It's shaping up to be a very busy week for the US logistics sector. FedEx will show its results tomorrow, and UPS has announced its planned sale of Coyote Logistics to RXO. Coyote Logistics is engaged in logistics services for full-load delivery, less-than-truckload and intermodal transportation.

The deal is expected to be for $1.025 billion, a strong discount to the price UPS paid for Coyote Logistics in 2015, when it acquired the company for $1.8 billion. Nonetheless, news of the deal was warmly received by investors, with the company gaining more than 1.5% today. According to the companies' announcements, the transaction is expected to be completed by the end of 2024.

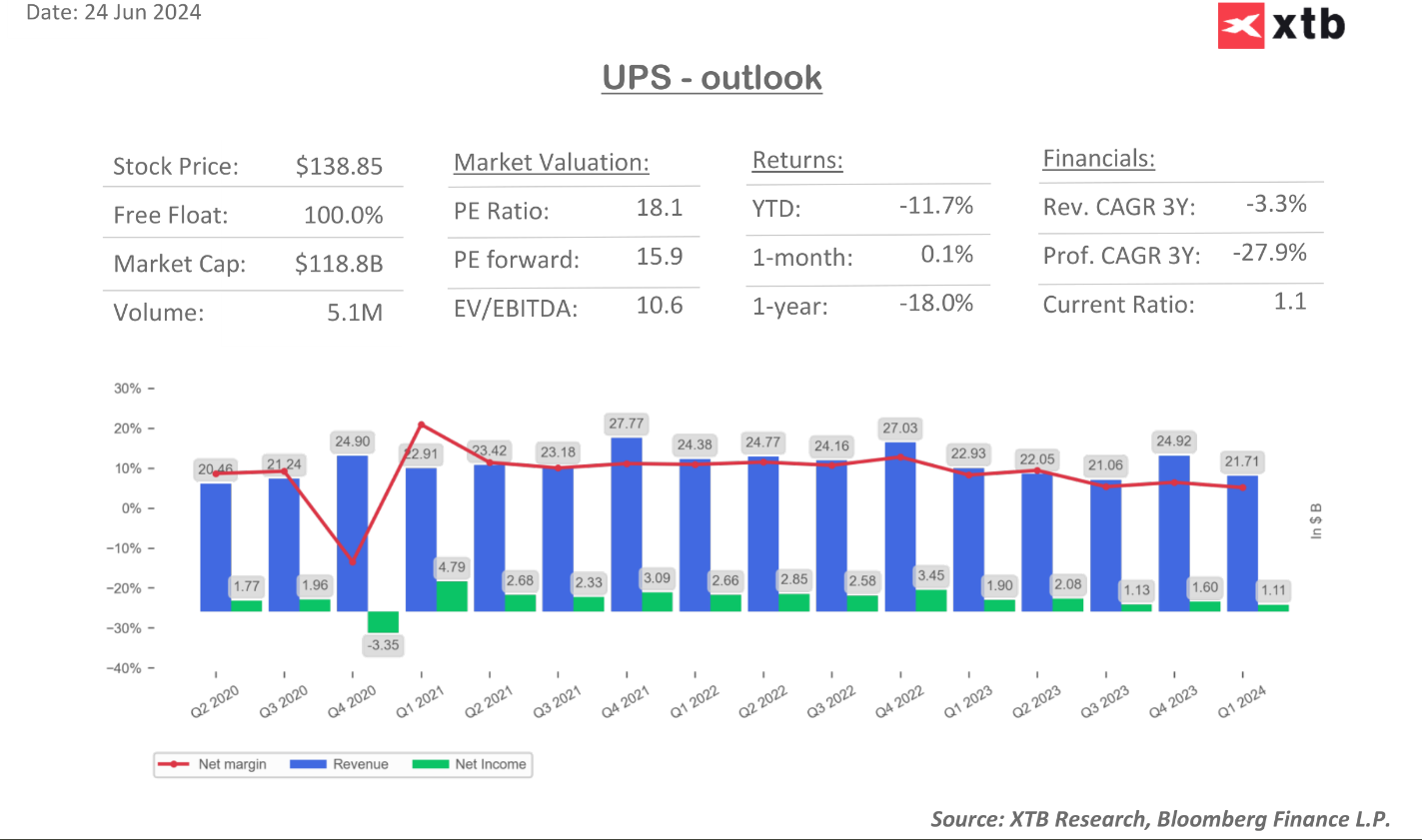

The sale of Coyote Logistics is expected to help UPS continue its strategy based on increasing its market share in the transportation of smaller packages, a core business segment for UPS. The supply chain solutions segment appeared to remain under severe pressure in the last quarter from both softer demand and stronger competition. This caused it to record the lowest operating margin of all the company's segments at only 7%.

In addition, UPS is being challenged by Amazon's increasingly strong growth at the package delivery level, which has overtaken UPS in the US market in previous years. For global package delivery, UPS continues to be the largest company by volume, but maintaining this position will require the company to improve its core segment's activites. It seems that freeing up some capital from the supply chain services solutions segment and moving it to the package delivery segment could help the company achieve its ambitious goals of achieving an adjusted operating margin of 13% over the next two years (in 1Q24 the company achieved an adjusted margin of 8%).

UPS has been in a downward trend since mid-March this year. The company has been facing negative revenue growth and increased competition in the sector for six quarters. Today, however, we can see positive movements on the chart, which allowed the company to break through the short-term resistance level set around $138. The company's stock price continues to remain under strong downward trend pressure, and for now there are no signals strongly favoring the bulls and therefore indicating an occuring of the strong breakout. The catalyst for the further direction of the company's quotations may be tomorrow's FedEx results. Source: xStation

UPS has been in a downward trend since mid-March this year. The company has been facing negative revenue growth and increased competition in the sector for six quarters. Today, however, we can see positive movements on the chart, which allowed the company to break through the short-term resistance level set around $138. The company's stock price continues to remain under strong downward trend pressure, and for now there are no signals strongly favoring the bulls and therefore indicating an occuring of the strong breakout. The catalyst for the further direction of the company's quotations may be tomorrow's FedEx results. Source: xStation

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?