Summary:

-

US PPI M/M: -0.1% vs +0.2% exp; Y/Y: 2.8% vs 3.2% exp

-

Core readings also come in lower than expected

-

USD falling lower with USDJPY hitting lowest level of the day

The most recent inflation figures from the US have come in lower than forecast and seen the USD come under a little bit of selling pressure. The PPI M/M for August unexpectedly declined by 0.1% after a consensus forecast called for a rise of 0.2% following a flat print (0.0%) previously. This is the first negative reading in M/M terms since last December’s data and only the 4th in the last 2 years. Given that the previous reading was flat the decline is even starker in relative terms. It’s a similar picture if we strip out food and energy with this core reading also declining by 0.1% against expectations of a +0.2% print and +0.1% prior.

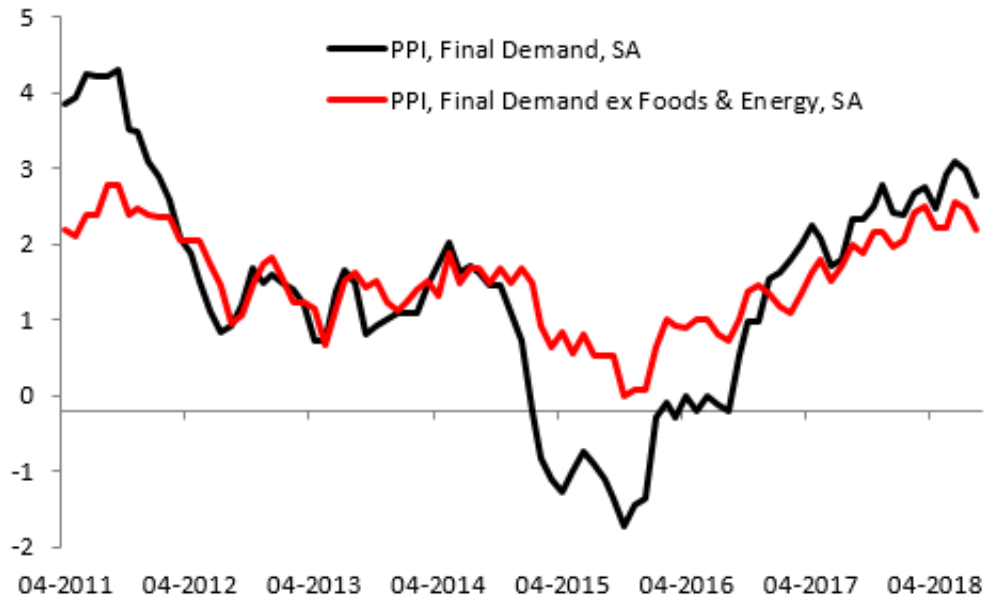

Given that the M/M reading can be quite volatile a broader overview can be arrived at by looking at Y/Y data points. Here there was also lower than expected releases, with a Y/Y figure of +2.8% compared to +3.2% forecast. The core reading also missed, coming in at +2.3% Y/Y vs +2.7% expected. It should be pointed out that both the headline and core readings remain above the 2% level even though they both were lower than expected.

Both the PPI and core PPI dipped back lower according to the latest data, and while they both remain above 2% in Y/Y terms the uptrend seen since 2015 appears to be potentially levelling off. Source: XTB Macrobond

The US dollar was trading mixed on the day ahead of the release but it has since fallen back lower with the USDJPY dropping to make new lows. The pair was subject to a recommendation from Thomson Reuters yesterday which suggested a buy limit at 111.15 with a stop loss at 110.15. The market is now not too far from the aforementioned limit buy and how it reacts around here could be interesting to watch going forward. The pair has run into quite clear resistance around 111.85 with 3 attempts to break up above there being met with selling in recent weeks.

USDJPY has dropped to its lowest level of the day following the release and price is now not far from the buy limit that Thomson Reuters recommended in yesterday’s post. Source: xStation

USDJPY has dropped to its lowest level of the day following the release and price is now not far from the buy limit that Thomson Reuters recommended in yesterday’s post. Source: xStation