The biggest company on Wall Street, Microsoft (MSFT.US) provided better than expected results on almost every measure and very strong performance of Azure and Copilot make investors believe in capitalizing AI trend. Alphabet (GOOGL.US) performance were also very strong, with strong Google Cloud and Google Ads momentum, driving net results 57% higher YoY. Intel (INTC.US) earnings were higher than expected but only slightly higher than expected sales, disappointing guidance with no changes in dividend policy pressured shares, which lose more than 8% after-market hours. Here are key facts and commentary.

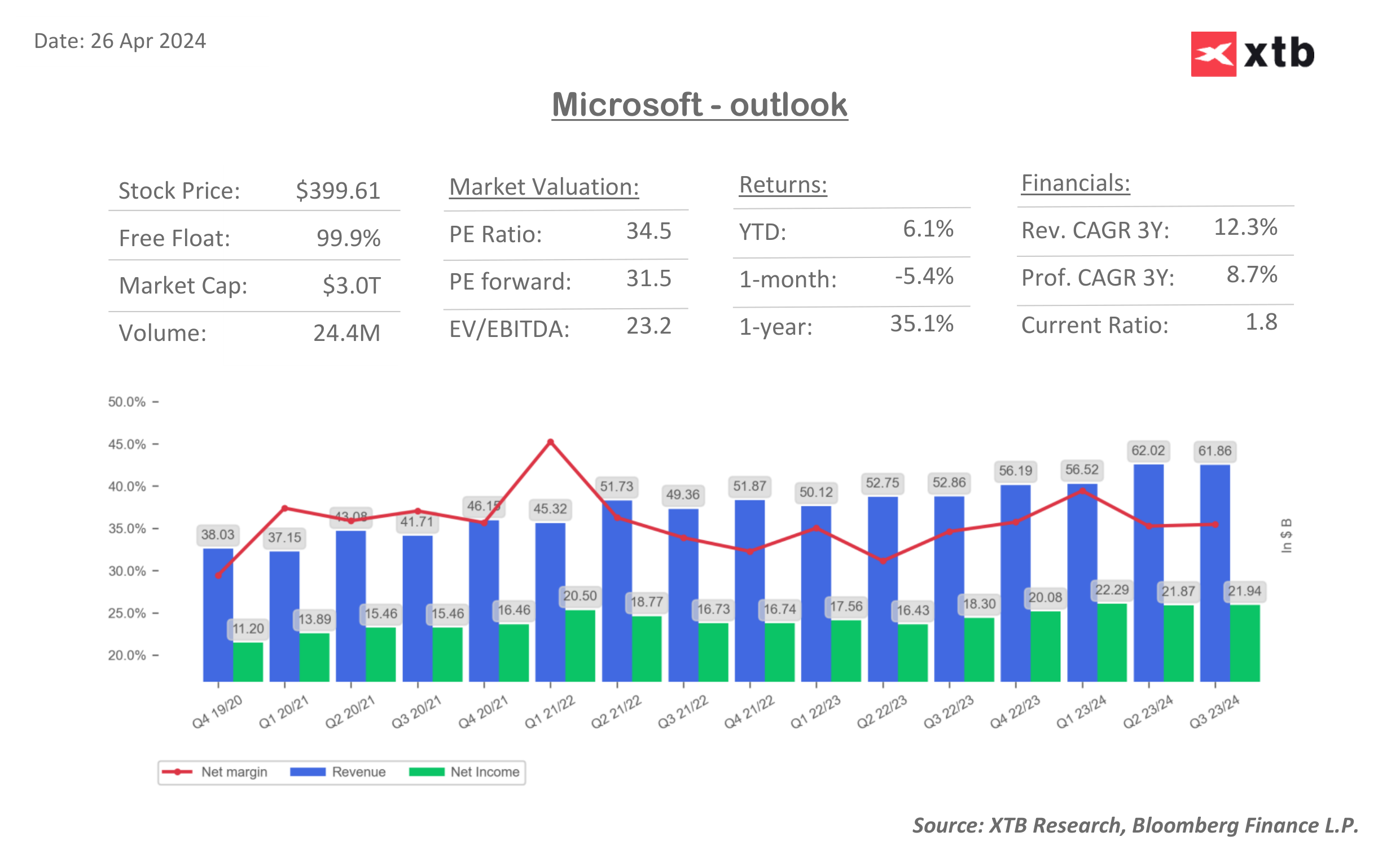

Microsoft (MSFT.US) - Outstanding Azure growth and AI Copilot building wide moat

- Revenues: $61.9B vs $60.9B exp. (17% YoY)

