- Wall Street indices open higher

- US2000 attempts to break back above 2,050 pts

- Fastenal drops 5% after Q1 2024 earnings

Wall Street indices launched today's trading higher, recovering part of yesterday's losses. S&P 500 opened 0.2% higher, Dow Jones gained 0.1% at session launch, while Nasdaq and small-cap Russell 2000 jumped 0.3% and 0.4%, respectively. Today's PPI reading did not turn out to be a hawkish surprise like yesterday's CPI print. In fact, headline PPI inflation accelerate less than expected, triggering an uptick on US indices.

Source: xStation5

Source: xStation5

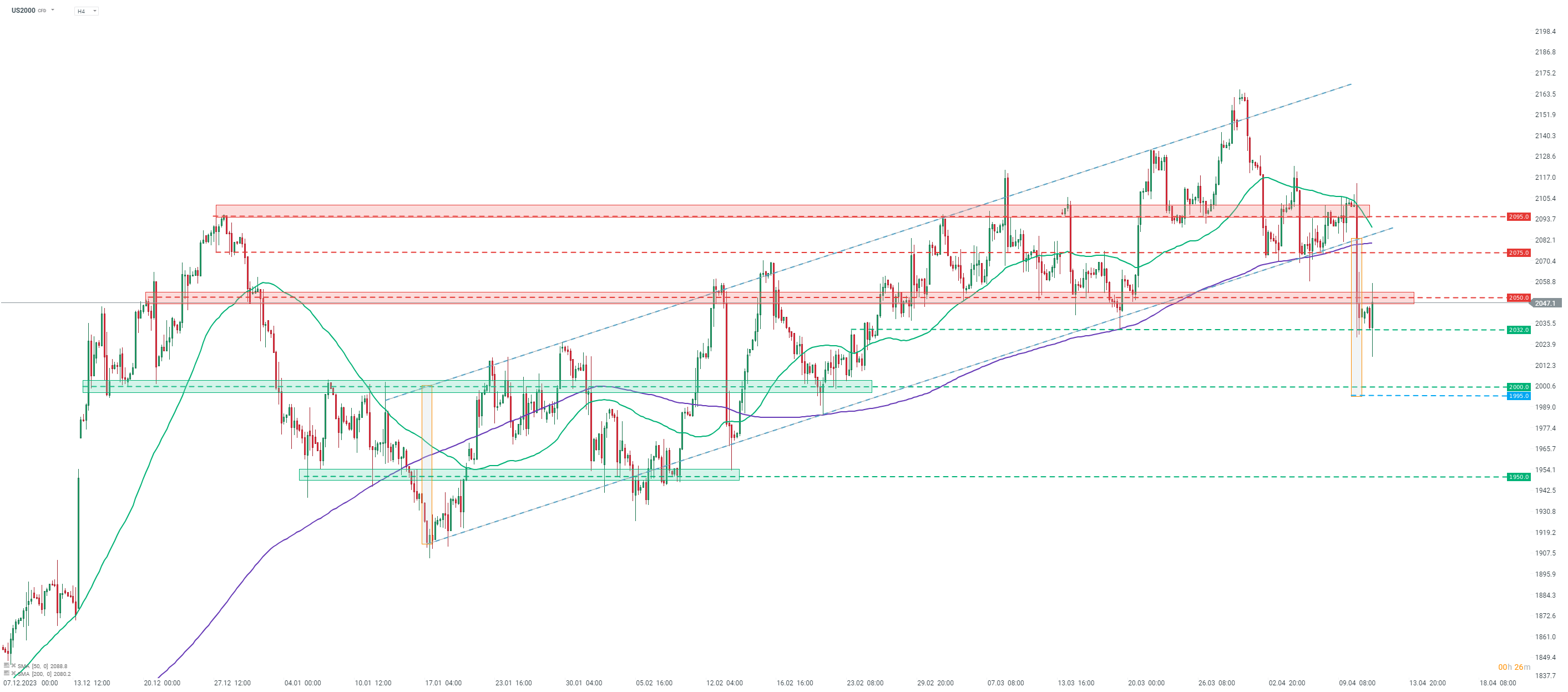

Russell 2000 futures (US2000) outperform other US indices today. US2000 is up around 0.5% on the day, erasing a part of yesterday's plunge. Taking a look at US2000 chart at H4 interval, we can see that the index plunged below the 2,075-2,080 pts area yesterday, marked with the previous price reactions, 200-period moving average (purple line) and the lower limit of the bullish channel. A textbook target of the downside breakout from the channel suggest a possibility of a move to as low as 1,995 pts area. However, declines seem to have been halted in the 2,032 pts swing area, at least for now. Should the stock managed to recover back above the 2,050 pts resistance zone, an attempt may be made to return to the bullish channel.

Company News

Fastenal (FAST.US) drops after reporting Q1 2024 earnings ahead of the market open. Company reported 1.9% YoY increase in net sales to $1.90 billion (exp. $1.91 billion). Daily sales climbed 2.1% YoY to $29.6 million (exp. $30 million). Operating income at $390.2 million was 0.8% YoY lower (exp. $404.3 million), while operating margin at 20.6% was lower than 21.2% reported a year ago and also lower than 21.1% expected by the markets. EPS stayed unchanged compared to a year ago at $0.52 (exp. $0.53). Company expects full-year capital expenditures to reach $225-245 million (exp. $222 million).

Vertex Pharmaceuticals (VRTX.US) agreed to acquire Alpine Immune Systems, a kidney drug developer, in a cash transaction. Company will be acquired at $55 per share, or a total of $4.9 billion in cash. Alpine shares surged over 30% to around $64 per share, while Vertex shares held steady. Analysts view the move favorably, saying that Alpine acquisition is a strategic fit for Vertex

Analysts' actions

- Atlassian (TEAM.US) upgraded to 'overweight' at Barclays. Price target set at $275.00

- Nike (NKE.US) upgraded to 'buy' at Bank of America. Price target set at $113.00

- Robinhood Markets (HOOD.US) downgraded to 'sell' at Citi. Price target set at $16.00

- DoorDash (DASH.US) upgraded to 'buy' at MoffetNathanson. Price target set at $164.00

- Albemarle (ALB.US) upgraded to 'buy' at Berenberg. Price target set at $160.00

- Exelixis (EXEL.US) downgraded to 'equal-weight' at Barclays. Price target set at $25.00

- Gen Digital (GEN.US) downgraded to 'equal-weight' at Barclays. Price target set at $25.00

- Kenvue (KVUE.US) rated 'underperform' at Bernstein. Price target set at $18.00

Vertex Pharmaceuticals (VRTX.US) launched today's trading slightly higher, following announcement of Alpine Immune Systems acquisition. Stock climbed to record highs at the turn of January and February 2024, but has struggled since and traded lower. Stock is now trading in a short-term downward channel. Source: xStation5

Vertex Pharmaceuticals (VRTX.US) launched today's trading slightly higher, following announcement of Alpine Immune Systems acquisition. Stock climbed to record highs at the turn of January and February 2024, but has struggled since and traded lower. Stock is now trading in a short-term downward channel. Source: xStation5

Chart of the day: USDJPY (17.11.2025)

Alibaba sell-off extends amid White House national security concerns📌

US Earnings Season Summary 🗽What the Latest FactSet Data Shows

3 markets to watch next week (14.11.2025)