The electric car manufacturer showed results well below market expectations. Tesla is strongly feeling the competition from the Chinese producers, which forces it to make significant price cuts. Coupled with the congestion in the automotive market, where there is a trend among consumers to opt for hybrid cars, company faces challenges that weaken its results.

However, despite results significantly below expectations, investors were drawn to the news of accelerating production plans for new models in the second half of 2025. Due to the fact that the suspension between adjusting current production lines and introducing new products currently poses the biggest challenge dragging down the company's results, potential decrease of this gap is significant news for investors. In response to this information, Tesla's stock price rose by 6.8% after market close.

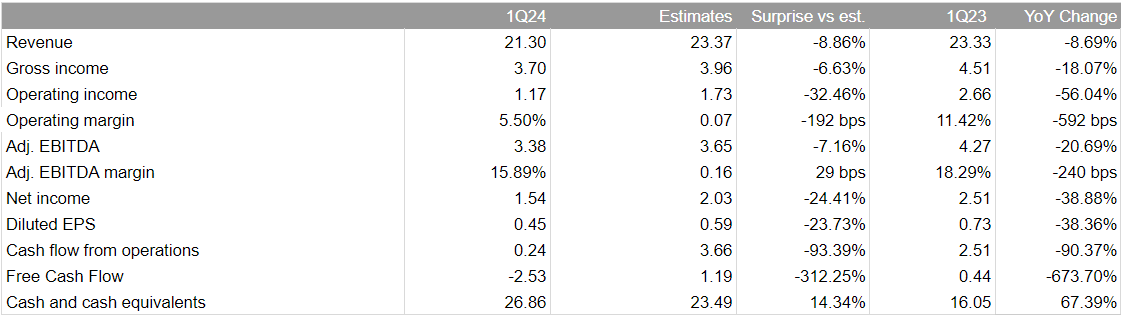

The company reported revenues of $21.30 billion (-8.7% YoY), which is a miss of -8.7% compared to market expectations. Lower sales volumes, which ultimately amounted to 386.81 thousand vehicles (-9% YoY), combined with price cuts, pushed the company's revenues below market expectations. Of the three business segments, the company saw improvement in Energy Generation and Storage (+6.93% YoY) and Services and Other (+24.12% YoY). However, this was not enough to reduce declines in the most important Automotive segment, where the company's sales fell by -13% YoY and were -11% lower than expected.

The company's profitability also suffered in 1Q24. Tesla recorded $1.17 billion in operating income, which is a decrease of -32.5% compared to consensus estimates and -56% YoY. The sharp decline in profitability is primarily due to the increase in operating expenses associated with the development of projects connected with AI and other developments.

The company notes that the deterioration in 1Q24 results is related to a series of challenges Tesla faced during the first three months of this year, including an attack by arsonists at the Gigafactory in Berlin, as well as conflicts in the Red Sea. The global electric vehicle market is currently experiencing challenges related to strong competition from hybrid cars. Despite the tough environment, the company is actively investing in further development of its projects, which is affecting its cash flow. The company's cash flow from operation amounted to only $242 million, the worst result in three years.

At the EPS level, Tesla reported $1.54 (-24.1% compared to expectations and -39% year-over-year), while the adjusted EBITDA level reached its lowest values since 2Q22 and continues the downward trend since mid-2023.

Tesla 1Q24 results. Source: XTB Research, Company's financial statement

Tesla's stock price soars even though the company missed estimated results. Source: xStation

Tesla's stock price soars even though the company missed estimated results. Source: xStation

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?