Tesla (TSLA.US) stock surged nearly 6.0% after CEO Elon Musk said he would list SpaceX's space internet venture, Starlink, when its cash flow is reasonably predictable, adding that Tesla investors might get preferential treatment to buy these shares. Additionally the automaker's stock is trading higher partially due to a recent jump in Bitcoin prices. Tesla is often associated with Bitcoin because as it has bought $1.5 billion worth of the cryptocurrency, therefore any sharp movements in digital asset’s price could impact the company's earnings report.

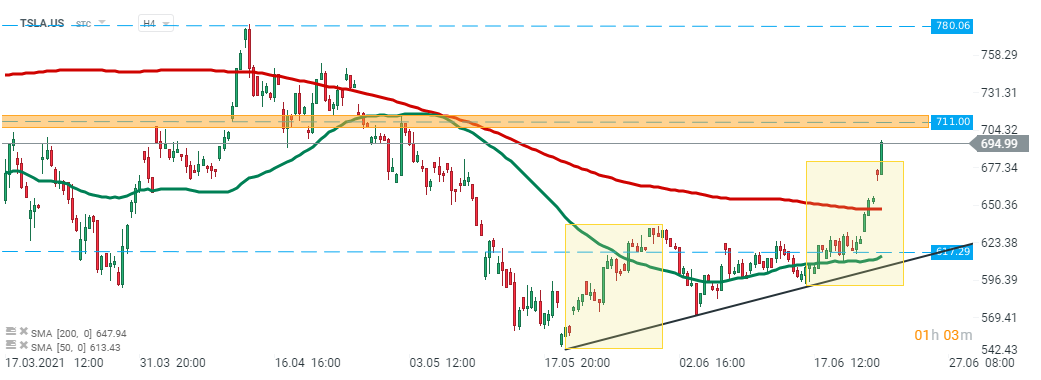

Tesla (TSLA.US) stock launched today's session with a bullish price gap and broke above the upper limit of the 1:1 structure. Currently the price is approaching local resistance at $711.00. Should a break higher occur, then upward move may be extended towards April high at $780.06. On the other hand, if sellers will manage to halt advances, then 200 SMA ( red line) should act as the nearest support. Source: xStation5

Tesla (TSLA.US) stock launched today's session with a bullish price gap and broke above the upper limit of the 1:1 structure. Currently the price is approaching local resistance at $711.00. Should a break higher occur, then upward move may be extended towards April high at $780.06. On the other hand, if sellers will manage to halt advances, then 200 SMA ( red line) should act as the nearest support. Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales