Summary:

-

China’s economy expanded last year at the slowest pace in 28 years

-

A bag of readings for December looks quite solid

-

PM Theresa May is likely to give up on cross-party talks

The slowest since 1990

The Chinese economy grew 6.6% last year yielding the slowest pace of growth since 1990. However, the data was in line with expectations like the release for the fourth quarter producing a 6.4% YoY rate of economic growth.

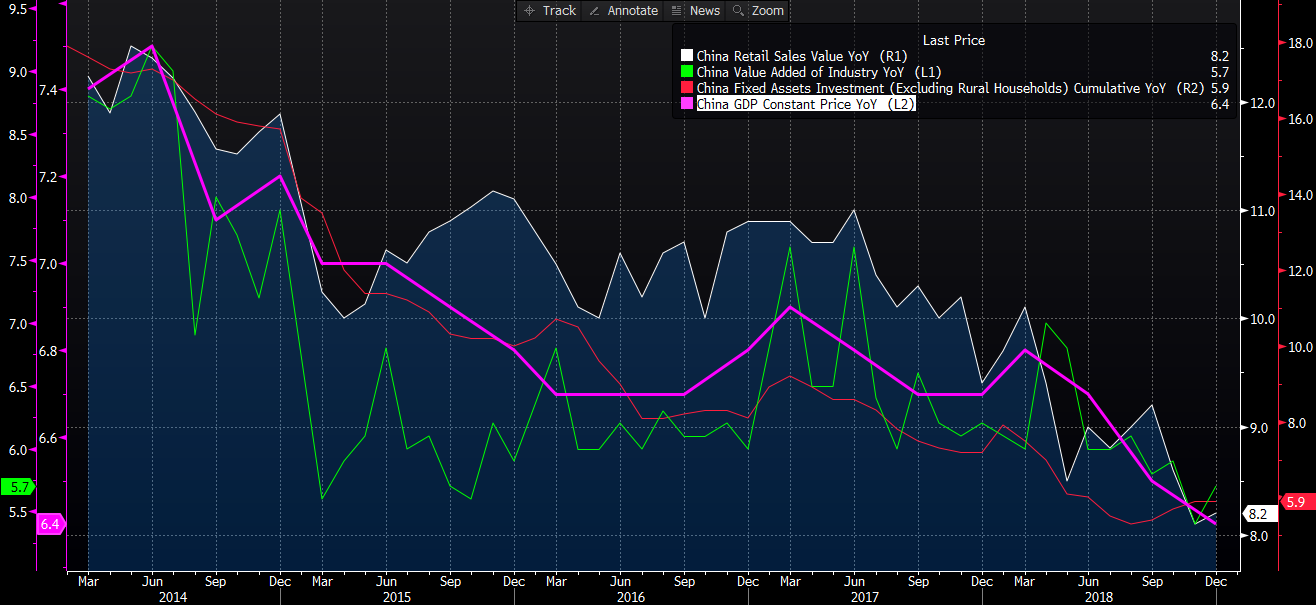

The China’s GDP and activity data turned out to be more or less in line with expectations. Source: Bloomberg

Compared to 2017 the world’s second largest economy faced more headwinds resulting in a deceleration from 6.8%. In this place one needs to remind that Beijing is expected to target growth between 6% and 6.5% for this year. What could have boosted the China’s GDP in the second half of the year was probably the export front loading impact. This one may have occurred before the G20 summit in Argentina where both the US and China struck a deal to suspend imposing new tariffs until March 2019. This truce is to give time needed to talks in order to work out a common ground at this field to avoid a further trade war escalation. Having said that, nothing suggests that a major progress has been made as of yet. According to the US Treasury “little progress has been made on an intellectual property issue”. Getting back to the China’s data one may consider two questions. First, a higher demand for Chinese goods, which may have arisen in before the beginning of December, is likely to fade as the new year unfolds. Second, a batch of stimuli the authorities have already introduced may take more time to begin kicking in. Therefore, it seems to be reasonable to anticipate the China’s economy to slow more before it revives partly due to implemented measures. Last but not least, China does not want to pump a dump of debt, this is a reason why Beijing has ruled out a “flood” of measures aimed at rekindling growth. On top of the GDP report we also were offered a bag of readings for December and we may think that activity stalled at the end of the last year but it did not deteriorate more in December. Industrial production rose 5.7% YoY beating the consensus of 5.3% YoY and improving from 5.4% YoY seen in November. Overall the course of the past year industrial output increased 6.2% YoY matching expectations. Fixed asset investments (excluding rural) increased 5.9% YoY over the year bringing a slight miss compared to a 6% YoY rate of growth expected. Investment expenditure in the private sector grew 8.7% YoY in the corresponding period of time. Finally retail sales picked up 8.2% YoY coming in above expectations and the prior rate of growth (8.1%). Over the year retail sales increased 9% YoY, the value consistent with forecasts.

