Tesla shares gained 5.0% in a prematet move after Tesla’s Supercharger network adoption.

-

General Motors (GM) and Ford have joined forces with Tesla, adopting the Supercharger network, which is expected to become the industry standard in the US. This collaboration will provide car buyers access to 12,000 charging stations and create a unified North American charging standard. The move puts pressure on other automakers to transition from the previous CCS standard to Tesla's system, ensuring a seamless transition to electric vehicles and addressing concerns about adequate charging infrastructure.

-

Furthermore, Tesla is reportedly in advanced negotiations for a €4.5 billion ($4.8 billion) Gigafactory in the Valencia region of Spain. This new manufacturing facility, expected to be larger than Volkswagen's battery production gigafactory, highlights Tesla's commitment to expanding its manufacturing footprint beyond the United States, China, and Europe.

-

Additionally, Elon Musk, CEO of Tesla, held discussions with Mongolia's Prime Minister to explore the possibility of siting a Tesla EV battery plant in the country. Mongolia's wide availability of copper and rare earth elements, crucial components for electric vehicle batteries, makes it an attractive investment opportunity for Tesla. The conversation also touched upon the potential introduction of Starlink, a satellite communications provider, to address communication challenges in remote parts of Mongolia.

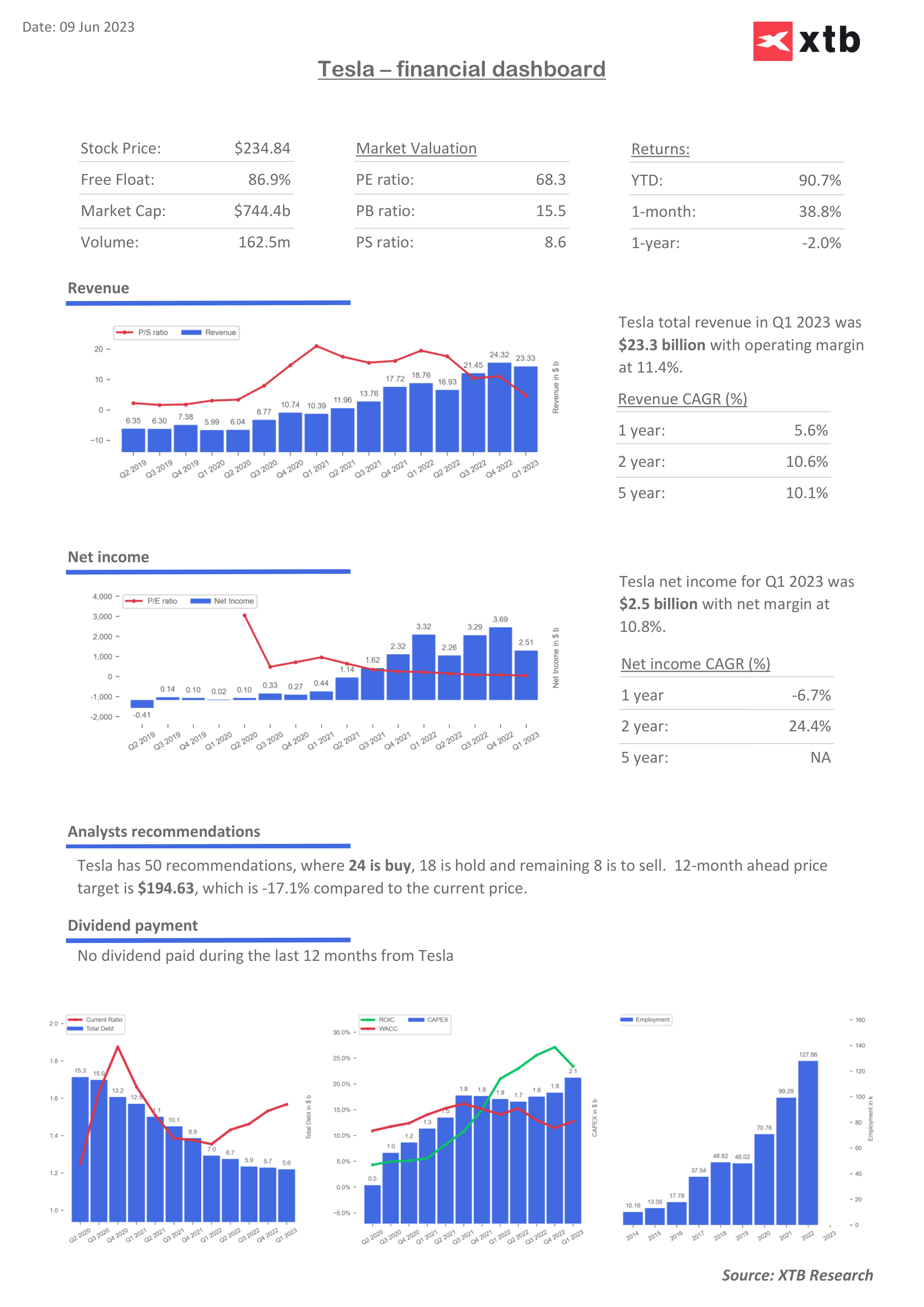

Tesla (TSLA.US) shares gained 6.3% in premarket trading following the news of a potential GM supercharger deal, pushing the stock price up to $249.

H1 interval, source xStation 5

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