-

Wall Street opens higher extending positive sentiment

-

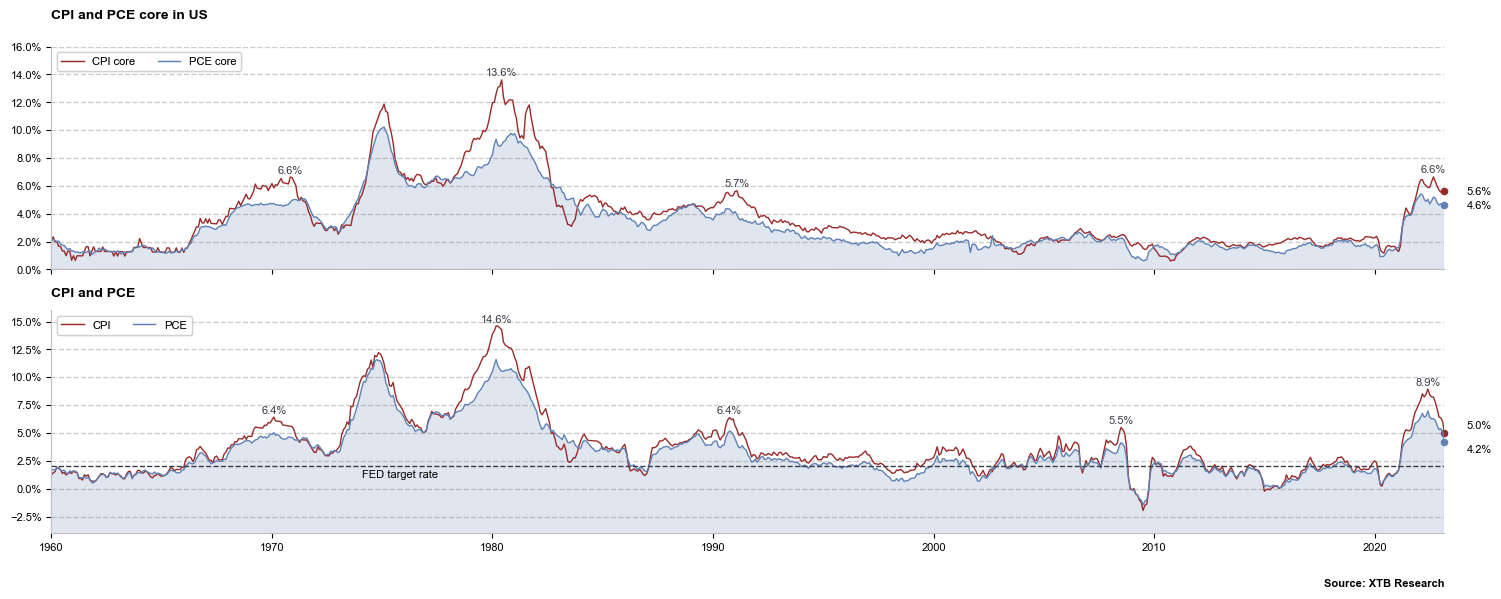

PCE core inflation above expectations

-

UoM in line with forecasts, but 1-year inflation expectation rises

Today, the economic calendar is once again quite busy. Investors have received a couple of important macroeconomic indicators, while the company earnings season continues.

At 1:30 BST time, the PCE data was published. The core PCE inflation rate increased in March, adding to evidence of sticky inflation and making it likely that the Fed will raise rates at the May 2-3 meeting. headline PCE rose 4.2%, compared to February’s revised 5.1%. The figure was higher than the consensus expectation of 4.1% YoY. Core prices remained sticky at 4.6% and came slightly lower than February’s revised 4.7%, but still higher than 4.5% expected.

However, what may be more concerning is that the survey conducted by the University of Michigan has shown an increase in 1-year inflation expectations and came at 4.6% with a 1 pp rise compared to previous results.

However, what may be more concerning is that the survey conducted by the University of Michigan has shown an increase in 1-year inflation expectations and came at 4.6% with a 1 pp rise compared to previous results.

US100 price action

The US100 index is currently trading at 13250, with a slight decrease by -0.1% after a strong gain yesterday. The index is approaching a key support level at 13350 points, which may act as a barrier to further upward movement. Traders should closely monitor the price action around this level.

Company News:

-

Capital One (COF.US) price is up 4.2% after the company reported adjusted earnings per share for the first quarter that fell short of analyst estimates. The firm reported total deposits for the first quarter that beat the average analyst estimate.

-

First Republic (FRC.US) is down 19% after CNBC reported a bankruptcy filing is highly probable at the moment.

-

Mondelez International (MDLZ.US) gains 2% after the packaged-food company behind Oreo cookies and Cadbury chocolate reported first-quarter organic-revenue growth that topped the highest analyst estimate. The company also increased its full-year outlook, though some analysts still see the projections as conservative.

-

Pinterest (PINS.US) falls as much as 11% after the social-media company gave a forecast that was seen as weak. While analysts noted that the macro backdrop remains tough, some were optimistic that the firm is on track to expand its margins this year

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report