Summary:

- UK Services PMI 50.4 vs 50.3 exp and 48.9 prior

- GBP on course for solid weekly gain

- FTSE recovers but is it time to Sell in May?

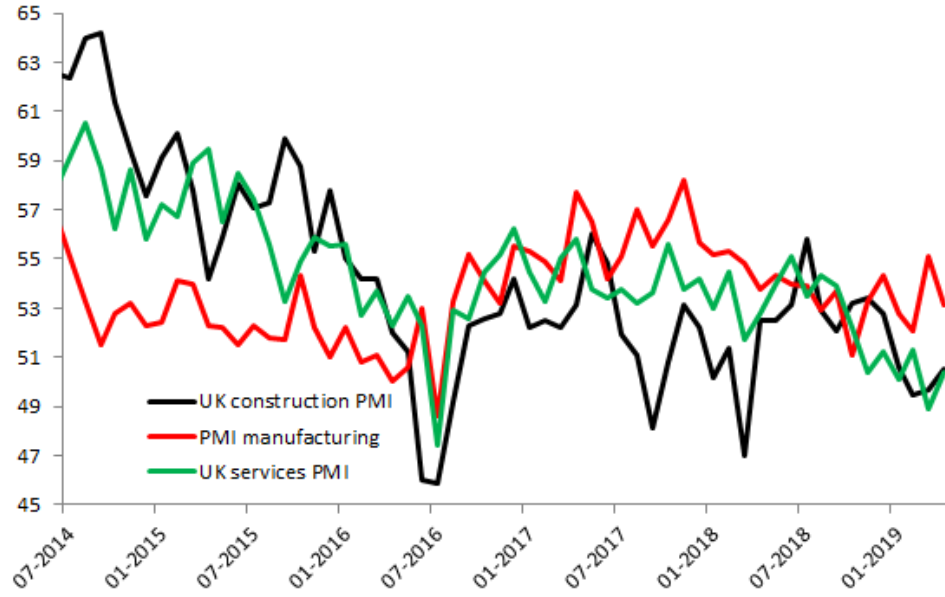

For April the UK services PMI came in pretty much in line with forecasts at 50.4 meaning that while the index has returned to expansion territory, activity in the country’s largest sector remains subdued. Looking at the components the outlook appears less favourable with new orders continuing to shrink and a reading of 49 means this data point is on its longest run in contraction territory (below 50) in a decade. The release is the 3rd and final PMI reading in as many days and the overall message seems to be that while the UK economy is just about plodding along ok it is far from firing on all cylinders.

While the services PMI mirrored an improvement like that seen in the construction equivalent the overall picture shows that economic activity in the UK has slowed. The manufacturing reading has been boosted by Brexit stockpiling and therefore gives a picture of artificial strength. Source: xStation

The market reaction has been pretty muted for the pound at the end of what has been a good week for the currency, with sterling making impressive gains in the first couple of sessions before fading a little but the market is still higher against all of its major peers on the week.

EURGBP has seen some sizable selling this week with the pair pulling back from resistance around the 0.8655 level once more. Source: xStation

As far as equities are concerned, the FTSE is set to post a second consecutive weekly loss and even though the benchmark has seen a bit of a bounce off Wednesday’s lows investor will be mindful that we are entering a period that has traditionally been weaker for stocks with the “Sell-in -May” adage sure to be rolled out several times in the coming weeks.

The FTSE has made a peak in May in each of the last two years, with 2018 seeing the all-time high of 7906 posted. Will we get more weakness this May? Source: xStation

The FTSE has made a peak in May in each of the last two years, with 2018 seeing the all-time high of 7906 posted. Will we get more weakness this May? Source: xStation