GBPUSD

Let's start today's analysis with the technical situation on the GBPUSD chart. Volatility in the GBP market is expected to pick up tomorrow as the Bank of England is set to announce a monetary policy decision at 12:00 pm BST. Taking a look at GBPUSD chart at H4 interval, we can see that the pair reached a key resistance zone in the 1.2115-1.2245, marked with the upper limit of a market geometry, upper limit of the upward channel and a 50% retracement of the downward move launched at the end of May. According to classic technical analysis, a continuation of the downward move can be expected if bulls fail to break above this zone. On the other hand, a break above may pave the way for a test of 1.2320 and 1.2480 resistance levels.

GBPUSD on H4 interval. Source: xStation5

GBPUSD on H4 interval. Source: xStation5

GOLD

Next, let's take a look at the situation on the gold market. Taking a look at H4 interval, we can see that the pair has been trading in a downward trend for some time already. In spite of painting an inverse head and shoulders pattern (green line on the chart marks neckline), upward correction was halted at $1,777 resistance - way ahead of potential inverse SHS pattern target. The $1,777 zone is marked with 50% retracement of the downward impulse launched in June as well as with the upper limit of the Overbalance structure. According to the Overbalance methodology, a downtrend may be about to resume. In such a scenario, the aforementioned neckline of the inverse SHS pattern may act as the first support.

GOLD on H4 interval. Source: xStation5

GOLD on H4 interval. Source: xStation5

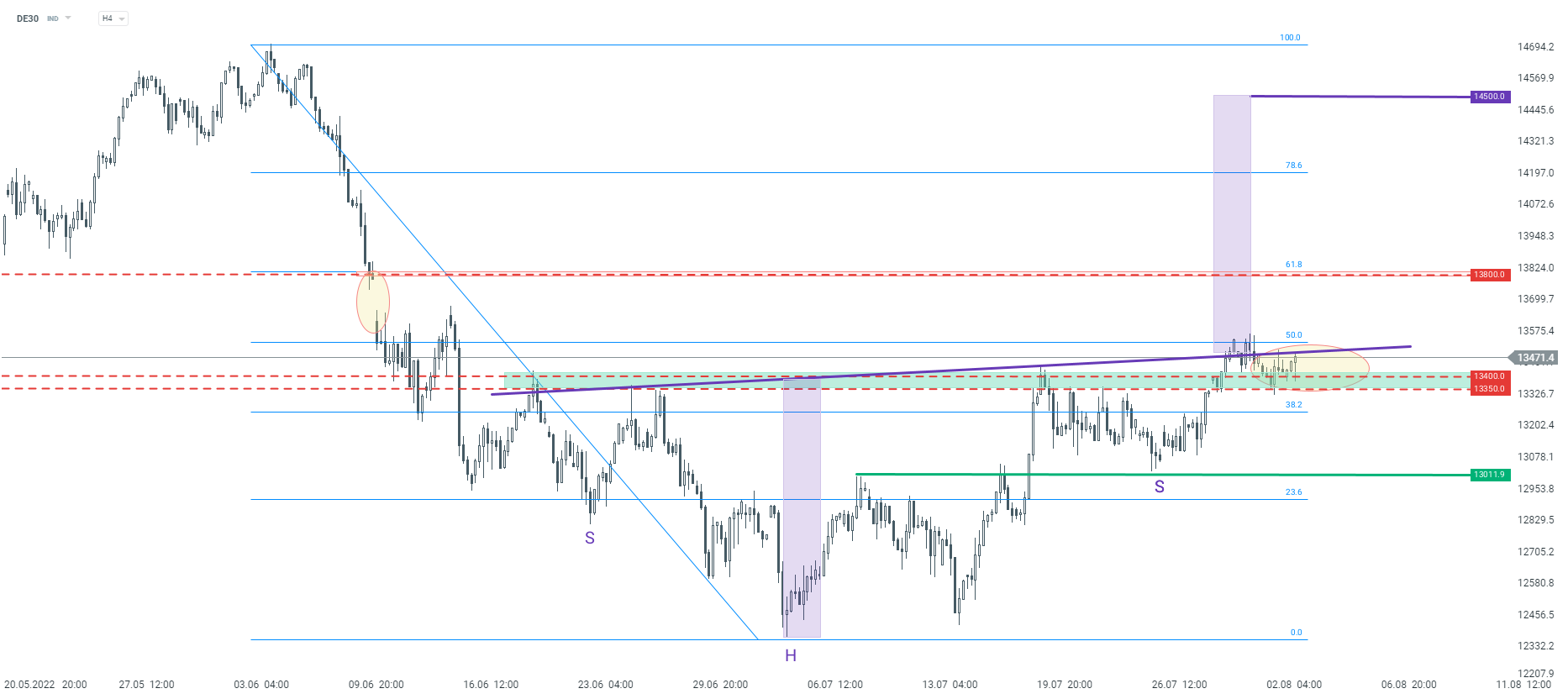

DE30

Last but not least, let's take a look at German DAX index (DE30). Taking a look at DE30 at H4 interval, we can see that a broad inverse head and shoulder pattern surfaced on the chart. Nevertheless, the upward move lost momentum following a break above the neckline of the pattern and a downward correction started. A 13,350-13,450 pts price zone looks to be key now. If the index manages to stay above it, an upward move towards the potential range of the inverse SHS pattern could be launched. On the other hand, a break below would brighten the outlook for bulls and may be followed by a test of 13,011 pts support.

DE30 on H4 interval. Source: xStation5

DE30 on H4 interval. Source: xStation5

Delta Airlines stock lifts off after earnings✈️

DE40: Europe looking for direction amid mixed PMI reports

DE40: Europe on the raise

DE40: Europe maintains cautious growth