- Wall Street contracts gain on the last day of this quarter and week

- USDIDX remains slightly stronger at the start of the session

- Yields on 10-year bonds fall below the 4.20% threshold

Indexes start the last trading session of this quarter, and at the same time, this week. Tomorrow the holidays begin, during which most markets will remain closed on Friday, and the long market will extend to Monday for European exchanges. US exchanges will start trading normally on Monday. At the start of the cash session, the US500 gains 0.10% to 5310 points, US100 also 0.10% to 18500 points, and US200 gains 0.45% to 2145 points.

US2000

The US small-cap index (US2000) records a good second session. In the first part of the day, contracts on the index gain almost 0.50% to 2145 points. Thus, the quotes enter the resistance zone marked on the chart in yellow, around the historic highs set at the end of 2021.

Source: xStation 5

Company news

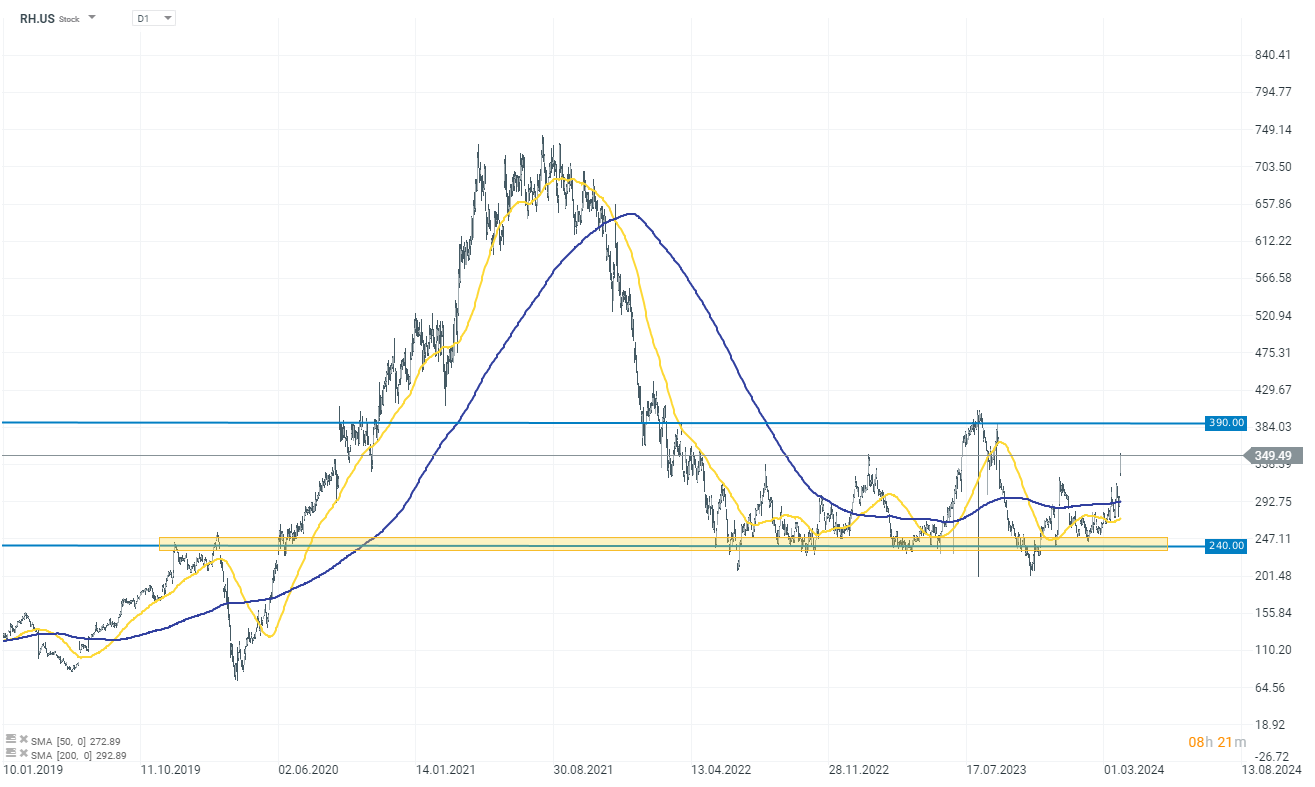

RH (RH.US) gains as much as 18% despite missing Q4 expectations. RH gins could be attributed to the optimism for improved home furnishing business performance. Q1 is expected to see demand growth in the positive mid-single digits, but revenue might drop slightly in the low single digits. Adjusted operating margin and EBITDA are projected at 6%-7% and 12%-13% respectively. FY2024 forecasts include 12%-14% demand growth, 8%-10% revenue increase, with adjusted operating margin at 13%-14% and EBITDA margin at 12%-13%.

Source: xStation 5

Estée Lauder (EL.US) gains over 4.00% following an upgrade by BofA Securities, which now sees the company as a more resilient and profitable company. Despite challenges from COVID lockdowns and a slow Chinese economy, Estée Lauder’s innovation and product updates are expected to yield potential earnings of $6 per share in FY26. BofA upgraded the stock to Buy and raised the price target to $170.

MillerKnoll (MLKN.US) dips over 18% after a mixed FQ3 report and a lower-than-expected outlook for 4Q24, with sales estimates between $880M and $920M, and adjusted earnings per share forecasted between $0.49 and $0.57.

AMC Entertainment Holdings (AMC.US) fell 11.60% after announcing plans to sell up to $250M in shares, amidst concerns over $7B losses in four years and ongoing financial struggles.

Palantir Technologies (PLTR.US): decreased about 4% after Monness downgraded the stock from Neutral to Sell, citing a "high valuation" and concerns about revenue consistency, execution, and economic challenges, despite strong performance and AI trend benefits. Monness set a price target of $20.

Source: xStation 5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report