-

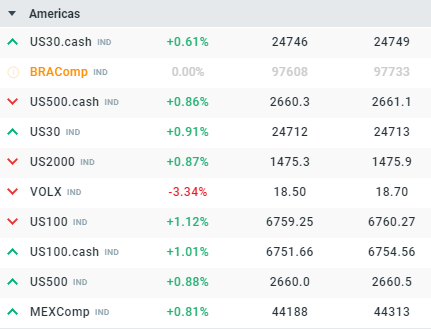

US markets open firmly in the green

-

US500 at 2660 and not far off being back to flat on the week

-

Intel shares drop sharply after revenue miss and weak guidance

The final session of the week for US stocks has begun on the front foot with all major US indices trading firmly higher. The Nasdaq100 (US100 on xStation) is the biggest gainer and higher by more than 1% on the day while the US500 is back above the 2660 handle once more. Despite the recent gains the US500 is still slightly lower on the week, but price has recovered pretty well from consecutive attempts to break lower on Tuesday and Wednesday and now it appears that the bulls will have a chance to ramp higher into the weekend. Note that there’s no US durable goods orders or new home sales data set to be released this afternoon due to the ongoing government shutdown.

There’s a sea of green across US markets not long after the cash open with the US100 leading the charge higher. The only market lower is the volatility index (VOLX) which has declined by 3.35%.

One stock making headlines for the wrong reasons today is Intel, with the share price opening lower by more than 5% after delivering a downbeat set of earnings after last night’s closing bell. For the 4th quarter the key figures were as follows:

Earnings: $1.28 per share, excluding certain items, vs $1.22 per share expected by analysts according to Refinitiv

Revenue: $18.66B vs $19.01B as expected by analysts according to Refinitiv

The revenue miss here has seemingly outweighed the earnings beat and investors also eagerly awaiting an update on Intel’s search for a new CEO were left disappointed. Bob Swan, Intel’s finance chief, has since been serving as interim CEO. “The board continues to evaluate candidates for what I believe is the biggest and best open job on the planet,” Swan told analysts on a conference call following the earnings release on Thursday. “They are proceeding with a sense of urgency while also ensuring that they make the right choice for this great company.”

Shares in Intel have opened sharply lower after the latest earnings release with the market once more failing to break above resistance around the 50.50 mark. Source: xStation

Shares in Intel have opened sharply lower after the latest earnings release with the market once more failing to break above resistance around the 50.50 mark. Source: xStation