European Central Bank (ECB) Governing Council member Peter Kazimir emphasized the need for caution before implementing a rate cut, suggesting that the ECB should wait until June for its first reduction. Kazimir highlighted that there are still upside risks to inflation, which are "alive and kicking," and stressed the importance of gathering more hard evidence on the inflation outlook. He believes that by June, the ECB will have enough confidence and crucial data to make an informed decision. He favors a "smooth and steady" approach to policy easing, indicating that discussions on easing have already begun and will continue in the coming weeks.

Despite the ECB keeping interest rates at record high levels last week, Kazimir expressed growing confidence that inflation is on a downward trajectory. However, he warned that wage pressures are still too high and highlighted potential risks such as looser fiscal policy, rising natural gas prices and the cost of the green transition. Markets expect four interest rate cuts this year, starting in June. Most policymakers reportedly favour a June rate cut, with some even considering an additional move in July.

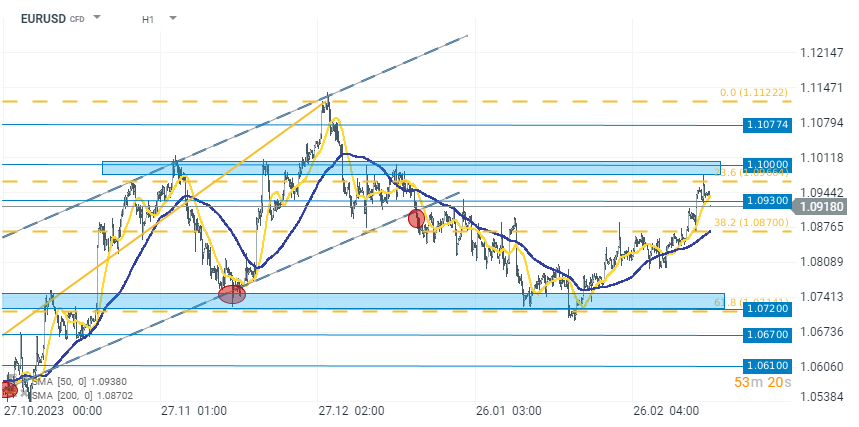

EURUSD lost 0.15% to 1.0918 at the time of publication. However, in the last few weeks, a stable upward trend has been observed in this currency pair, supported by a weaker dollar and a slight strengthening of the euro. Last week, EURUSD pulled back in an attempt to break through the 1.10 level, which is currently still ongoing. If the bulls manage to hold the 1.0870 level, the upward trend will be maintained, and the next range of the upward movement will still be the area above 1.1000.

Source: xStation 5

What does newest NFP report tells us?

US OPEN: Investors exercise caution in the face of uncertainty.

BREAKING: University of Michigan sentiment slightly better than expected!

BREAKING: Employment in Canada better than expected! 🍁📈