- China announced sanctions on U.S. entities linked to one of South Korea’s largest shipbuilders

- Investors fear that the trade escalation between US and China will persist longer

- Goldman Sachs and BlackRock shares are down in pre-market despite solid Q3 earnings reports

- China announced sanctions on U.S. entities linked to one of South Korea’s largest shipbuilders

- Investors fear that the trade escalation between US and China will persist longer

- Goldman Sachs and BlackRock shares are down in pre-market despite solid Q3 earnings reports

US stocks tumbled after China intensified its trade dispute with the United States, reigniting fears of a renewed confrontation between Beijing and Washington. The escalation comes at a time when equities already appear stretched in valuation following a months-long rally. China announced sanctions on U.S. entities linked to one of South Korea’s largest shipbuilders and signalled that further measures could follow. What's important, last time the US announced military partnership with South Korea in navy ship-building.

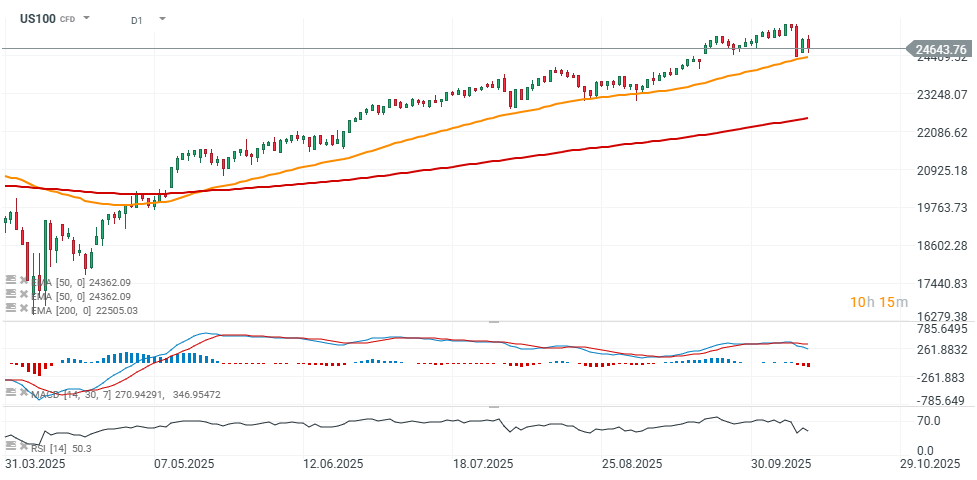

Investor focus is now turning toward the unofficial start of earnings season, with BlackRock shares down almost 1% in after-market trading despite a rock-solid earnings report from Q3; also, Goldman Sachs shares are down 2% after the report. Traders will be watching closely for insights on the sustainability of AI-related investments and the potential fallout from higher trade tariffs in the months ahead. US100 falls 1% today, falling to 24,600 points and try to maintain above EMA50. Falling below 24,300 points may potentially open the way for a larger sell-off.

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report