- US stock opened lower

- US retail sales well above expectations

- FOMC minutes at 7:00 pm GMT

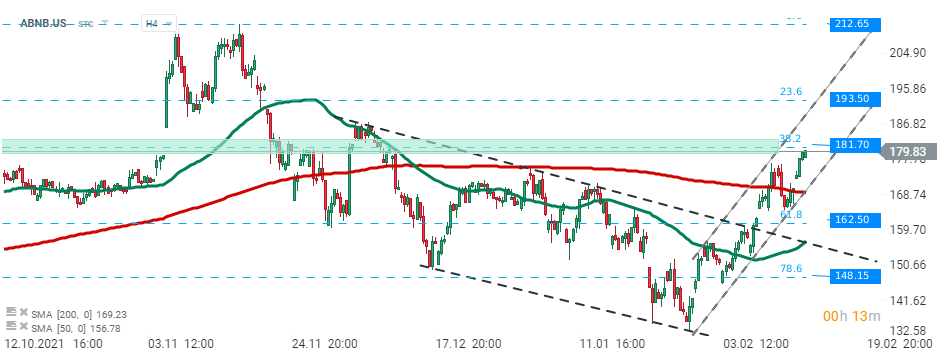

- Airbnb (ABNB.US) stock surges on upbeat quarterly results

US indices launched today’s session lower as investors try to assess the ongoing crisis between Russia and Ukraine while awaiting the FOMC minutes release, which may provide some hints on potential scope of policy tightening during a meeting next month. Many economists are expecting that the US central bank will deliver a 50 bps rate hike in March, however recent comments from several FED members indicate that consensus has not been reached. On the geopolitical front, NATO officials revealed that Russia is still concentrating troops near the Ukrainian border a day after Moscow insisted they had withdrawn some forces.

On the data front, US retail sales rose 3.8% mom in January, rebounding from an upwardly revised 2.5% decline in previous month, and beating analyst estimates of 2% rise. Industrial production increased 1.4% from a month earlier in January, after a 0.1% fall in December and well above market projections of a 0.4% increase.

US100 rose sharply yesterday, however buyers failed to break above 50 SMA (green line) and the index pulled back. If current sentiment prevails, retest of the local support around 14350 pts is possible. On the other hand, if buyers manage to regain control, then upward move may accelerate towards psychological resistance at 15000 pts, which is marked by the upper limit of the 1:1 structure. Source: xStation5

US100 rose sharply yesterday, however buyers failed to break above 50 SMA (green line) and the index pulled back. If current sentiment prevails, retest of the local support around 14350 pts is possible. On the other hand, if buyers manage to regain control, then upward move may accelerate towards psychological resistance at 15000 pts, which is marked by the upper limit of the 1:1 structure. Source: xStation5

Company news:

Airbnb (ABNB.US) stock rose over 6.0% in premarket after the home rental company reported $0.08 earnings per share for the quarter, topping analysts’ estimates of $0.05.Revenue jumped 78% to $1.53 billion, well above Wall Street expectations of $1.46 billion. Company issued an upbeat current-quarter forecast reinforcing a trend toward longer stays and higher average spending by guests.

Airbnb (ABNB.US) stock launched today’s session higher and is currently approaching local resistance at $181.70 which is marked with 38.2% Fibonacci retracement of the last upward wave. Should a break higher occur, an upward move may accelerate towards next resistance at $193.50 which coincides with the upper limit of the ascending channel. Source: xStation5

Airbnb (ABNB.US) stock launched today’s session higher and is currently approaching local resistance at $181.70 which is marked with 38.2% Fibonacci retracement of the last upward wave. Should a break higher occur, an upward move may accelerate towards next resistance at $193.50 which coincides with the upper limit of the ascending channel. Source: xStation5

Kraft Heinz (KHC.US) stock rose over 1.0% in the premarket after the food maker posted adjusted quarterly profit of 79 cents per share, easily beating analysts’ estimates of 16 cents. Revenue figures also topped market projections.

Roblox (RBLX.US) shares plunged 17% in premarket after the gaming platform posted weak quarterly results as daily active user number remained unchanged and engaged gaming hours fell short of forecasts.

Viacom (VIAC.US) stock slumped over 18% before the opening bell after the media giant posted disappointing quarterly figures, which raised investors’ concerns that its streaming services will require a significant amount of extra resources if the company wants to compete with main competitors Netflix and Disney+.

3 markets to watch next week - (17.10.2025)

US100 tries to recover🗽Sell-off hits uranium stocks

Zions Bancorp rebound after sharp US regional bank stocks sell-off 📈

DE40: European markets decline due to concerns about the U.S. banking sector