-

American stocks gain after Thursday’s sell-off

-

Michigan Consumer Sentiment beats the expectations

-

Hertz (HTZ.US) seeks to sell up to $1 billion in shares

Yesterday’s session must have been tough for every investor around the world. The rapid sell-off was indeed the biggest market crash since March 2020. The day after Fed’s decision and Powell’s press conference, all US major indices dived more than 5%. Federal Reserve Chairman warned about long-term effects of COVID-19 pandemic, indeed. Some also associate yesterday’s declines with fears of a second wave of coronavirus pandemic. Nevertheless, after a hectic day investors with exposure to the US stock market may sigh with relief today.

All major US indices opened higher today as positive moods seem to dominate on global stock markets. S&P 500 and Nasdaq are rising roughly 2% while DJIA is adding almost 3%. Russell 2000 is surging 3,50%! The University of Michigan's consumer sentiment was released at 3:00 pm BST. The index rose in June to 78.9 pts (vs exp. 75.0). The current conditions subindex stood at 87.8 pts (vs exp. 85.0) while the consumer expectations subindex rose to 73.1 pts (vs exp. 70.0).

Start investing today or test a free demo

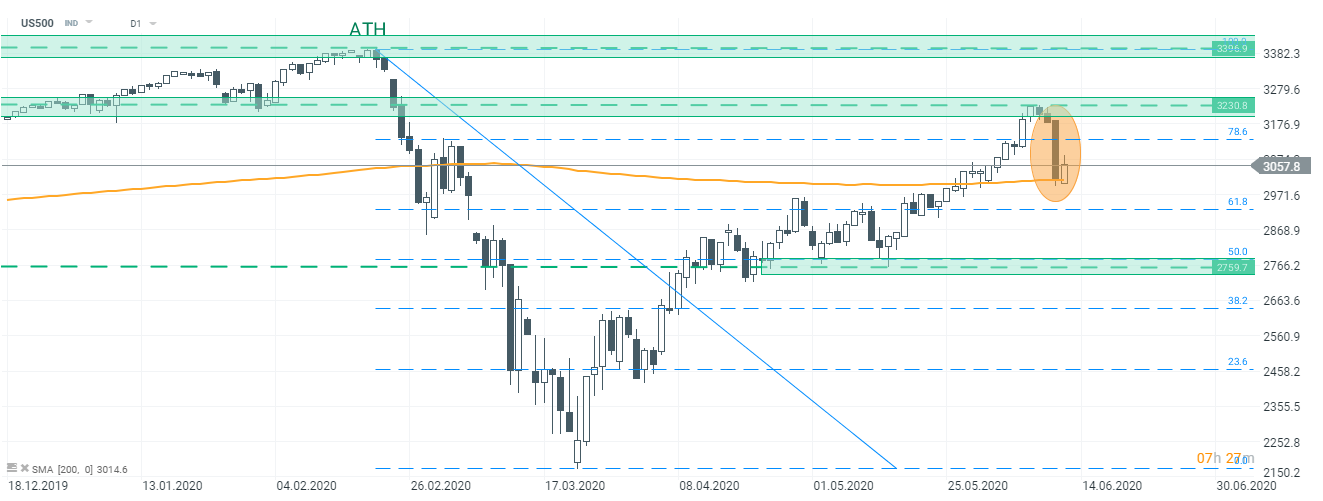

Create account Try a demo Download mobile app Download mobile app After yesterday’s market crash, S&P 500 (US500) is trading higher again. Index bounced off 200-period moving average and is currently heading towards post-pandemic highs (3,230 pts area). Because of today’s solid gains, some people view yesterday’s sell-off as a one-off event. As positive moods prevail around the world, the mentioned area of 3,230 pts may be treated as the main target for market bulls. However, should the number of COVID-19 cases skyrocket during the weekend, the moods might dramatically change on Monday. In this scenario, one should view 61.8% retracement of February-March sell-off as the first support. The next support is located at 50.0% retracement (2,760 pts). Source: xStation5

After yesterday’s market crash, S&P 500 (US500) is trading higher again. Index bounced off 200-period moving average and is currently heading towards post-pandemic highs (3,230 pts area). Because of today’s solid gains, some people view yesterday’s sell-off as a one-off event. As positive moods prevail around the world, the mentioned area of 3,230 pts may be treated as the main target for market bulls. However, should the number of COVID-19 cases skyrocket during the weekend, the moods might dramatically change on Monday. In this scenario, one should view 61.8% retracement of February-March sell-off as the first support. The next support is located at 50.0% retracement (2,760 pts). Source: xStation5

Hertz Global Holdings (HTZ.US) allegedly asked the court for a chance to sell up to $1 billion of new stock. The company wants to take advantage of the rapid surge of the share price (in recent days stock price rose almost 10-fold!). Bloomberg reports that Hertz proposes an offering as many as 246.78 million common shares. Hertz apparently stated that it would warn potential investors that “the common stock could ultimately be worthless”.

Hertz Global Holdings (HTZ.US) shares are rising almost 50% today! In recent days stock price rose almost 10-fold (orange circle on the chart above). Today investors seem to betting on the firm’s future once again as the company seeks to sell up to $1 billion in shares. Source: xStation5

Hertz Global Holdings (HTZ.US) shares are rising almost 50% today! In recent days stock price rose almost 10-fold (orange circle on the chart above). Today investors seem to betting on the firm’s future once again as the company seeks to sell up to $1 billion in shares. Source: xStation5

Adobe Inc. (ADBE.US) was gaining over 4% in pre-market trading. On Thursday afternoon, the company announced its quarterly financial results (fiscal second quarter). The firm reported revenue of $3.13 billion and GAAP EPS of $2.27. Even though Adobe missed revenue estimates, its Digital Media (including Creative and Document Cloud businesses) turned out to be exceptionally strong. Digital Media revenue rose 18% annually to $2.23 billion. However, Adobe now seems to be struggling with Digital Experience segment - its revenue rose only 5% annually to $826 million (it missed guidance for 12% growth).

American Airlines Group (AAL.US) shares are up roughly 15% today. The company published some business updates. It mentioned significant cost reduction actions, but also financial forecasts for second quarter. The firm expects its quarter revenue and total system capacity to be off by 90% and 75% respectively (YoY). What seems to be crucial is a statement that the firm has “passed the peak in cash refund activity”. As flight demand is finally starting to improve, the carrier hopes to fly 55% of its domestic schedule and about 20% of its international schedule in July.