Tilray (TLRY.US) stock rose more than 4% during today's session after the Canada-based cannabis producer announced plans to buy $ 166 million in convertible debt of U.S. producer MedMen Enterprises as Tilray plans to enter the US market. Tilray is investing in MedMen to position itself into the US retail market for cannabis should it be legalized on the federal level. "Backed by accelerating trends towards legalization globally, we are focused on building the world's leading cannabis-focused consumer branded company with a goal of $4 billion of revenue by the end of our fiscal 2024," said Irwin Simon, Tilray's chairman and CEO, in a statement. He also said that the deal with MedMen "is a critical step towards delivering on our objective as we work to enable Tilray to lead the US market when legalization allows."

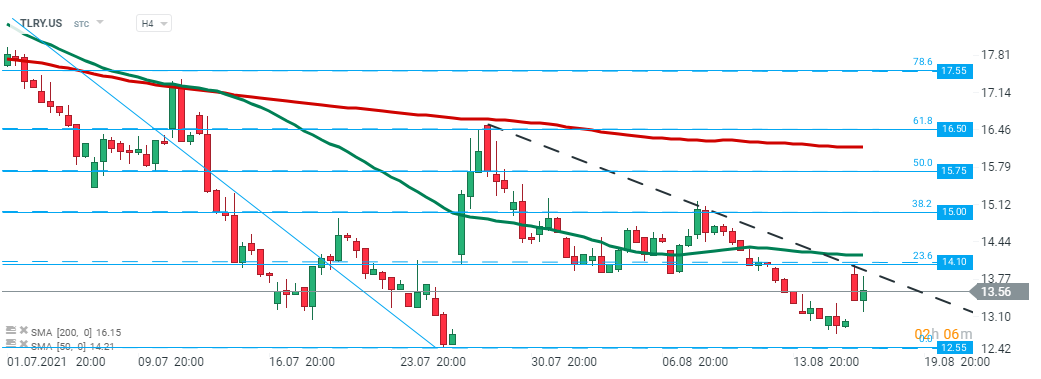

Tilray (TLRY.US) stock launched today's session with a bullish price gap, however buyers failed to break above major resistance at $ 14.10 which coincides with downward trendline, 50 SMA (green line) and 23.6 Fibonacci retracement of the downward wave which started at the end of June. Source: xStation5

Tilray (TLRY.US) stock launched today's session with a bullish price gap, however buyers failed to break above major resistance at $ 14.10 which coincides with downward trendline, 50 SMA (green line) and 23.6 Fibonacci retracement of the downward wave which started at the end of June. Source: xStation5

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales