Summary:

- The Reserve Bank of India considers introducing its own digital currency

- Turkish investors appreciate cryptocurrencies

- Bitcoin (BITCOIN on xStation5) could not choose a direction this week

Friday’s trading has started rather equivocally as Bitcoin, like its counterparts, has yet to find its direction. In general, major cryptocurrencies have not changed since yesterday. The capitalization of the whole cryptocurrency market stays slightly above $225 billion whereas the capitalization of the most popular digital currency stands a little above $120 billion (as we can see, its value has remained close to the yesterday’s level). Today’s newsflow concerns the Reserve Bank of India’s virtual currency plans and a survey related to cryptocurrencies holdings among consumers.

Yesterday, BITCOIN initially declined to below the $6800 handle, but the cryptocurrency increased to nearly $7000 afterwards. Source: xStation5

Yesterday, BITCOIN initially declined to below the $6800 handle, but the cryptocurrency increased to nearly $7000 afterwards. Source: xStation5

The first piece of news comes from India where the national central bank mulls over introducing its own digital currency, as reported the Indian central bank in its Annual Report 2017-2018 published on Wednesday. The Reserve Bank of India (RBI) has created a special interdepartamental group. The new unit is aimed to research “desirability and feasibility of introducing a central bank digital currency” for domestic payments. The Indian govt. and central bank are keeping a close eye on cryptocurrencies, as we could read in the mentioned bank’s report. The Reserve Bank of India is not the first one considering such the idea. For instance, Venezuela has already launched its central bank digital currency, called Petro.

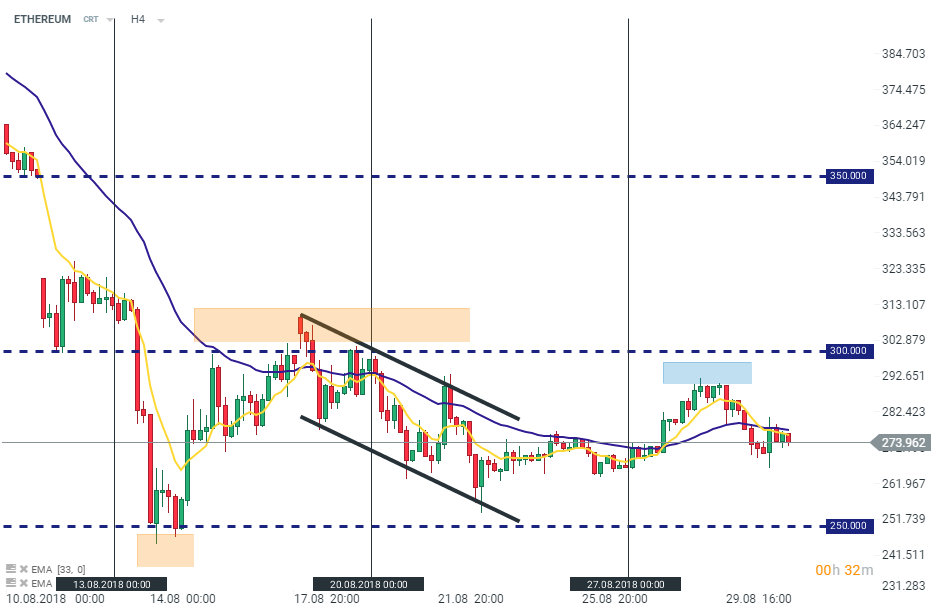

Over the past 24 hours ETHEREUM, like other peers, was trading rather undecidedly. The virtual currency is fluctuating around the $275 handle moving a little below the 8-period moving average on the H4 interval (the yellow line on the chart) at press time. Source: xStation5

Over the past 24 hours ETHEREUM, like other peers, was trading rather undecidedly. The virtual currency is fluctuating around the $275 handle moving a little below the 8-period moving average on the H4 interval (the yellow line on the chart) at press time. Source: xStation5

Another piece of news concerns the crypto-related survey conducted by Statista. According to this survey, 18% of Turkish consumers owns Bitcoin or similar digital currencies. Turkey is followed by Romania (12%) and Poland (11%). The rank of countries having at least 10% of crypto holdings among consumers is summed by Spain (10%). What’s interesting, the three first ones belong to an emerging markets group. This fact may show that developing countries’ inhabitants eagerly accept some new financial ideas.

RIPPLE has rebounded from around the psychological $0.35 mark to nearly $0.32. At press time, RIPPLE is sitting in the vicinity of the $0.325 handle, moving below the 8- and 33-period moving averages on the H4 interval (the yellow and purple lines on the chart). Source: xStation5

RIPPLE has rebounded from around the psychological $0.35 mark to nearly $0.32. At press time, RIPPLE is sitting in the vicinity of the $0.325 handle, moving below the 8- and 33-period moving averages on the H4 interval (the yellow and purple lines on the chart). Source: xStation5