Summary:

-

US indices dragged lower by Europe once more

-

US500, US100 and US30 all in negative territory on the day

-

Has the US30 bounced from support?

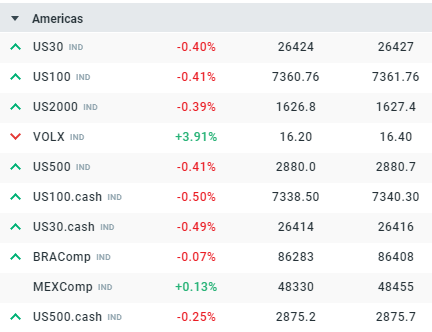

A recurring theme of late has seen weakness which emanates from Italy, weighing on fellow European bourses and also stocks across the Atlantic. Looking at a snapshot of the American indices, it is apparent that most are lower with only the volatility index (VOLX) and MEXComp in the green. The declines are fairly controlled at the moment with losses of around 0.4% seen in the US30, US100 and US500 - the small cap US2000 is also down by a similar amount.

The majority of US indices are in the red ahead of the cash open, with only a couple of bright spots seen. The declines are fairly measured and no bigger than 0.5%. Source: xStation

The past 3 sessions for the US have seen the markets begin under pressure before making a low not long after the European close (4:30 PM) and then recovering into the Wall Street closing bell. This pattern has caused long wicks to be drawn below the daily candles for the US30 and is indicative of the buying pressure. From a price action point of view this could be seen as positive as even though shorts are able to push the market lower, it has recovered and ended a fair distance of its lows.

Long wicks can be seen below recent D1 candles for the US30 with yesterday seeing the market recoup its entire decline and eke out a green close. Price has pulled back to the 21 EMA (Yellow line) but remains in a longer term uptrend for now. As long as low of 26224 aren’t broken below with conviction this then a recovery could lie ahead with 26556 and 26685 levels to keep an eye on to the upside. Source: xStation

Long wicks can be seen below recent D1 candles for the US30 with yesterday seeing the market recoup its entire decline and eke out a green close. Price has pulled back to the 21 EMA (Yellow line) but remains in a longer term uptrend for now. As long as low of 26224 aren’t broken below with conviction this then a recovery could lie ahead with 26556 and 26685 levels to keep an eye on to the upside. Source: xStation