- What's next for the DE40 prices?

- What's next for the DE40 prices?

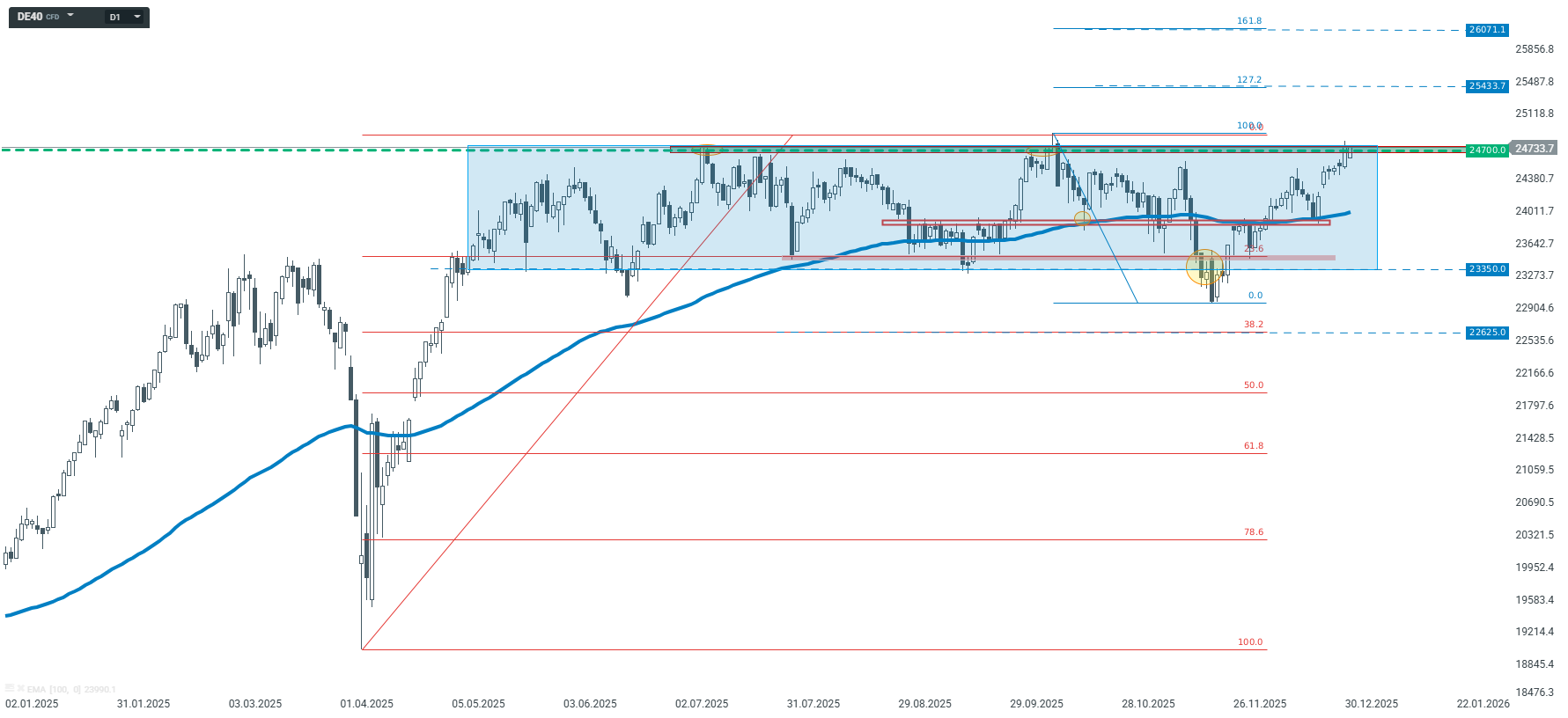

On the D1 interval, the German D40 index has been moving in a wide consolidation for a long time. Practically since May last year, quotations have been oscillating between 24,700 and 23,350 points. Currently, we are observing a test of the upper limit of this pattern. If it breaks above 24,700, the targets for buyers may be 25,430 and 26,070 points, which result from external measurements of the last downward correction — 127.2% and 161.8% Fibonacci retracements, respectively. On the other hand, rejection of this resistance may mean a return to the ongoing consolidation, i.e., further movement within the range marked by the blue rectangle on the chart.