- Earnings per share (EPS): $2.94 vs $2.84 exp.

- Net income: $21.94 billion vs $18.30 billion during Q1 2023

- Microsoft Cloud revenue: $35.1B vs $33.93B exp. (23% YoY, 31% YoY for Azure)

- Intelligent Cloud: $26.71B vs $26.25B exp.

- Productivity revenue: $19.57B vs $19.54B exp.

- Personal computing: $15.58B, vs. 15.07B exp.

Market positively responded to Microsoft CEO, Nadella comments of 'new era of AI transformation, driving better business outcomes across every role and industry' as Microsoft earnings showed significant double-digit growth despite almost $3 trillion market cap.

- Microsoft revenue from Azure and cloud services grew 31% on the yearly basis vs 30% in the Q4 2023 quarter. Analysts (Street Account) expected 28.6%. The company introduced surface PCs in Q1 with access to Copilot chatbot and started selling its Copilot AI add-on for small businesses with subscriptions to Microsoft 365 software during Q1.

- Microsoft hired Mustafa Suleyman, co-founder of artificial intelligence lab DeepMind, to run a new AI group, acquiring also a lot of specialists from the startup Inflection in a deal worth $650 million. Investors may see it as a signal of a building wide business moat.

- Gaming Q1 (fiscal Q3) gaming revenues were 51% higher YoY (55% from Activision Blizzard). Xbox content & services revenue came inn 62% higher YoY (61% from Activision Blizzard) but Xbox hardware sales declined 31% YoY.

