- US stocks open lower

- Evergrande fears weigh on market sentiment

- Tesla (TSLA.US) criticized by the chief of the National Transportation Safety Board

US indices launched today’s session sharply lower amid mounting concerns over a massive default in the Chinese real estate market and potential spillover effects sink indices in Asia, Europe and the United States. Dow Jones fell more than 500 pts to a fresh 2-month low and both the S&P 500 and the Nasdaq are trading more than 1% lower as investors' risk appetite retreated ahead of FOMC meeting which will take place on Wednesday and investors are worried the central bank will signal that it is ready to start the tapering process.

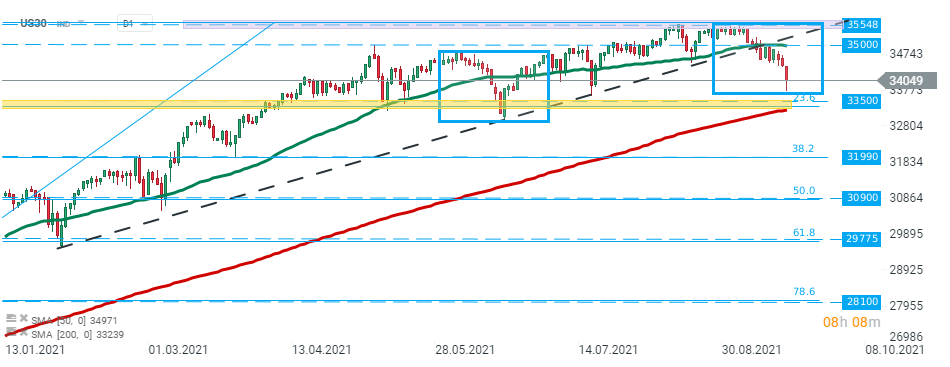

Taking a look at the US30 chart, we can see that the index fell sharply during today’s session however sellers failed to break below major support at 33500 pts where the lows from July are located. This level is also marked with a lower limit of the 1:1 structure, 200-session moving average (red line) and a 23.6% retracement of the upward move launched in November 2020. Should break lower occur, then downward correction may deepen towards support at 31990 pts. However as long as the price sits above the aforementioned 33500 pts level, then further upward impulse may be launched. Source: xStation5

Taking a look at the US30 chart, we can see that the index fell sharply during today’s session however sellers failed to break below major support at 33500 pts where the lows from July are located. This level is also marked with a lower limit of the 1:1 structure, 200-session moving average (red line) and a 23.6% retracement of the upward move launched in November 2020. Should break lower occur, then downward correction may deepen towards support at 31990 pts. However as long as the price sits above the aforementioned 33500 pts level, then further upward impulse may be launched. Source: xStation5

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appCompany news:

Tesla (TSLA.US) stock dropped over 3.0% in premarket after National Transportation Safety Board chief Jennifer Homendy criticized the company’s rollout of driver-assistance software in an interview with the Wall Street Journal. Homendy believes that Tesla needs to address safety deficiencies in its full self-driving technology.

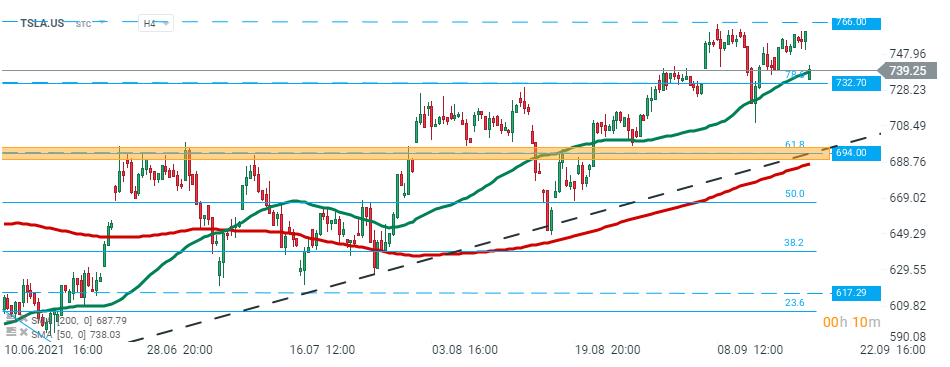

Tesla (TSLA.US) stock launched today’s session with a bearish price gap and is currently approaching strong support at $732.70 which is marked with 78.6% Fibonacci retracement of the last downward wave launched in April and 50 SMA (green line). Should break lower occur, downward move may accelerate towards major support at $694.00 which coincides with the upward trendline, 200 SMA (red line) and 61.8% Fibonacci retracement. However if buyers will manage to regain control, then another upward impulse towards recent highs at $766.00 may be launched. Source: xStation5

Tesla (TSLA.US) stock launched today’s session with a bearish price gap and is currently approaching strong support at $732.70 which is marked with 78.6% Fibonacci retracement of the last downward wave launched in April and 50 SMA (green line). Should break lower occur, downward move may accelerate towards major support at $694.00 which coincides with the upward trendline, 200 SMA (red line) and 61.8% Fibonacci retracement. However if buyers will manage to regain control, then another upward impulse towards recent highs at $766.00 may be launched. Source: xStation5

Colgate-Palmolive (CL.US) shares rose nearly 0.50% in premarket after the Deutsche Bank upgraded consumer staples stock was to buy from hold as Colgate’s difficulties with inflation and in some international markets was already priced into its stock.

Pfizer (PFE.US) stock fell over 1% in premarket after the drug maker confirmed that trials showed its Covid vaccine can be administered to children ages 5 to 11. Pfizer and partner BioNTech are planning to submit the results for approval “as soon as possible.”

Netflix (NFLX.US) won more prizes during the 73rd Emmy Awards, compared to any other competitor, network or platform, for the first time ever. Still stock fell over 1.0% in premarket.