Nike (NKE.US) stock slumped 7% during today's session after the apparel giant reduced its revenue forecasts due to supply chain issues which are hurting its business more than it previously anticipated. This was mainly due to the ongoing supply disruptions from Vietnam, which is a key manufacturing hub for Nike products. Nike produces about three-quarters of its shoes in Southeast Asia, 51% of which is made in Vietnam and 24% in Indonesia. However, recent pandemic restrictions have forced the company to close its factories several times. In Vietnam, for instance, it has lost 10 weeks of production since July.

"We are not immune to the global supply chain headwinds that are challenging the [manufacturing] and movement of product around the world," Chief Financial Officer Matthew Friend said on an earnings call. "Over the last 90 days, two things have happened in the industry that we didn't anticipate. First, already long transit times worsened; and second, local governments mandated shutdowns in Vietnam and Indonesia," Friend told analysts Thursday.

Company also warned of possible supply shortages lasting into the holiday season. The sneaker giant now expects revenue for this fiscal year to grow by single digits, compared to its previous guidance of double-digit growth in the previous year.

Results for the quarter ended August were mixed. Company reported earnings of $1.16 per share, which is a 22.1% increase from the same period last year and above analysts' expectations of $1.11 per share. Revenues increased 16% to $12.2 billion, slightly below market projections of $12.465 billion.

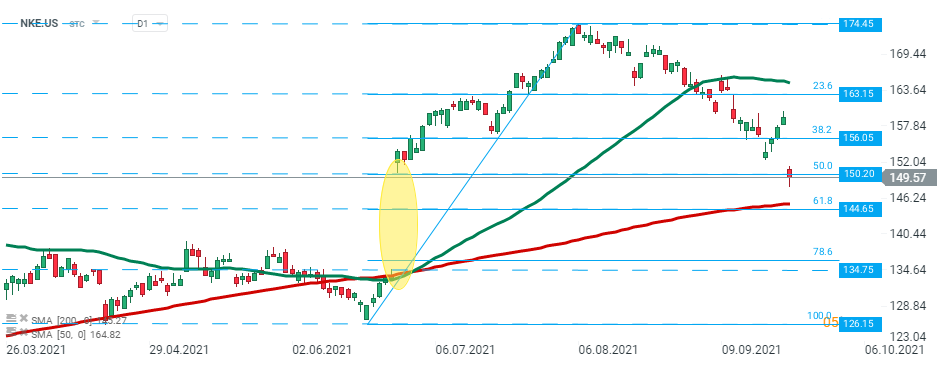

Nike (NKE.US) stock launched today’s session sharply lower and broke below the support at $ 150.20 which coincides with 50% Fibonacci retracement of the last upward wave and upper limit of the bullish gap from end of June. If current sentiment prevails then the downward correction may be extended to the support at $144.65 which is marked with 61.8% retracement and 200 SMA (red line), or even to $134.75 handle where lower limit of the aforementioned price gap is located. On the other hand, if sellers manage to regain control, then another upward impulse towards resistance at $156.05 may be launched. Source: xStation5

Daily summary: The beginning of the end of disinflation?

Block Inc. lays off 40% of its workforce and rises 16% - Is this a new paradigm?

US Open: Rising oil and PPI pressure Wall Street 📉 Technology and financial stocks drop

Dell surges 12% amid AI driving 40% revenue growth 📈