Summary:

- US indices dragged higher by dovish ECB

- US500 revisits recent highs near 2800

- However, possible reversal signal printed yesterday

The incredible rally seen in European indices since the ECB caught markets off guard with a more dovish than expected announcement earlier today, has lifted indices all over with the US trading higher a couple hours into their cash session. However, the US500 remains not far from its last swing high and a bearish engulfing D1 candle following last night’s Fed decision could offer some warning signs to longs. The region from Wednesday’s high of 2793 to the March high of 2804 could be seen to be an important resistance zone an until this is cleared above then the outlook remains unclear.

US500.cash is showing some reversal signs near prior resistance around the 2800 handle. Unless price can break up through here, then a pullback could lie ahead. Source: xStation

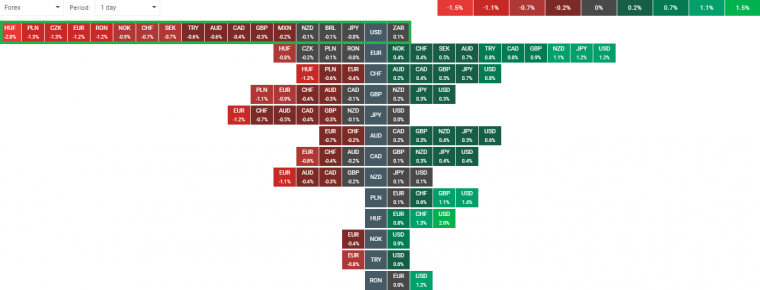

The drop in the EURUSD is largely due to the ECB announcements earlier, but it is due in part to a strengthening US dollar. The buck received some positive news earlier in the form of strong US data and it is actually enjoying a pretty good day in its own right. Only the South African Rand is strong than the greenback today and there are some pretty large declines seen also. Even the pound is now lower against USD, after earlier rallying strongly on its own retail sales beat.

USD is enjoying a strong day of gains and further strength could cap rallies in US stocks. Source: xStation

The US dollar has been pulling back in recent sessions and after the dust settled was lower last night following the Fed decision to hike. Should we get another bout of strength in the buck then it may provide some resistance to further gains for US stocks and this could be another thing to keep an eye on going into the weekend.

Disclaimer

This article is provided for general information purposes only. Any opinions, analyses, prices or other content is provided for educational purposes and does not constitute investment advice or a recommendation. Any research has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Any information provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk, we do not accept liability for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.