Summary:

- US core retail sales M/M: +0.9% vs +0.5% exp

- Draghi strikes dovish tones in press conference

- EURUSD drops below 1.17; DE30 above 13000

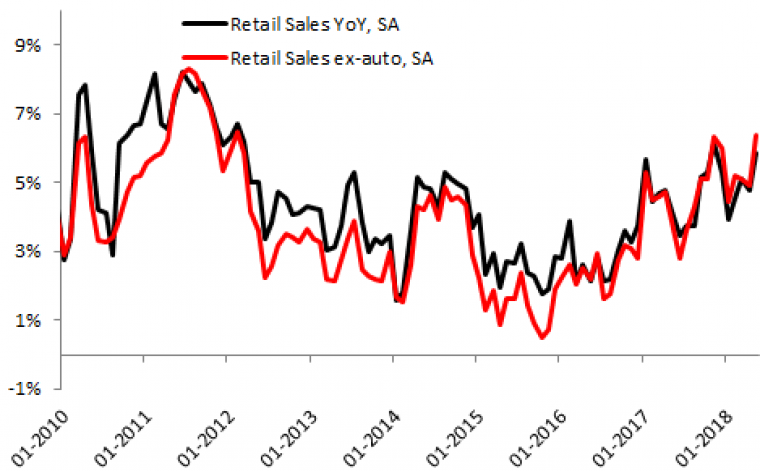

A batch of data from the US has shown several positives for the world’s largest economy. First off, retail sales beat with the M/M reading for the headline rising by 0.8% (0.4% exp and 0.4% prior - revised up from 0.3%) as well as the core figure up to 0.9% (vs 0.5% exp and 0.4% prior - also revised higher from 0.3%). Initial jobless claims also provided a better than expected reading, falling to 218k compared to 223k expected.

US retail sales and the core component continued to rise in May. Both these measures are near their highest levels in several years. Source: XTB Macrobond

While this data is no doubt pleasing, it is of secondary important this afternoon to the Draghi press conference after the ECB earlier stunned markets by announcing what could be described as a dovish taper. Some selected comments from the press conference are as follows:

- The decision was unanimous

- The soft patches will continue in some countries in Q2

- Increasing uncertainty from risks; don’t want to underplay them

The decidedly dovish ECB has caused a huge drop in the single currency with the Euro dropping sharply across the board. The EURUSD has dropped more than 150 pips from its high of the day at 1.1852 - which was seen shortly after the decision was announced - and is now back below the 1.17 level. There’s also been a rally seen in stocks with the DE30 moving back above the 13000 level and higher by around 1.5% on the day.

EURUSD has tumbled over 150 pips and is back below 1.17 as the markets clearly view today’s ECB as far more dovish than expected. Source xStation

Disclaimer

This article is provided for general information purposes only. Any opinions, analyses, prices or other content is provided for educational purposes and does not constitute investment advice or a recommendation. Any research has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Any information provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk, we do not accept liability for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.