Source: xStation5

Source: xStation5

Source: XTB Research, Bloomberg Financial LP

Source: XTB Research, Bloomberg Financial LP

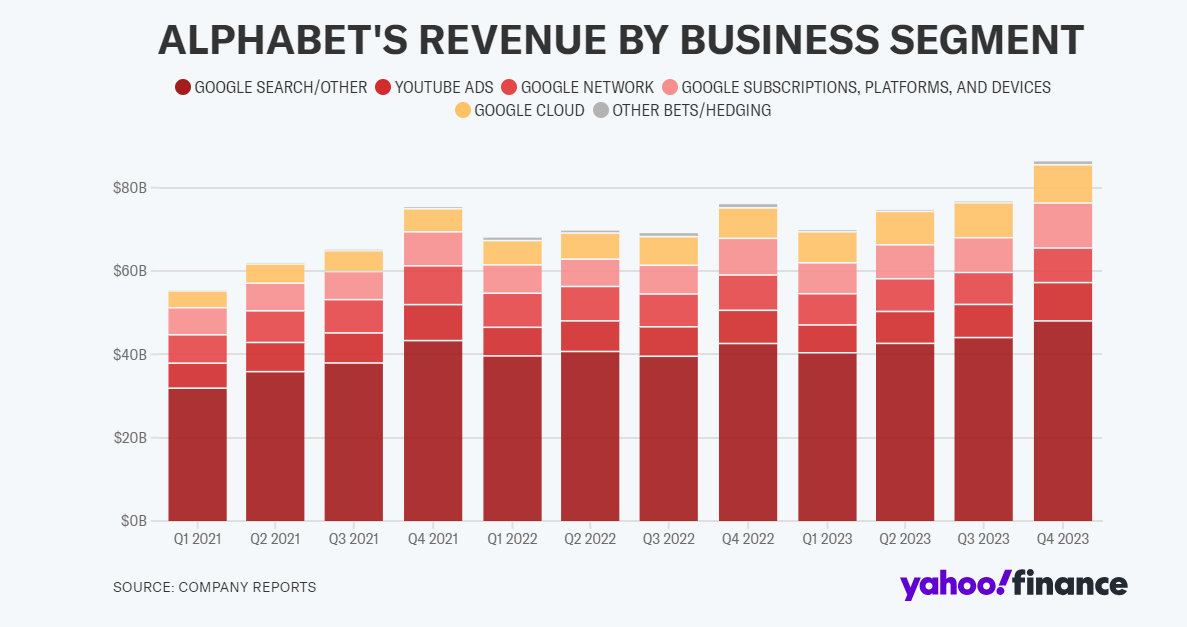

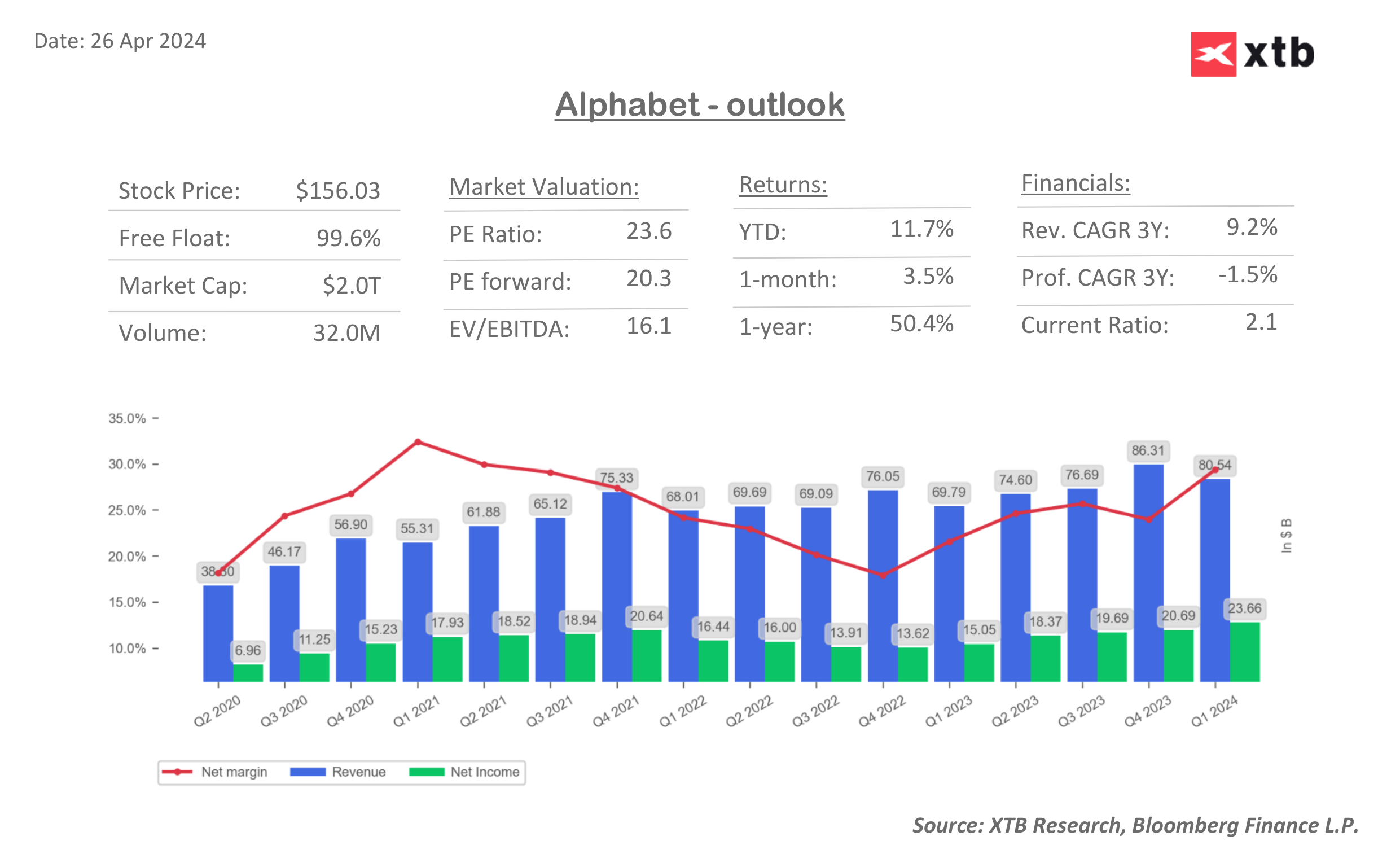

Alphabet (GOOGL.US) - Strong Google Ad performance with profitability catalysts from AI and Cloud

- Revenues: $80.54B vs $78.7B expected and $69.8B in Q1 2023 (15% YoY)

- Earnings per share (EPS) $1.89 vs. $1.51 exp. and $1.17 in Q1 2023

- Net income:$23.66B vs $15.05B in Q1 2023 (57% YoY)

- Google Ad revenue: $61.66B vs.$60.18B exp. and $54.55 in Q1 2023 (13% YoY)

- Google Cloud revenue: $9.57B vs. $9.37B exp. (28% YoY)

- YouTube revenue: $8.09B vs $7.73B exp. (21% YoY)

- Others: $495M vs $372.4M exp.

- Operating income: $25.47B vs $22.4B exp.

Google CEO, Sundar Pichai, said the company has clear paths to monetize AI breakthroughs. Through such channels as advertising, cloud and subscriptions. Looking at Q1 earnings, investors have no reason to don't believe in it. Alphabet’s Board authorized a repurchase program up to an additional $70.0 billion. The company declared the first ever cash dividend of 0.2% per share due to very strong performance of Google Search, YouTube and Cloud.

- Google Cloud revenues risen in high-pace, but the growth is still lower than Azure (31% YoY), even despite much lower scale of Google Cloud operations. Looking at Google overall, as a business, we may assume, that the company will be beneficiary of eventually further economic development as Google Search see almost no meaningful rivals on the horizon, and Google Ads business fundamentals are constantly improving with additional catalyst from AI and Cloud on profitability

