-

AI Dominance: TSMC's Q3 results are crucial for the AI ecosystem (Nvidia being a top client) as the HPC/AI segment now drives 60% of revenue.

-

High Expectations & Historical Beat: Consensus expects a record quarter (36% YoY revenue growth), with preliminary data already nearing the high-end of guidance. TSMC historically beats by ∼6%.

-

Key Bottleneck: The CoWoS advanced packaging capacity constraint remains the primary production hurdle, expected to persist throughout 2025.

-

Geopolitical Focus: The earnings call will be scrutinized for commentary on US-China trade tensions and the impact of tariffs on the global supply chain.

-

AI Dominance: TSMC's Q3 results are crucial for the AI ecosystem (Nvidia being a top client) as the HPC/AI segment now drives 60% of revenue.

-

High Expectations & Historical Beat: Consensus expects a record quarter (36% YoY revenue growth), with preliminary data already nearing the high-end of guidance. TSMC historically beats by ∼6%.

-

Key Bottleneck: The CoWoS advanced packaging capacity constraint remains the primary production hurdle, expected to persist throughout 2025.

-

Geopolitical Focus: The earnings call will be scrutinized for commentary on US-China trade tensions and the impact of tariffs on the global supply chain.

The Taiwanese semiconductor manufacturing behemoth, TSMC, is set to announce its third-quarter 2025 results on Thursday, October 16, just before the opening of European markets. This comes at a time when enthusiasm for Artificial Intelligence (AI) has reached levels where speculation about a potential bubble is emerging. The results from the Taiwanese chip giant will be crucial not just for the company itself, but also for the entire AI ecosystem, led by Nvidia, one of TSMC's primary clients.

Market Expectations: A Record Quarter Within Reach

Q3 2025 - Bloomberg Consensus:

- Net Profit: NT$406.67 billion ($13.39 billion) — a 25% increase year-over-year (YoY)

- Revenue: NT$968.44 billion ($31.89 billion) — a 36% increase YoY

- Gross Margin: 57.2%

- Operating Income: NT$459.12 billion ($15.12 billion)

- Operating Margin: 47.3%

Q4 2025 - Analyst Forecasts:

- Revenue: $31.3 billion

- Gross Margin: 57.1%

- Operating Margin: 46.9%

Preliminary September 2025 Data:

- September Revenue: NT$330.98 billion ($10.90 billion) — significantly above the NT$302 billion consensus

- Total Q3 Revenue: NT$989.92 billion ($32.60 billion) — close to the high end of the company's guidance ($31.8−$33 billion)

TSMC Q2 2025 Guidance:

- Q3 Revenue: $31.8−$33.0 billion (midpoint $32.4 billion)

- Gross Margin: 56.5%

- Operating Margin: 46.5%

Additional Metrics:

- Full-Year 2025 Revenue Growth: 32−34%

- Historical Earnings Surprise: an average of +6% above expectations over the last four quarters

- Expected Share Movement Post-Earnings: ±5.88% according to implied volatility from the options market

- Price Changes in Recent Months:

