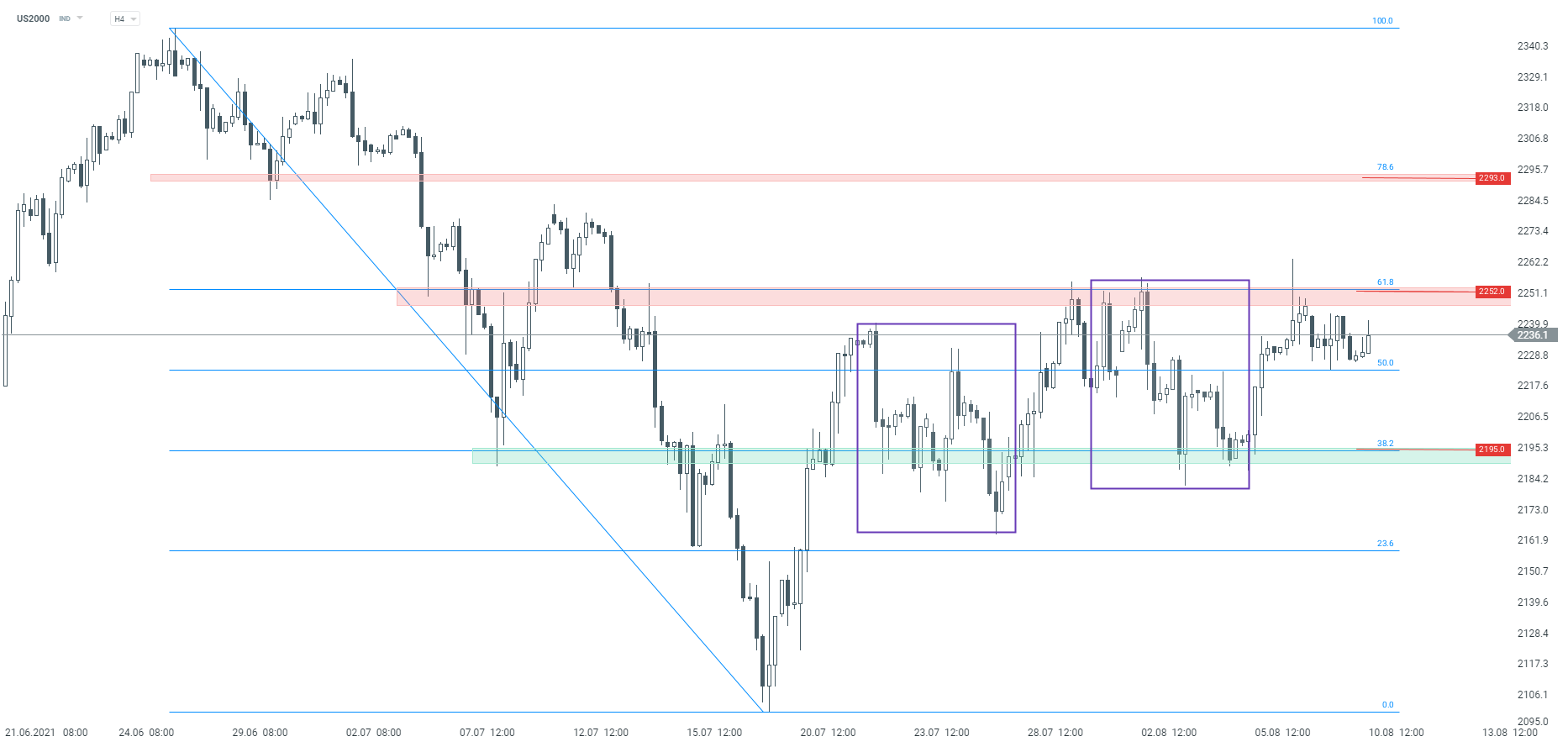

Recently, we can observe mixed sentiment in the US stock market. Let's take a look at the technical situation on the US2000. Looking at the H4 interval, we can distinguish two key zones. The resistance is located at 2252 pts, while the major support lies at 2195 pts, and only breaking any of these levels can trigger a bigger move. As for the Overbalance methodology, it still favors buyers - index has recently bounced off the lower limit of the 1: 1 structure and then reached new local high. In the case of the bullish scenario, the next resistance is located around 2,293 pts and is marked with the 78.6% Fibonacci retracement of the last downward wave.

US2000 interval H4. Source: xStation5

US2000 interval H4. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers