US earnings season for Q4 2020 is slowly coming to an end with more than 96% of S&P 500 companies already reporting results. Having said that, most of the companies that are yet to report earnings reports are small and less known. So far, Q4 earnings growth rate for S&P 500 companies is 3.9% year-over-year, significantly above the 9.4% decline forecasted by analysts at the end of December 2020. Q4 revenue growth sits at 3.2% YoY.

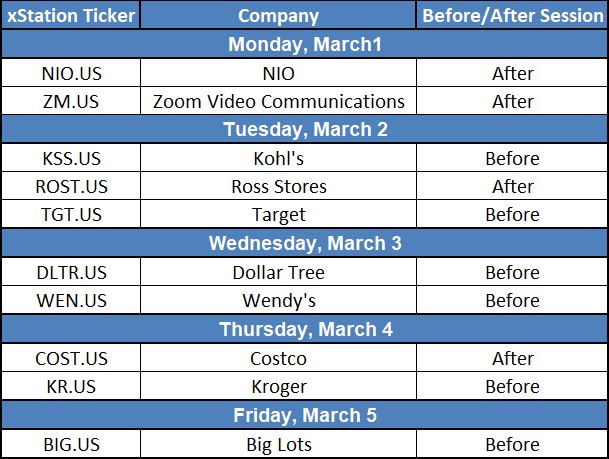

Two well-known companies that are set to report earnings this week will do so today after the close of the Wall Street session - NIO (NIO.US) and Zoom Video Communications (ZM.US). The former is expected to show $0.06 loss per share and $1.04 billion in revenue, while the latter is expected to report EPS of $0.79 and revenue of $810 million. Apart from that, this week's calendar is dominated by smaller US retailers, like Kohl's, Target, Dollar Tree or Big Lots.

Top US stock reports to watch this week. Source: Bloomberg, XTB

Top US stock reports to watch this week. Source: Bloomberg, XTB

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales