- US indices launched today's cash trading sharply lower

- US CPI inflation above expectations

- Oracle (ORCL.US) stock falls despite upbeat revenue figures

US indices fell sharply on Tuesday following disappointing CPI inflation reading. The Dow plunged 1.8%, and the S&P 500 and the Nasdaq lost 2.3% and 3.0%, respectively as monthly CPI unexpectedly rose 0.1%, against analysts' expectation of a 0.1% contraction, and the headline fell only to 8.3%, while markets expected 8.1%. Money markets have priced in a 75 bp hike next week and placed almost 20% odds on 100 bp.

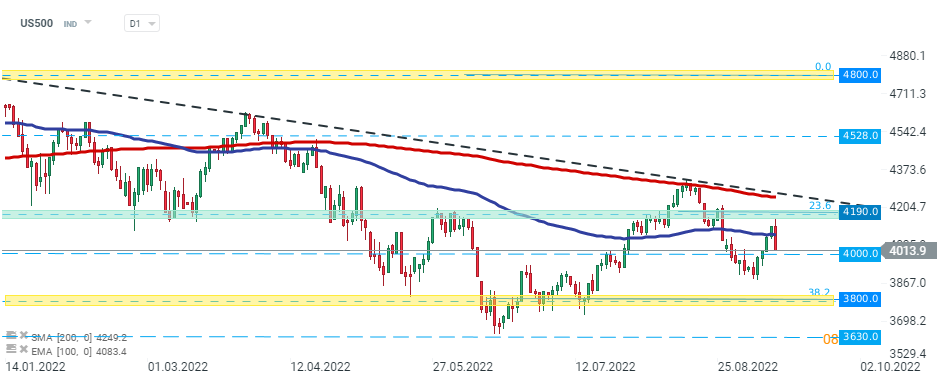

US500 fell sharply following the release of CPI figures and gave back a significant part of recent gains and is currently approaching psychological support at 4000.0 pts. Should break lower occur, the next target for sellers is located at 3800 pts which coincides with 38.2% Fibonacci retracement of the upward wave launched in March 2020. Source: xStation5

US500 fell sharply following the release of CPI figures and gave back a significant part of recent gains and is currently approaching psychological support at 4000.0 pts. Should break lower occur, the next target for sellers is located at 3800 pts which coincides with 38.2% Fibonacci retracement of the upward wave launched in March 2020. Source: xStation5

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appCompany news:

Oracle (ORCL.US) stock fell 0.50% in premarket despite the computer technology company recorded 18.0% revenue increase YoY, boosted by a recent acquisition in software maker Cerner. Also demand for its cloud services remains strong.

Oracle (ORCL.US) stock launched today's session lower as market sentiment deteriorated after the inflation report. If current sentiment prevails, support at $73.00 may be at risk. Source: xStation5

Oracle (ORCL.US) stock launched today's session lower as market sentiment deteriorated after the inflation report. If current sentiment prevails, support at $73.00 may be at risk. Source: xStation5

Peloton Interactive Inc. (PTON.US) stock rose 1.0% in premarket after the exercise equipment and media company announced that executive chairman and co-founder John Foley will resign as part of a massive restructuring process.

Dow (DOW.US) stock fell 1% in premarket after Jefferies downgraded its stance on the chemicals company to ‘hold’ from ‘buy’, citing excess supply and demand risks.

Wolfspeed (WOLF.US) stock plunged over 3.0% in premarket despite Evercore ISI initiated coverage of the semiconductor stock with an outperform rating, saying Wolfspeed “is one of the greatest ways to invest in the Electric Vehicle transition underway today.”