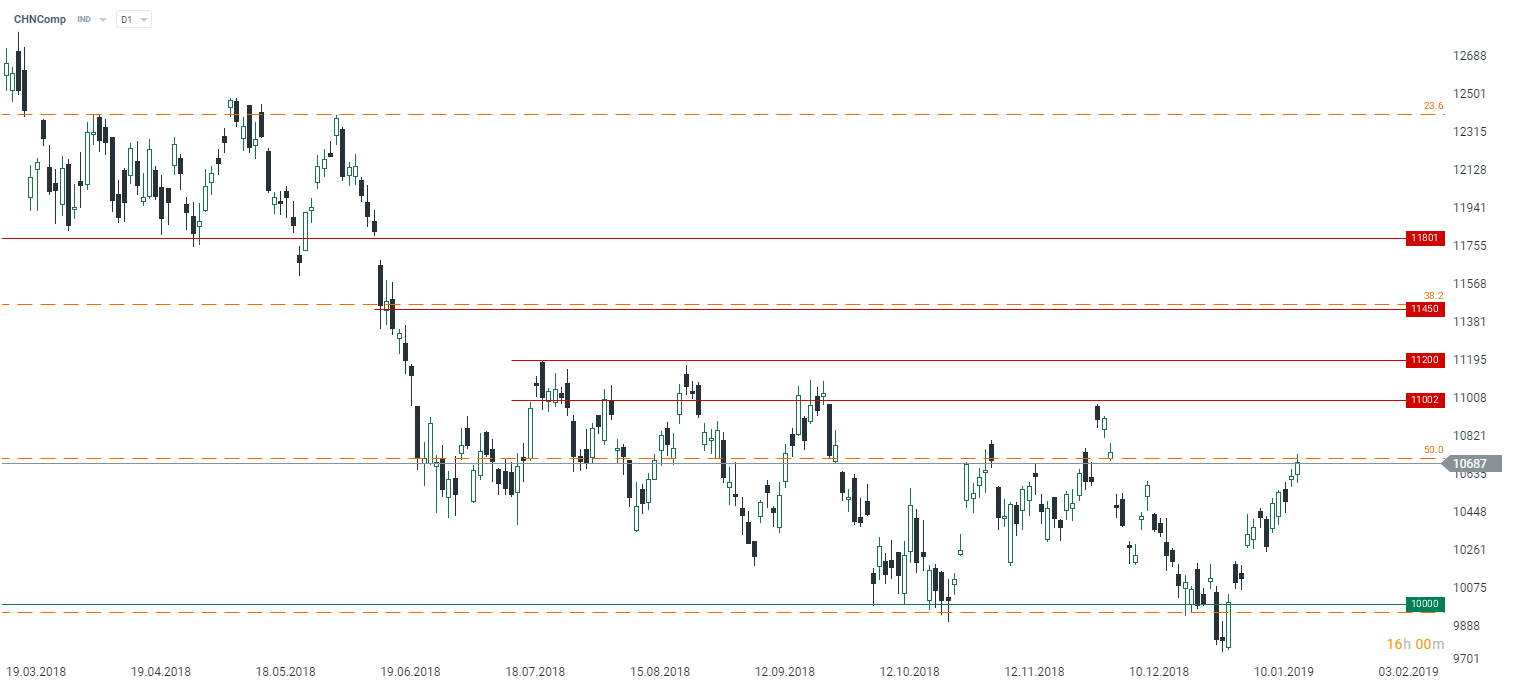

In response to these releases Asian stock market have risen moderately. In China the Shanghai Composite is rising 0.4% while the Hang Seng (CHNComp) is climbing 0.55% at the time of writing. From a technical viewpoint one could expect the price to reach a top nearby 11000/11200 points before correcting this rise e.g. due to a failure in trade talks between the US and China. Source: xStation5

