Over the last two weeks, the Nasdaq 100 has lost over 8%, and a negative market sentiment led to the breaking of a key support line. The declines were accelerated mid-week following disappointing results from some companies, including Alphabet. Today, however, investors regained hope after Amazon published its quarterly report. Along with it, other companies that reported better quarterly results, such as DexCom, Intel, and Meta Platforms, also saw gains.

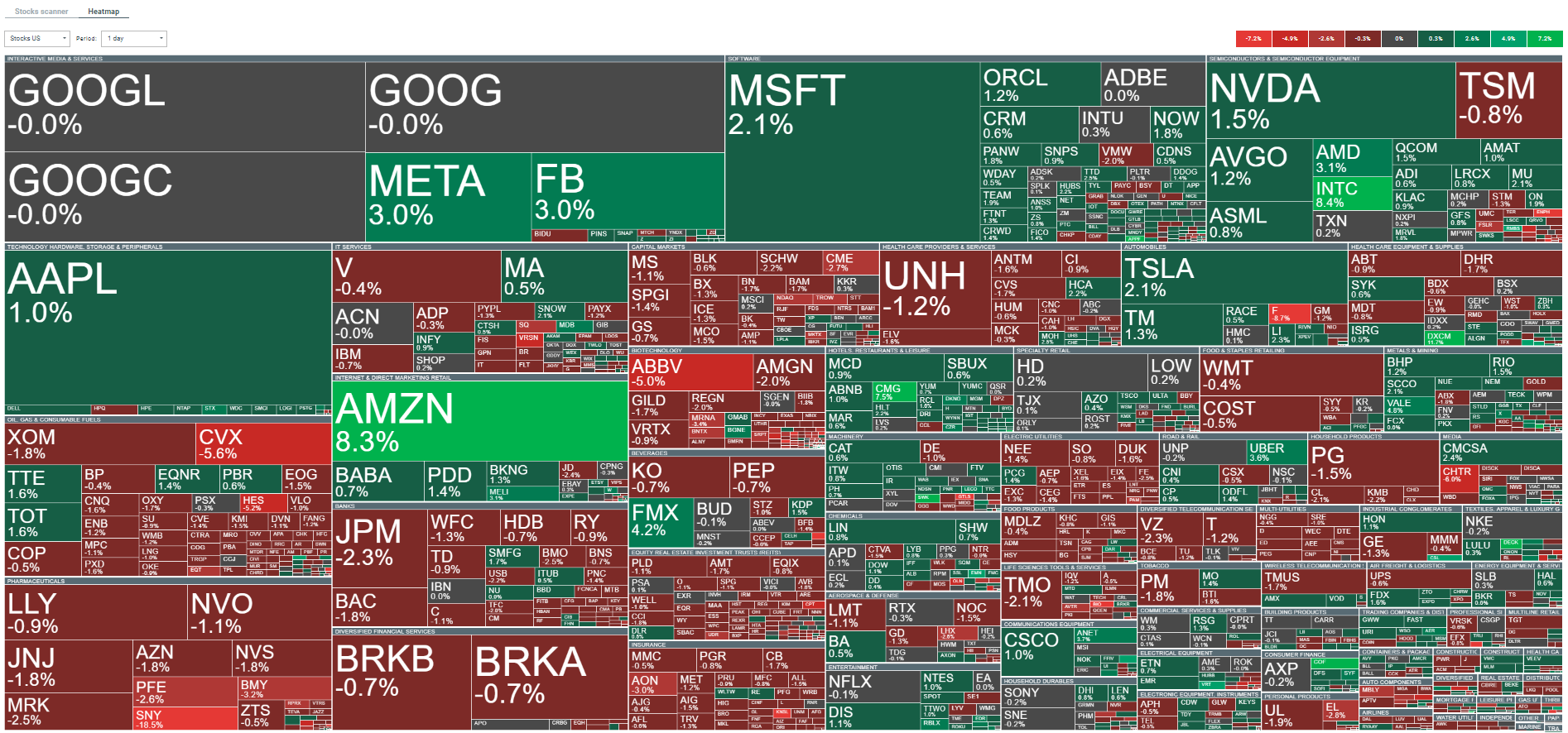

Looking across all companies in the American market, once again, the biggest intraday increases are attributed to mega caps, i.e., companies with the highest market capitalizations. Among these companies, Amazon (AMZN.US) stands out today, gaining over 8.6% after publishing its results. Source: xStation

US100 contracts gain 1% intraday and are trading in the zone between the 200-day exponential moving average (golden curve) and the 61.8% Fibonacci retracement of the downtrend that began in November 2021. Source: xStation

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Daily summary: Weak US data drags markets down, precious metals under pressure again!