Etsy (ETSY.US) is the US e-commerce company and one of the so-called pandemic winners. Share price of the company jumped 300% throughout 2020 before stock began to trade sideways during the first months of 2021. However, shares have caught a bid recently, thanks to M&A news and the stock is one of the best performing S&P 500 members this week. Let's take a look at Etsy, recent news on the company as well as the situation on the chart.

Overview

Start investing today or test a free demo

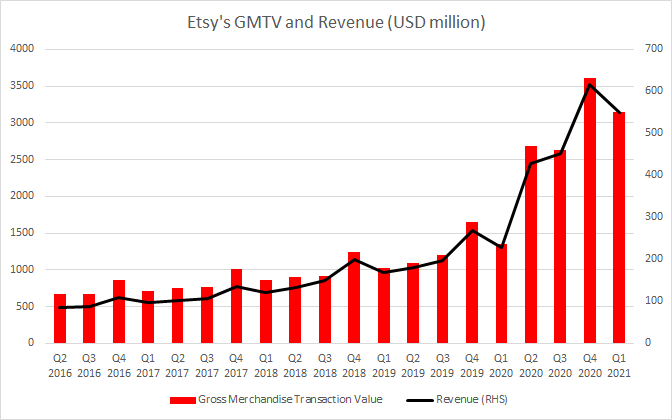

Create account Try a demo Download mobile app Download mobile appEtsy (ETSY.US) is an e-commerce company that provides a marketplace platform for homemade as well as vintage items. Company's strategy is different from the likes of Amazon or Walmart that try to sell all sorts of products on their e-commerce platform. While one could expect Etsy's potential to be limited due to a focus on niche products, it is not really the case. Taking a look at the chart above we can see that the value of transactions on Etsy's platform has been rising for years. A pandemic-related jump in e-commerce spending can be easily spotted starting from Q2 2020. Company's revenue grew in-line with transaction values and has reached a quarterly high in Q4 2020 at almost $620 million.

Etsy's gross merchandise transaction value and revenue in USD million. Source: Bloomberg, XTB Research

Etsy's gross merchandise transaction value and revenue in USD million. Source: Bloomberg, XTB Research

Acquisition in Brazil

Shares of Etsy (ETSY.US) trade sideways during the first months of 2021. Stock dropped at the start of May after the company issued a slightly disappointing EBITDA and sales forecasts. However, stock started to recover with an upward move accelerating this week. Why? Company announced an acquisition in Brazil! Etsy announced that it will acquire Brazilian Elo7, a marketplace for handmade items. Elo7's business profile fits Etsy and the acquisition will help broaden presence in the South American e-commerce market worth $29 billion. Etsy currently has a smaller presence on the continent. US company will pay $217 million for the Brazilian peer. News were well-received by analysts, who touted potential to enhance growth rates and profitability.

Technical situation

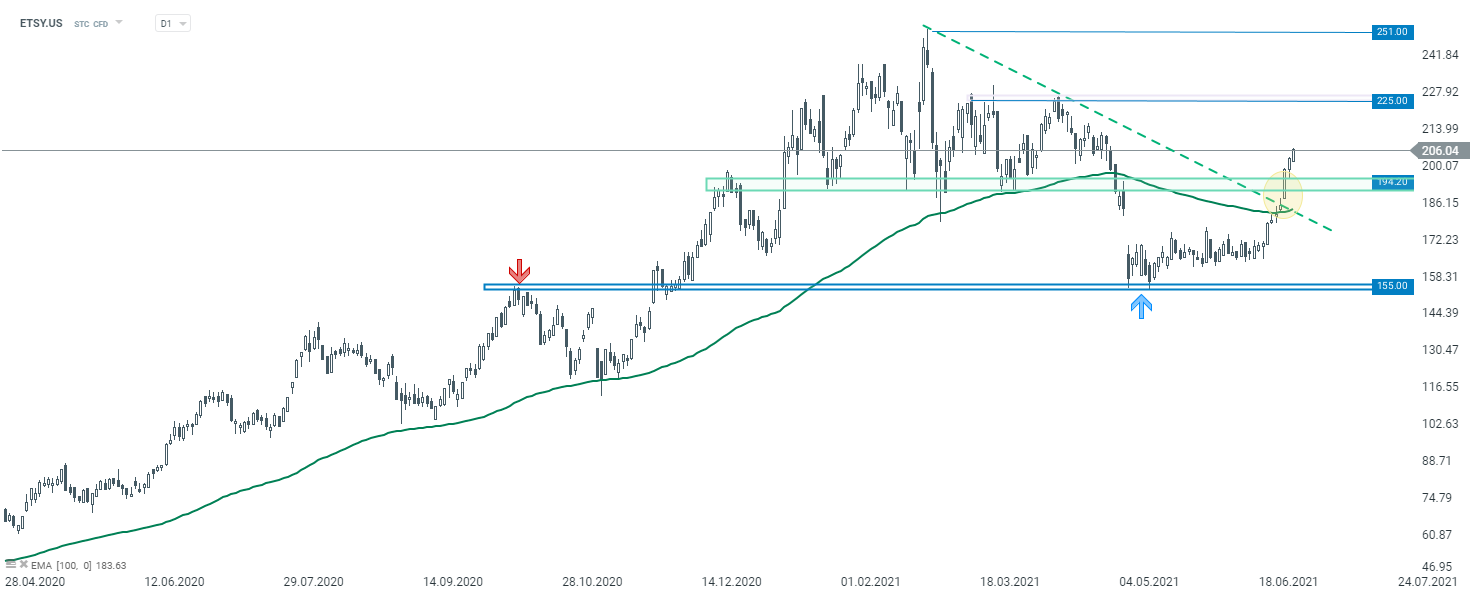

Share price of Etsy (ETSY.US) reached an all-time high near $250 at the turn of February and March 2021. Price dropped almost 40% over the next two months on the back of weaker performance of tech sector as well as lacklustre outlook announcement from Etsy. However, after a 1.5-month sideways move near $170 handle, stock caught a bid and broke above the 100-session EMA (green line) by the end of the previous week. M&A news added more fuel for recovery this week, allowing stock to jump above the downward trendline as well as above the resistance zone at $194.20, that is marked with previous price reactions. The near-term resistance to watch can be found in the $225 swing area and is a final hurdle for the bulls before all-time high area.

Source: xStation5

Source: xStation5