- US stocks opened lower

- Bed Bath & Beyond (BBBY.US) stock surged 70% after GameStop Chair revealed he had a nearly 10% stake in the retailer

- Boeing (BA.US) suspended buying titanium from Russia

US indices launched today's session lower as investors continued to assess how escalating Russian military aggression will affect commodity prices and inflation. Secretary of State Antony Blinken yesterday announced that the US and its allies may decide to ban Russian oil and natural gas imports. Investors try to figure out how the ongoing tensions will affect the central bank's next rate decision. Federal Reserve chair Jerome Powell pointed to a 25 basis point rate hike at the March policy meeting but said the central bank is prepared to move more aggressively later if inflation does not abate as expected.

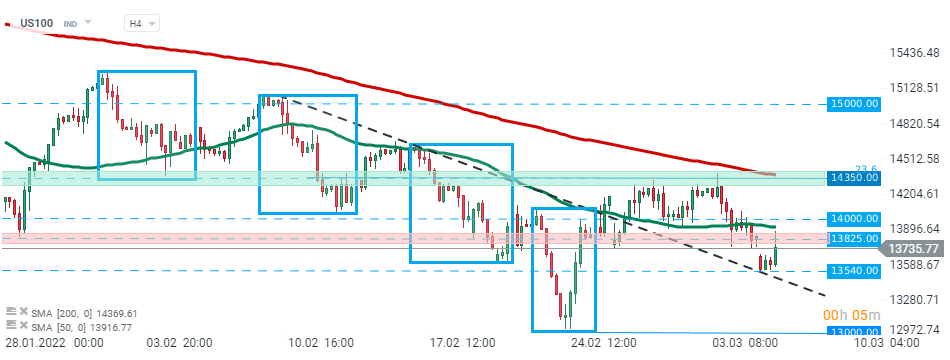

US100 launched today's session higher, however buyers struggle to break above resistance at 13825 pts. The nearest support is located around 13540 pts. Source: xStation5

US100 launched today's session higher, however buyers struggle to break above resistance at 13825 pts. The nearest support is located around 13540 pts. Source: xStation5

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appCompany news:

Bed Bath & Beyond (BBBY.US) stock of the home goods retailer jumped 70% before the opening bell after GameStop (GME.US) Chairman Ryan Cohen announced he bought almost 10% stake in the retailer through his investment company RC Ventures.

Bed Bath & Beyond (BBBY.US) stock launched today's session with a massive bullish price gap and trades above major support at $21.90 which coincides with 61.8% Fibonacci retracement of the upward wave from April 2020 and 200 SMA (red line). If current sentiment prevails, upward move may accelerate towards resistance at $33.33. Source: xStation5

Bed Bath & Beyond (BBBY.US) stock launched today's session with a massive bullish price gap and trades above major support at $21.90 which coincides with 61.8% Fibonacci retracement of the upward wave from April 2020 and 200 SMA (red line). If current sentiment prevails, upward move may accelerate towards resistance at $33.33. Source: xStation5

Chevron (CVX.US), Exxon (XOM.US) and other oil stocks rose from 2.0% to 4.0% in premarket due to high energy commodities prices as WTI crude briefly broke above $130 per barrel.

Boeing Co (BA.US) announced today it has suspended buying titanium from Russia, a move that could worsen the company’s relationship with its largest supplier of the commodity, VSMPO-Avisma.

Visa (V.US) Mastercard (MA.US) stock fell approximately 2.0% in premarket after both payments giants announced that they were suspending operations in Russia.

Citigroup (C.US) stock fell nearly 3.0% in premarket after receiving a downgrade from Jefferies. The firm said Citi appeared unlikely to hit the financial targets detailed at an investor conference last week.