- TSMC Share Price Growth Year-to-Date (YTD): +53%

- Growth Since September (Post-AI Deals): +25%

- Growth Since March 2025: +67% vs. +15% for the S&P 500

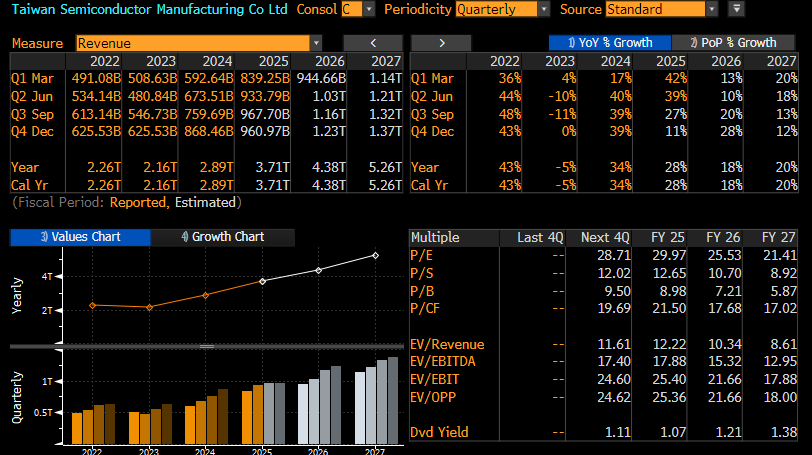

The company is expected to report revenue of around NT$978 billion, followed by forecasts indicating two subsequent quarters of flat quarter-on-quarter revenue growth. Nevertheless, projections for Q3 2026 and beyond suggest TSMC will resume strong growth, driven by robust orders from top companies in the AI segment. Source: Bloomberg Finance LP

Key Performance Drivers

AI and HPC Dominance

The High-Performance Computing (HPC) segment, primarily comprising AI chips, now accounts for 60% of TSMC's revenue — a dramatic increase from previous years. Demand for the most advanced manufacturing processes (3nm, 5nm, 7nm) remains "insatiable," according to semiconductor analysts. Companies such as Nvidia, AMD, Apple, and data center operators (Google, Microsoft, Amazon) are vying for the Taiwanese giant's production capacity.

Bloomberg Intelligence suggests that the momentum of TSMC product demand should continue into Q4, as strong orders for Apple's A19 chips and Nvidia's Blackwell architecture are expected to largely offset typical seasonality and tariff-related challenges. The company is also anticipated to report full-year revenue growth in the range of 32−34%, an increase from its earlier 30% expectation.

Risks and Uncertainties

Geopolitical Tensions and Tariffs

The key focus of the earnings call will likely be comments regarding the US-China trade war and the impact of tariffs introduced by the Trump administration. The President announced 100% tariffs on semiconductor chips, though TSMC has received an exemption due to its $165 billion factory construction in Arizona.

Nevertheless, Taiwan is still subject to a temporary 20% tariff on other sectors, and trade negotiations are ongoing. Investors will be seeking indications of how TSMC plans to secure its material and tool supplies should the trade conflict escalate.

Advanced Packaging Bottleneck

A critical constraint remains the production capacity for CoWoS (Chip-on-Wafer-on-Substrate) technology, essential for manufacturing AI chips. TSMC is aggressively expanding this capacity from 13,000 wafers per month at the end of 2023 to a planned 70,000−80,000 by the end of 2025, with a target of over 100,000 in 2026. CEO C.C. Wei has acknowledged that the supply tension will persist "throughout 2025" and hopes for an easing in 2026.

This issue is particularly acute because new architectures like Nvidia Blackwell take up 3.3× the reticle space compared to previous generations, and the upcoming Rubin is expected to take 4.0× — exponentially increasing the demand for CoWoS capacity.

Packaging refers to the company's advanced chip packaging technologies, such as CoWoS and SoIC (System-on-Integrated-Chips), which integrate multiple chips into a single package to boost performance and reduce energy consumption, crucial for AI and HPC processors. TSMC is building new chip packaging centres, for instance, in the United States, to meet rising demand, despite initially having to ship some chips from US fabs back to Taiwan for final packaging. In 2025, TSMC plans to open a new CoWoS production line and partner with Amkor in the United States to expand its capabilities.

Market Reaction Scenarios

Positive Scenario: Continuation of the AI Bull Run

- TSMC: If TSMC beats expectations (as it has in the last four quarters with an average surprise of +6%) and raises its guidance for Q4 and full-year 2025, we can expect continued gains for TSMC. Although the 12-month share price target for TSMC has been reached, a beat could trigger updated recommendations. Analysts at Susquehanna recently raised their price target from $300 to $400, citing potentially stronger future quarters than initially anticipated.

- Nvidia: As the biggest beneficiary of strong TSMC results, Nvidia is likely to gain from confirmation that Blackwell chip production is progressing as planned. The correlation between TSMC and NVDA is nearly 60%, suggesting moderate co-dependence. Positive TSMC results and guidance confirming robust AI chip demand in Q4 and 2026 should bolster the narrative of a continuing AI super-cycle. Nvidia shares have already gained 25% since early September on the back of multi-billion dollar AI infrastructure contracts.

