Tesla reported Q4 car deliveries of 405,000 vehicles, against production of 439,000, and against expectations of deliveries of 412-420,000, according to Bloomberg consensus. The lower deliveries create a fair amount of uncertainty about demand, despite the fact that deliveries in the fourth quarter of the previous year were the highest on record. You can read more about deliveries in our previous post.

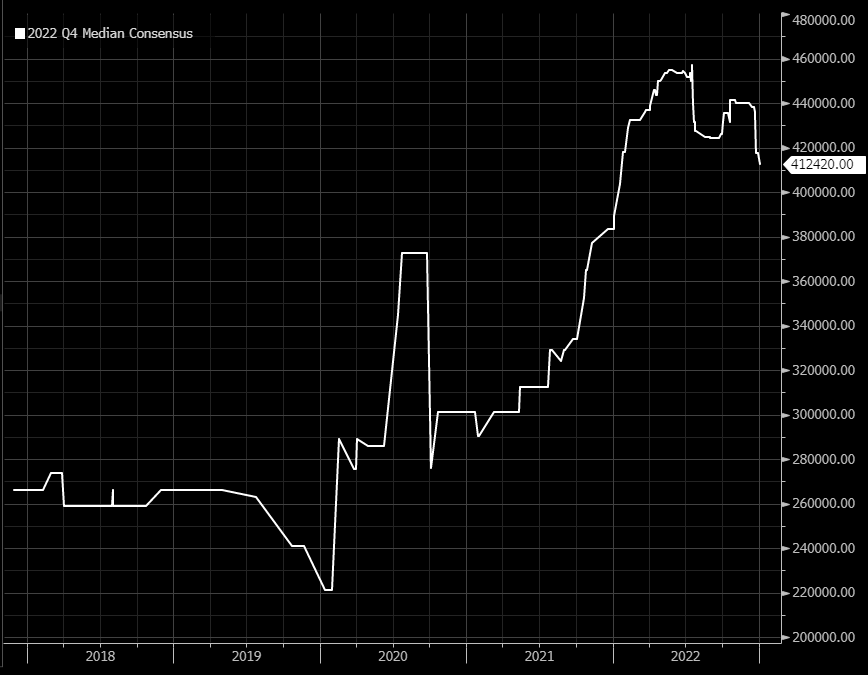

It's worth noting that the consensus for deliveries has been significantly reduced for the end of 2022 anyway. Source: Bloomberg

It's worth noting that the consensus for deliveries has been significantly reduced for the end of 2022 anyway. Source: Bloomberg

Tesla's share price has been close to the $100 level, which brings the P/E ratio (for financial results of the last 12 available months) to 32, while the forecast for Q4 indicates that the ratio will fall to 22. This is significantly lower than it was at the end of 2021, when the ratio reached 145 (in previous years the range was 200 to 950). This means that with the current disappointment in the company's results and guidance, the company is starting to become more interesting in terms of valuation.

Tesla has already lost 75% of its value since its historic peak, but at the same time it is clearly above the local lows of March/April 2020. From a technical point of view, it is worth noting that Tesla is doing significantly worse than the also heavily oversold Nasdaq 100 index. In addition, the stock is below the 78.6 retracement of the last upward wave from 2020 to 2021. The nearest important support is around $91.75 per share. Source: xStation5

Tesla has already lost 75% of its value since its historic peak, but at the same time it is clearly above the local lows of March/April 2020. From a technical point of view, it is worth noting that Tesla is doing significantly worse than the also heavily oversold Nasdaq 100 index. In addition, the stock is below the 78.6 retracement of the last upward wave from 2020 to 2021. The nearest important support is around $91.75 per share. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