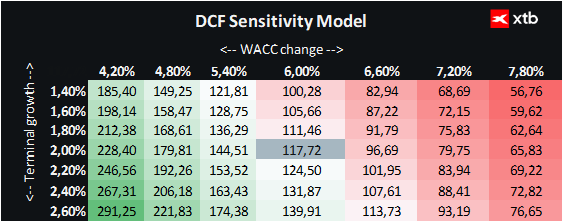

We present a valuation of CVS Health Corp using the discounted cash flow method. This is for informational purposes only and should not be considered investment advice or a precise valuation.

The analysis is based on the base scenario of financial forecasts, assuming continued stable revenue growth and the recovery of operating margins after the temporary decline in the third quarter of 2025. The model assumes a cost of capital (WACC) of 6 percent, appropriate for the healthcare and pharmaceutical sector, which features stable cash flows and a defensive risk profile. Terminal value was estimated using a conservative growth rate of 2 percent. Other financial parameters were averaged based on the results of the last five years.

Based on this analysis, the fair value of one CVS Health share is estimated at approximately $117.72, compared to the current market price of $80.30, indicating potential upside of 47 percent. This reflects both strong operational fundamentals and the anticipated recovery of margins in the medium term, while maintaining stable growth across all three business segments.

Chart View

CVS Health shares are currently in a very strong upward trend. The stock has clearly surpassed all key moving averages and stabilized above $80. The company still has significant potential, as there is still a gap to historical highs from 2021 and 2022, when the stock traded around $105–110. This suggests that current price levels may represent a stage of value recovery following a period of weakness, and the coming quarters, if the company executes ambitious restructuring plans and improves profitability, could provide further upside opportunities for investors.

Source: xStation5

Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%