- Despite that, ad business (fundamental for Google) is very, very strong with YouTube surpassing 20% YoY dynamics and strong overall ad sales. What's even more important to investors is that the company is bigger, but with rising sales also profitability rises. EBIT margin were 47% higher YoY and net income were 57% higher YoY

Source: Alphabet, YahooFinance

Source: Alphabet, YahooFinance Source: xStation5

Source: xStation5

Source: XTB Research, Bloomberg Financial LP

Source: XTB Research, Bloomberg Financial LP

Intel (INTC.US) - Lower than expected guidance and overall weak capitalizing on AI

- Revenue: $12.72B vs $12.71B exp.

- Adjusted EPS: $0.18 vs $0.13 exp. (GAAP loss of $(0.09) vs ($0.15) exp.

- GAAP Net Loss: $381M

- AI and Data Center revenues: $3.04 billion (5% YoY)

- Client Computing revenue: $7.53B, up (31% YoY)

- Mobileye revenue: $239 million

- Non-GAAP Gross margin: 45.1% vs 44.5 exp. (41% GAAP)

The company commented that it's confident in plans to drive quarterly growth momentum over 2024 and maintained the quarterly dividend at $0.125 per share. But the guidance is disappointing for Wall Street, as 5% growth in AI and Data Center shows definitely a very slow business pace (amid fast-growing peers). Intel CEO Pat Gelsinger underwhelmed on revenue outlook. Intel expects Q2 non-GAAP EPS of $0.10 per share on revenue between $12.5 billion and $13.5 billion vs analysts expected Q2 earnings of $0.26 EPS and $13.59 revenues (CapitalIQ). Markets see no huge business catalyst, despite a few billions from AI and data center sales. Intel expects 200bps of full-year gross margin improvement.  Source: xStation5

Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