Summary:

-

US indices in the green ahead of the opening bell

-

Reports of further US-China trade talks boost sentiment

-

US500 back near key resistance zone (2589-2624)

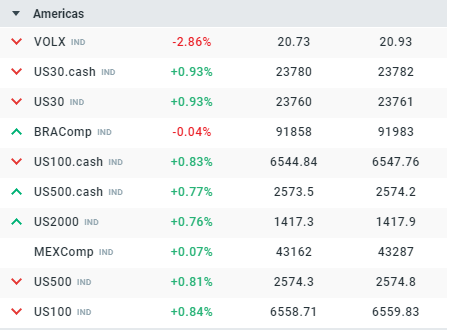

US stocks are looking to post a 3rd consecutive solid daily gain with all the indices firmly higher ahead of the opening bell. The biggest gains can be seen in the US30, which is up by nearly 1% on the day but even the worst performing market (US2000) is higher by more than 0.75%. The rise in equities has seen a marked decline in the volatility index with VOLX now trading with a 20 handle once more, after beginning Friday above 24.

There’s more solid gains seen across US indices ahead of the Wall Street open with the US30 leading the way while the VOLX has declined to trade with a 20 handle once more. Source: xStation

There’s more solid gains seen across US indices ahead of the Wall Street open with the US30 leading the way while the VOLX has declined to trade with a 20 handle once more. Source: xStation

The US500 is the broadest gauge of large-cap US stocks and has enjoyed a strong bounce of late after tumbling for much of December. The rally began on Boxing day with a stunning move higher which marked the start of the reversal. Price is now back around the highs seen from the last Fed meeting at 2589 when Chair Powell seemed to suggest that the bank wouldn’t alter course to provide support for the markets even after their travails. More recent comments last week seemed to mark something of a U-turn on this and with it expectations for further rate hikes have dropped markedly with derivatives now seeing no increases in 2019.

The region from 2589-2624 provided support on several occasions before being broken below last month, and the rally seen on the day of the December FOMC meeting peaked back at the lower reaches of this level. For these reasons one could suppose that this may now offer resistance and any reversal signals from here up until 2624 could provide attractive entry opportunities for those looking to short. Having said that a break above 2624 would open up the possibility of further upside, with a push to 2823 not out of the question should this occur.

The US500 is approaching possible resistance in the 2589-2624 region after a strong rally of over 250 points in just 9 days! Source: xStation

The US500 is approaching possible resistance in the 2589-2624 region after a strong rally of over 250 points in just 9 days! Source: xStation