- US indices launched today's cash trading lower

- Ford (F.US) cuts prices of its EV vehicles

- Coinbase (COIN.US) plunges despite analysts upgrade

Three major Wall Street indices launched today's session in red, with Dow Jones trading 0.17% lower, while S&P500 and Nasdaq fell 0.50% and 0.90% respectively, as markets are gearing up for interesting week packed with earnings releases form US mega tech companies and interest rate decisions from major central banks. Recent earnings results showed a mixed state of the US economy. On the policy side, the Fed is expected to ease the tightening process and deliver a 25 bps hike amid mounting evidence that inflation in the US has begun to ease. On the other hand, Powell stressed that he feared a repeat of the situation of the 1970s, when an overly hasty pivot led to the return of inflation.

S&P 500 index stocks categorized by sectors and industries. Size represents market cap. Source: xStation5

S&P 500 index stocks categorized by sectors and industries. Size represents market cap. Source: xStation5

The 1-Month Treasury Bill recently oscillates above 4.60%, slightly below high from August 2007 amid signs of slowing inflation and declining economic activity. Although the labor market remains strong, wage growth slowed down in December. Current yield level shows that the market is now expecting the Fed to hike only 25 bps this week. Source: Ycharts

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile app

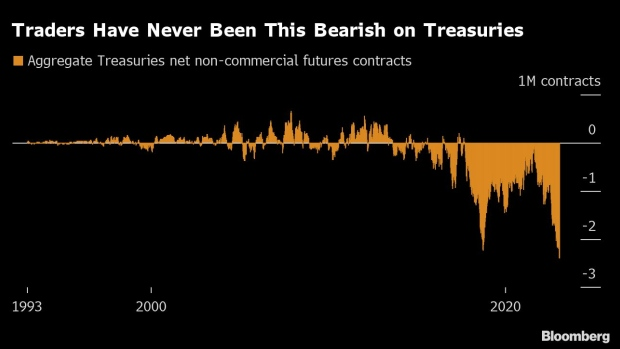

Hedge funds have the biggest net short position on US treasuries ahead of the FED meeting as they expect that yields will bounce. Source: Bloomberg via AlessioUrban Twitter

US30 pulled back slightly on Monday however buyers managed to defend major support at 33720 which coincides with 61.8% Fibonacci retracement of the downward wave launched in January 2022 and 50 SMA (green line). As long as price sits above, another upward impulse may be launched towards recent highs at 35000 pts. On the other hand, if sellers manage to regain control, then the nearest support to watch is located at 32620 pts. Source: xStation5

Company news:

Coinbase (COIN.US) stock fell nearly 2.5% in off-hours trading despite JMP Securities reiterated its outperform rating on crypto exchange on Friday.

Coinbase (COIN.US) stock rallied over 90.0% since the beginning of January, however buyers struggled to break above key resistance at $61.60, which is marked with previous price reactions. As long as price sits below, another downward impulse towards local support at $50.20 may be launched. Source: xStation5

Ford Motor (F.US) followed Tesla's footsteps and decided to lower prices of its electric Mustang Mach-E crossover and increase production.

Lucid Group (LCID.US) stock skyrocketed 98% on Friday after Bloomberg highlighted speculation by Betaville that Saudi Arabia's Public Investment Fund (SAPIF) is considering taking the electric vehicle company private.

Colgate-Palmolive (CL.US) stock rose over 1.0% before the opening bell after Morgan Stanley upgraded household and personal care products producer to overweight from equal weight citing recent dropdown in shares create an attractive entry point for investors.

Tesla (TSLA.US) was upgraded by Berenberg analysts, who believe that price cuts are part of a broader strategy and that battery cell production is another opportunity for the company to scale.

Salesforce (CRM.US) fell over 1.0% in pre-market even despite a recent upgrade form Morgan Stanley, which boosted its price target to $236 from $228 per share, implying 43% upside from Friday’s close.