During today's session, we can observe a sharp decline in the stock market, led by US tech companies, despite the fact that no information has appeared that would be responsible for the drops. It is often said that the "New Year's" wave of optimism passes at the end of the first month of the second quarter and often leads to a sell-off in line with the well-known saying 'Sell in May and Go Away'. On the other hand, it could be a result of profit taking and the uncertainty associated with huge debt, rising inflation and higher taxes. Also doubts whether tech stocks will be able to continue growing earnings bubbled to the surface.

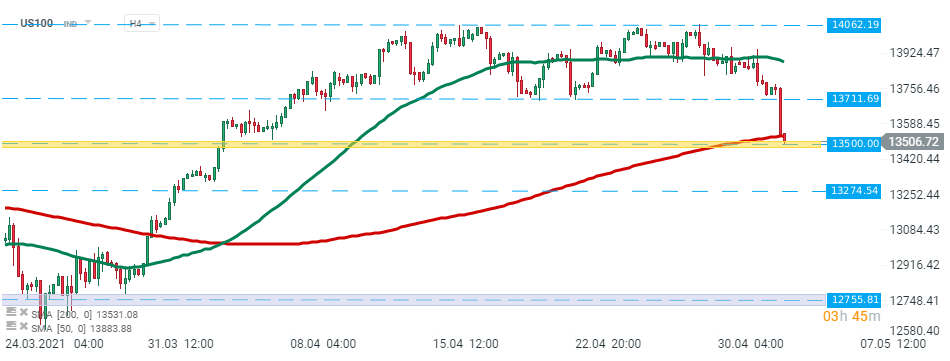

US100 fell sharply at the beginning of the US session and is currently testing major support at 13500 pts which coincides with 200 SMA (red line). Should break lower occur, downward move may be extended to the 13274 pts level or in the midterm to the support at 12755 pts. On the other hand, if buyers will manage to halt declines here, then another upward impulse towards resistance at 13711 pts could be launched. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers