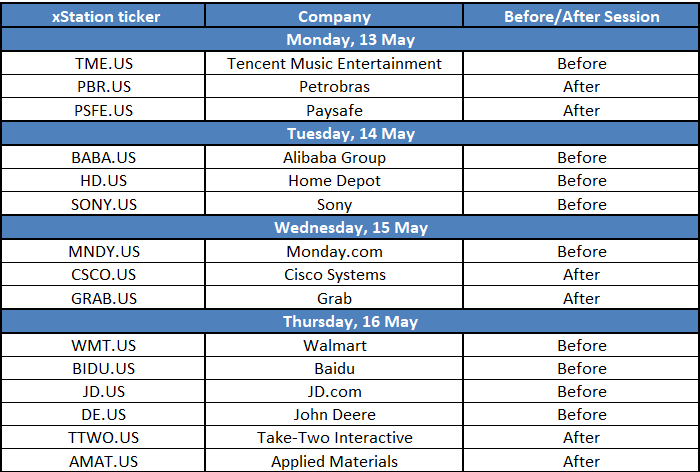

Wall Street earnings season for Q1 2024 is slowly heading to a close, with the majority of large US companies having already reported their results. Nevertheless there are still some well-known and noteworthy companies, which are yet to report. This week will see earnings releases from a number of US retailers, which will help gauge the strength of US consumer. Those include reports from, for example, Home Depot (Tuesday) and Walmart (Thursday). Apart from retailers, investors will also be offered a number from non-US companies, which have shares listed on the US markets. Among this group one can find Alibaba Group (Tuesday), JD.com (Thursday) or Sony (Wednesday). A list a key release can be found in the table below.

Top Wall Street earnings reports scheduled for this week. Source: Bloomberg Finance LP, XTB Research

Kongsberg Gruppen after earnings: The company catches up with the sector

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

Morning wrap: Tech sector sell-off (06.02.2026)

Amazon shares tumble 10% as investors recoil at the price of AI dominance