The crunch time for Theresa May

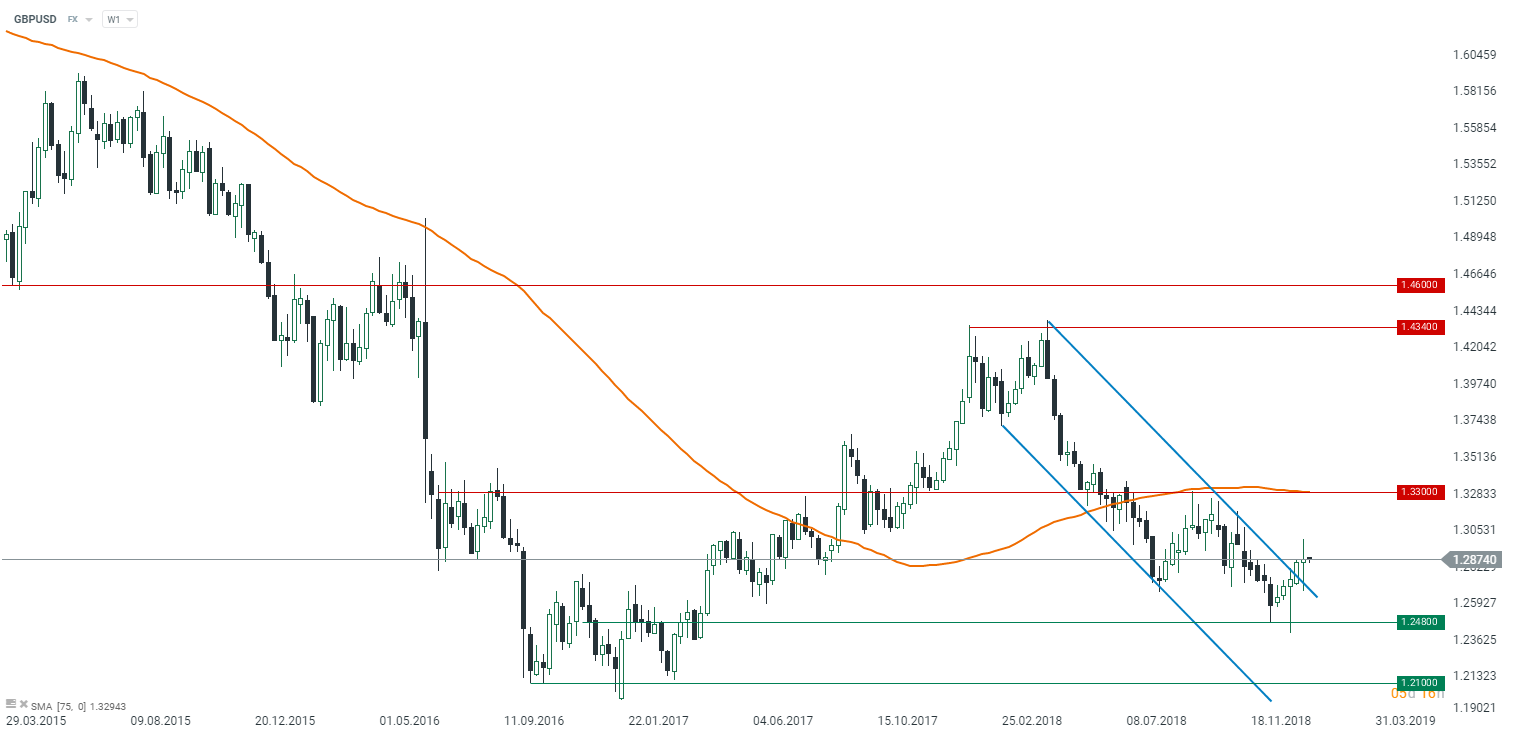

Theresa May was unable to get approval of her Brexit deal last week, but she survived a no-confidence motion being granted confidence to continue working on a deal which could be backed by the parliament. Today UK Prime Minister needs to present her alternative Brexit plan which is to be voted on January 29. Meanwhile, some unconfirmed revelations brought by Bloomberg suggest that May could seek changes to the Irish backstop section of the deal. The goal is to get enough pro-Brexit members of her Conservative Party. However, there is a notable risk the European Union will not want to negotiate anymore. Moreover, Theresa May briefed her Cabinet yesterday that there was little prospect of cross-party Brexit talks resulting in a workable alternative plan to this one being rejected last week. So, one may conclude that chaos drags on and nothing suggests it could come to an end in the weeks to come. Nevertheless, we expect that the most probable scenario right now is the EU will agree to postpone a deadline until summer (the date when the UK is to formally leave the EU is set on March 29). This could be supportive of GBP and this is why we hold a bullish view on the cable.

The GBPUSD managed to end the last week slightly above its prior candlestick suggesting that bulls could prevail in the weeks to come. The prime resistance might be localized at 1.3300. Source: xStation5

In the other news:

-

NZ dollar is the worst performing G10 currency this morning losing almost 0.2% against the US dollar, the Turkish lira is the worst currency when we look beyond the G10 group losing 0.3% against the greenback