- US stock opened lower partially due to geopolitical tensions

- Flash PMI indices below expectations

- Kohl’s (KSS.US) stock surges on acquisition news

US indices launched today's session sharply lower, extending recent losing streak. The Dow Jones dropped 1.7%, falling for a seventh straight day. The S&P 500 lost 2.1% and is down more than 10% from it's all-time high. The Nasdaq Composite plunged 2.4%, falling deeper into correction territory. Moods remain sour ahead of big tech earnings reports this week including IBM, Microsoft, Tesla, and Apple, after disappointing results last week from companies including Netflix and Goldman Sachs. Also geopolitical tension in Eastern Europe weigh on market sentiment. On the data front, flash PMI data disappointed. US factory growth dropped to lowest level in 15 months, while private sector growth slowed to 18-month low

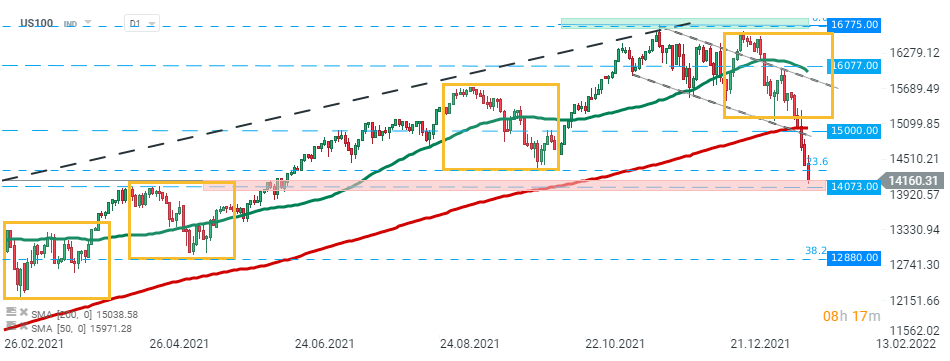

US100 deepened recent sell-off and is currently testing support at 14073 pts which is marked with previous price reaction. Should break lower occur, the next target for sellers is located at 12880 pts which coincides with 38.2% Fibonacci retracement of the upward wave launched in March 2020. Source: xStation5

US100 deepened recent sell-off and is currently testing support at 14073 pts which is marked with previous price reaction. Should break lower occur, the next target for sellers is located at 12880 pts which coincides with 38.2% Fibonacci retracement of the upward wave launched in March 2020. Source: xStation5

Company news:

Kohl’s (KSS.US) stock surged more than 30.0% in premarket trading after news that private equity company Sycamore Partners had made an offer of at least $65 per share for the struggling department store chain. Also Starboard-backed Acacia Research is offering $64 per share for Kohl’s, compared to Friday’s close of $46.84 a share.

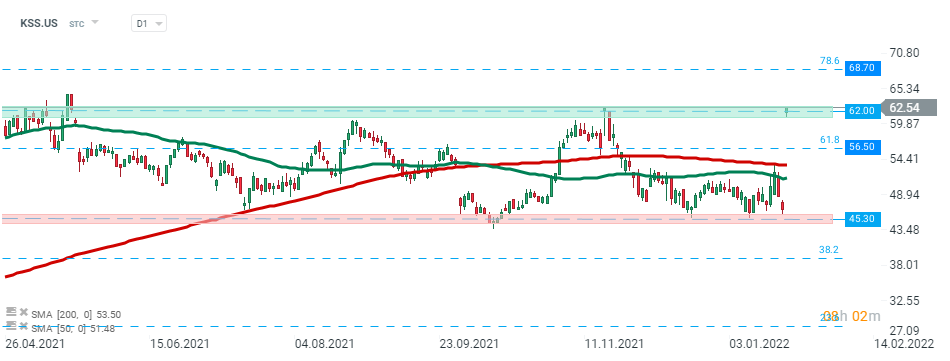

Kohl’s (KSS.US) stock launched today's session with a massive bullish price gap and is currently testing the upper limit of the consolidation zone around $62.00. Should a break higher occur, an upward move may accelerate towards resistance at $68.70 which is marked with 78.6% Fibonacci retracement of the downward wave launched in October 2018. On the other hand, if sellers will regain control, then nearest support lies at $56.50 and coincides with 61.8% retracement. Source: xStation5

Kohl’s (KSS.US) stock launched today's session with a massive bullish price gap and is currently testing the upper limit of the consolidation zone around $62.00. Should a break higher occur, an upward move may accelerate towards resistance at $68.70 which is marked with 78.6% Fibonacci retracement of the downward wave launched in October 2018. On the other hand, if sellers will regain control, then nearest support lies at $56.50 and coincides with 61.8% retracement. Source: xStation5

Coinbase (COIN.US) stock extended its recent downward move and fell another 10% in premarket and is approaching its new all-time low, as cryptocurrencies sell-off continues. MicroStrategy (MSTR.US) stock, which also invests in digital assets, lost 15% and is testing its lowest level since December 2020.

Halliburton (HAL.US) rose 1.5% in the premarket after the oilfield services company posted upbeat quarterly figures. Company earned 36 cents per share, slightly above analysts’ estimates of 34 cents per share. Demand for the company’s services jumped as oil prices rose. Company lifted its quarterly dividend to 12 cents per share from 4.5 cents a share.

Unilever (UL.US) jumped more than 6.0% in the premarket after news that Nelson Peltz’s Trian Partners increased its holding in the consumer products giant. The size of the stake could not be determined, and Trian said it did not comment on market rumors when contacted by CNBC.

Daily Summary – Wall Street Rally Driven by Powell’s Promises

TSMC Earnings Preview: Will the Key Semiconductor Supplier Surprise the Market?

US Open: American Indices Rally on Anticipated End of Fed Balance Sheet Reduction

Bank of America, Wells Fargo, and Morgan Stanley: Q3 2025 Earnings Overview