Summary:

- US announce 25% tariff on $50B of Chinese imports

- Development another step closer to a trade war

- US indices lower ahead of Wall Street open; Soybeans slump

Trade tensions between the world’s two largest economies have ratcheted up further today with the US announcing new tariffs on $50B in imports from China. The levies are expected to take effect within a few days and will likely see Beijing reciprocate in the not too distant future. China’s Commerce Minister has wasted no time in offering his opinion saying that he firmly objects US trade measures announced by Trump towards China, and that he will retaliate at a similar size

The US500.cash has fallen close to its lowest level of the week and if the market falls below 2766 then further declines could lie ahead. Source: xStation

"The United States can no longer tolerate losing our technology and intellectual property through unfair economic practices,” Mr Trump said. “These tariffs are essential to preventing further unfair transfers of American technology and intellectual property to China, which will protect American jobs. In addition, they will serve as an initial step toward bringing balance to the trade relationship between the United States and China.”

Soybeans have been particularly sensitive to trade tensions and have fallen to their lowest level in almost a year today. Source: xStation

This development is another step closer to a trade war and while the initial reaction has been fairly muted, stocks were already trading lower on the day and the forthcoming session could be a pivotal one for stocks. Despite the strong move higher seen in European markets following the ECB yesterday the move wasn’t followed in the US and even though the US500 ended in the green, the market failed to reach its highest level of the week. Since then the market has come back under pressure and unless we see the market break decisively above the 2793-2804 region then there’s a chance for a pullback lower.

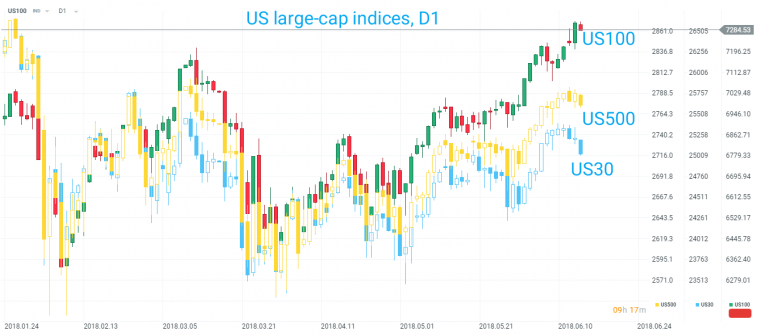

The US100 has outperformed its other large cap peers in recent trade with the US30 lagging behind. Source: xStation

There’s been a noticeable divergence amongst large-cap US indices of late with the US100 surging higher and the clear front runner while the US30 is something of a laggard. This was most clear yesterday when the US100 posted another all-time high and the US30 barely managed to eke out a gain. Unsurprisingly, the US500 is somewhere in between. The move higher in the US100 into record territory yesterday was on fairly narrow breadth with the benchmarks heavyweights such as the FAANGs accounting for much of the gains.

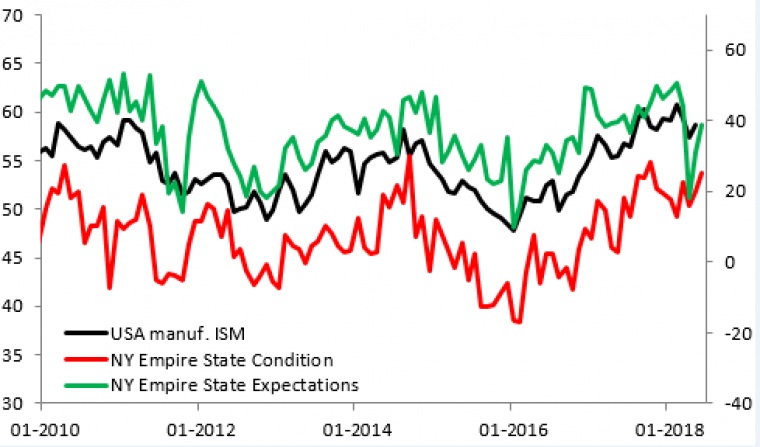

It’s a pretty quiet end to the week on the data front with the Empire state manufacturing index just beating forecasts in rising to 25.0 from 20.1 against 19.1 expected. Looking more closely at the survey there was a larger increase in expectations and this suggests positivity going forward as far as the sector is concerned. The metrics remain a little lower than their recent highs but are pretty high compared to the rest of the decade.

The NY Empire State manufacturing index rose strongly against expectations for a decline, but this is of secondary importance compared to the tariff news. Source: XTB Macrobond

Disclaimer

This article is provided for general information purposes only. Any opinions, analyses, prices or other content is provided for educational purposes and does not constitute investment advice or a recommendation. Any research has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Any information provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk, we do not accept liability for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.