- Broader Sector: Companies like AMD, Broadcom, Micron, data centre equipment providers (Nebius), and even Apple should benefit from confirmation of durable AI demand. European semiconductor equipment manufacturers (ASML, ASM International, BE Semiconductor) have already seen multi-percentage point gains following TSMC's preliminary September data.

Negative Scenario: Market Correction on Disappointment

If the results disappoint or the guidance is cautious, it could signal uncertainty regarding the future, potentially highlighting:

- Uncertainty related to tariffs and export restrictions

- CoWoS capacity issues

- Weaker-than-expected iPhone demand (the smartphone segment still accounts for 18% of revenue)

- Warnings of a slowdown in AI investments

How Shares Might React:

- TSMC: A correction from current levels ($303) is possible, especially given the 53% YTD surge. A forward P/E valuation of ∼30 is not low, although it is justified by 40% earnings growth. Following such strong gains, a correction cannot be ruled out. Notably, the stock experienced a correction of nearly 40% from January to early April, and another of under 10% in July.

- Nvidia: As the company with the highest exposure to TSMC (virtually 100% of its AI chip production), Nvidia could suffer the most. An additional risk is that Nvidia trades at a Forward P/E of 40 points, slightly higher than TSMC.

- Broader Sector: Declines would likely extend across the entire semiconductor sector, particularly for companies with high valuations and AI exposure. AMD, Broadcom, and HBM memory manufacturers (Samsung, SK Hynix, Micron) could all experience a sell-off.

Long-Term Perspective: TSMC as the Foundation of the AI Era

Regardless of the short-term market reaction, TSMC remains the best-positioned company in the AI supply chain. The firm controls over 60% of the global foundry market and a staggering 90% of the market for the most advanced chips (sub-10nm).

Competition is lagging: Intel is grappling with production issues and is only testing the 14A node with Nvidia, Samsung has its own difficulties scaling smaller nodes, and the barriers to entry in this business are so high that no new players are expected for the next decade.

Key Questions for the Earnings Call:

- What is the guidance for Q4 and full-year 2025?

- Commentary on securing supply in case of escalation of the US-China trade war.

- Update on long-term orders from Intel following Nvidia's recent investment.

- Ramping pace of the N2 process and US factory construction.

- Has the gross margin already bottomed out?

- Pricing outlook for 2026 (speculation about 5−10% price hikes for advanced nodes).

Summary

TSMC is on the cusp of releasing results that could either confirm or challenge the narrative of a durable AI boom. Earnings will most likely exceed expectations (typically around a 6% surprise), but the key will be the guidance and the management's tone regarding geopolitical risks.

For long-term investors, TSMC remains a company with exceptionally strong growth prospects, thanks to its unchallenged technological advantage and quasi-monopolistic position in the most profitable segment of chip manufacturing. For short-term traders, given the 53% YTD gain and the expected ±5.88% move, it might be prudent to hedge positions or realise some profits in the event of a negative surprise and look for the end of a potential correction.

Nvidia and other AI companies should follow TSMC's lead — potentially positive results and optimistic guidance will confirm the longevity of the AI super-cycle and drive further gains. A negative scenario could trigger a sector-wide correction, which would likely be a buying opportunity for patient investors, given the fundamental strength of the long-term AI trend.

TSMC shares have recently outperformed NVDA stock slightly, which could be an important sign for the world's largest AI chip producer. In the event of a positive surprise, shares could trade in the $320−330 range, whereas a negative surprise and order concerns could see investors look at the $255−265 range. Source: xStation5

TSMC shares have recently outperformed NVDA stock slightly, which could be an important sign for the world's largest AI chip producer. In the event of a positive surprise, shares could trade in the $320−330 range, whereas a negative surprise and order concerns could see investors look at the $255−265 range. Source: xStation5

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Block Inc. lays off 40% of its workforce and rises 16% - Is this a new paradigm?

US OPEN: Wall Street holds its breath ahead of Nvidia earnings

Michael Burry and Palantir: A well-known analyst levels serious accusations