Investor sentiment across U.S. equities is mixed today, despite a record-breaking rally in Nvidia (NVDA.US), which became the first company in history to surpass $4.5 trillion in market capitalization, surging more than 2%. The U.S. technology sector is performing solidly; CoreWeave (CRWV.US) shares are up over 12% following reports that the company will provide computing power for Meta Platforms (META.US). On the other hand, Intel shares are down nearly 3%, likely due to profit-taking after recent gains.

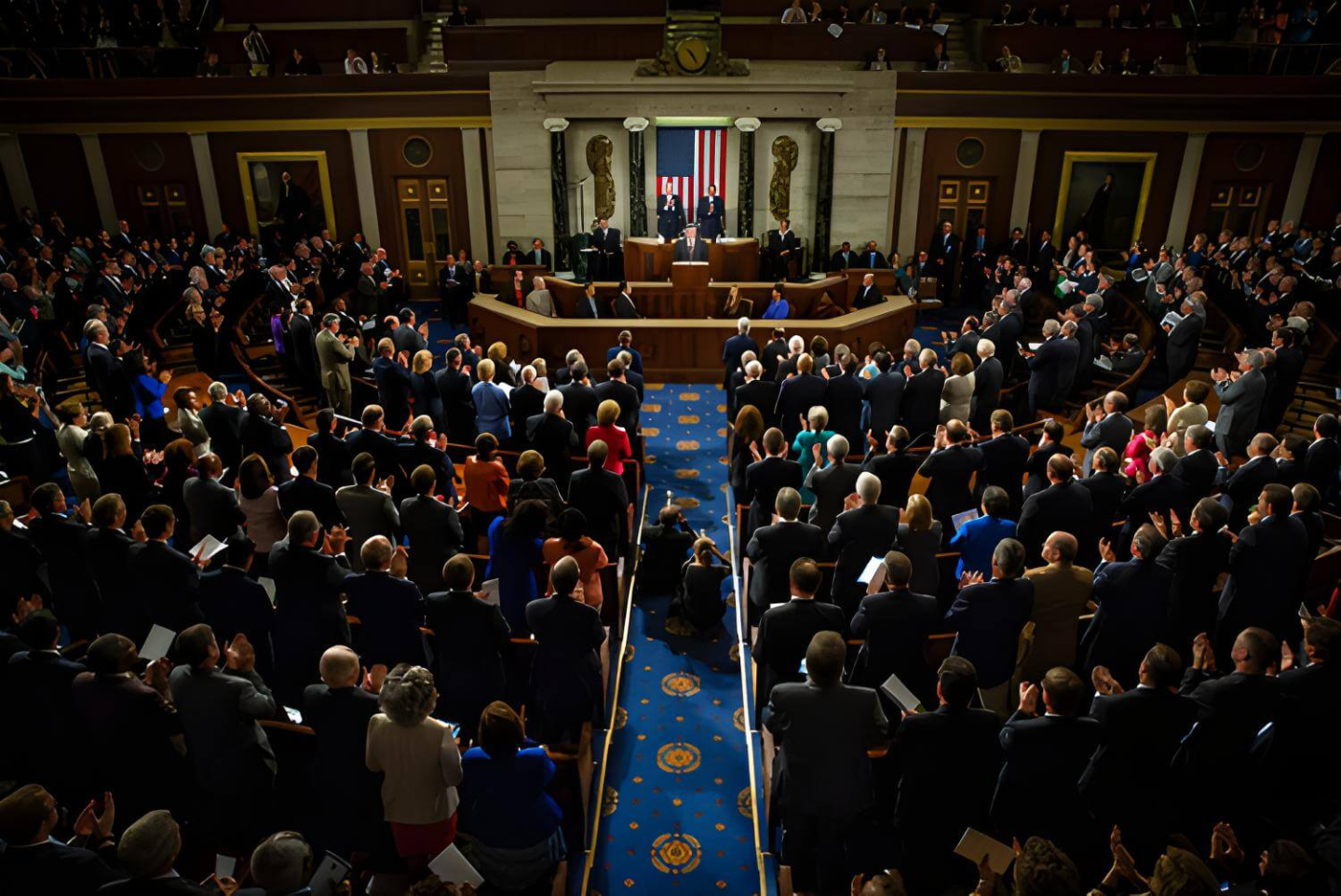

Meanwhile, Senate Minority Leader Chuck Schumer warned that the United States is currently on track for a government shutdown. On the Kalshi prediction platform, participants are now pricing in an 80% probability of a shutdown after midnight on October 1. Initial gains triggered by the JOLTS data, Conference Board consumer confidence, and the Chicago Fed’s regional index have largely faded.

Short-term concerns about a government shutdown, uncertainty around the timing of macroeconomic data releases (among other, still uncertain NFP reading this Friday), potential labor market issues, and the duration of any possible closure are all weighing on Wall Street. The US100 index is struggling to maintain gains, currently trading around 24,780 points, down 0.13%. At the same time, USDIDX futures are also down nearly 0.1%. Gold is benefiting from this uncertainty, poised to close out September with a gain of nearly 10%.

Source: xStation5

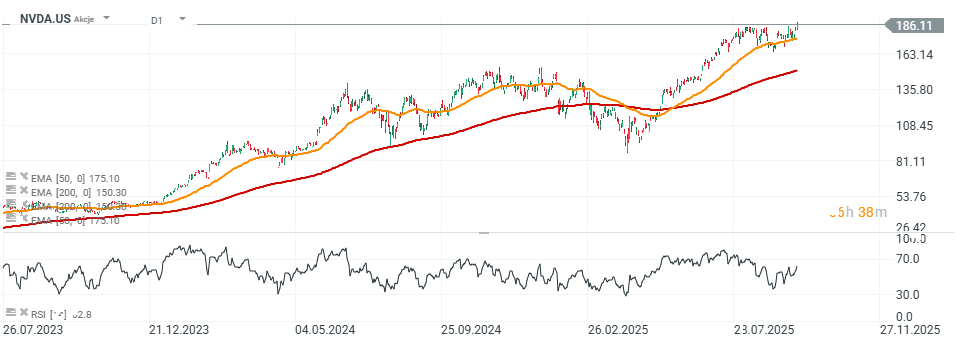

In recent days, Nvidia shares tested the 50-session exponential moving average (EMA50) near $175, rebounded, and are now trading at all-time highs above $186 per share. Source: xStation5

Source: xStation5

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report