Twitter's (TWTR.US) stock price jumped more than 12.0% in the premarket in the wake of reports that co-founder Jack Dorsey was stepping down as the company's CEO and Parag Agrawal, current chief technology officer, will take over his position. Dorsey will remain on the board until at least 2022, the company said, with Bret Taylor becoming independent chairman. "I've decided to leave Twitter because I believe the company is ready to move on from its founders," Dorsey wrote on Twitter.

"My trust in Parag as Twitter's CEO is deep. His work over the past 10 years has been transformational. I'm deeply grateful for his skill, heart, and soul. It's his time to lead," said Dorsey, who is also CEO of digital payments firm Square Inc (SQ.US). Earlier one of the Twitter stakeholder Elliot Management raised questions whether Dorsey is able to manage both firms.

Parag Agrawal said: "I look forward to building on everything we have accomplished under Jack's leadership and I am incredibly energized by the opportunities ahead." Agrawal is slated to speak at a Barclays investor event on December 7, alongside current CFO Ned Segal. New CEO will have to face firms ambitious internal targets. The company expects to have 315 million monetizable daily active users by the end of 2023 and is hoping to double its annual revenue by that time.

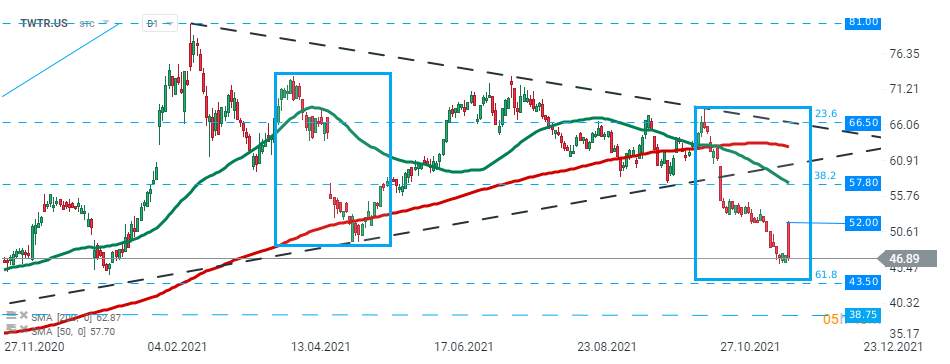

Twitter's (TWTR.US) stock launched today's trading with a bullish price gap around $52.00 level, only to plunge sharply later in the session. Currently price is heading towards local support at $43.50 which coincides with 61.8% Fibonacci retracement and lower limit of the 1:1 structure. Source: xStation5

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