D40 – D1 interval | Source: xStation5

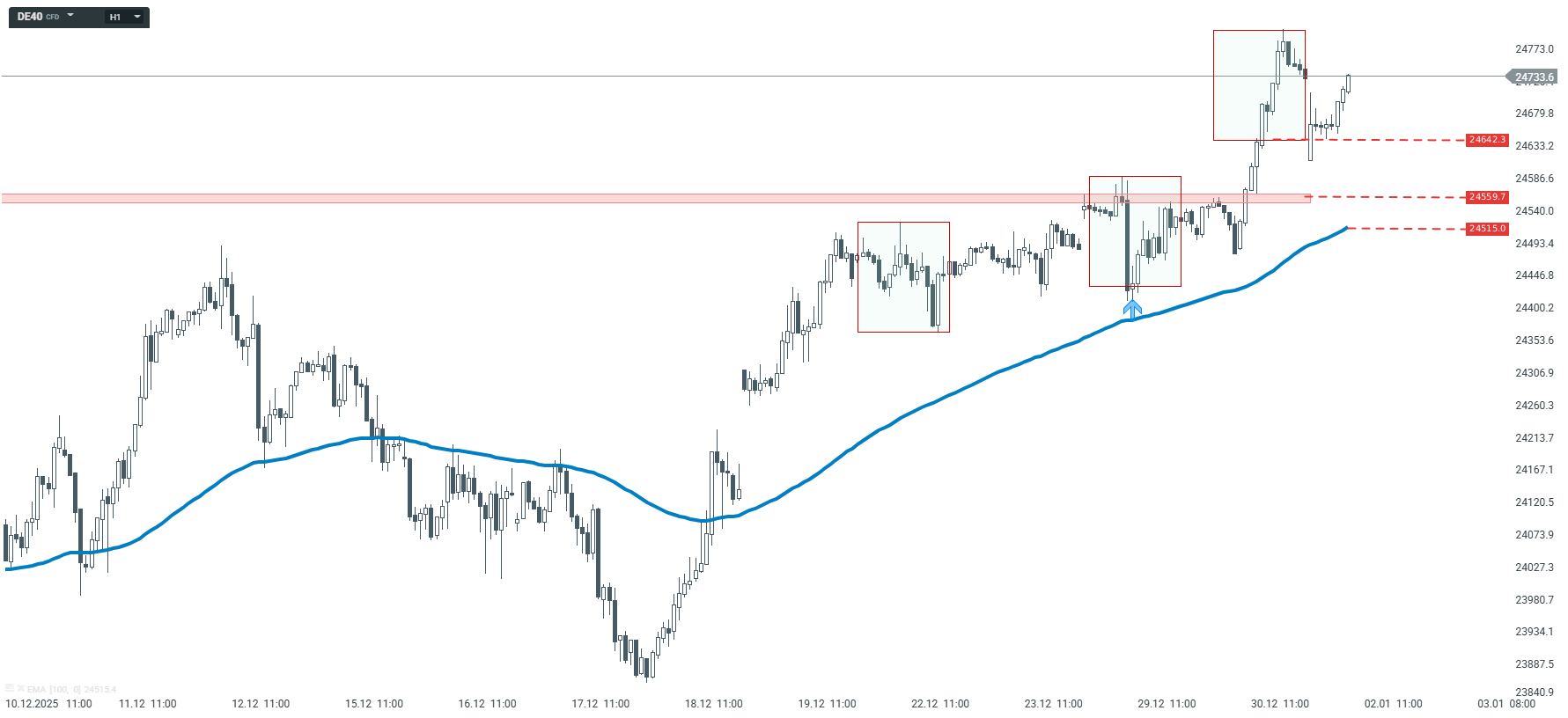

On the H1 interval, however, the quotes are in a local uptrend. The last two corrections were exactly the same range, as marked by red rectangles, and the current correction also fits into this structure. The key support level is at 24,642 points, and as long as it remains intact, according to the Overbalance methodology, the scenario of further increases remains valid. Even if there is a larger correction, attention should be paid to the next levels of defense: horizontal support at 24,560 points and support resulting from the 100-period average, marked in blue on the chart.

D40 – H1 interval | Source: xStation5

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge