Market reaction to the Fed's decision has been muted. The dollar initially ticked lower, while stock indices gained when the Fed announced it would begin tapering quantitative tightening (QT) on June 1. However, the market was expecting that it would happen soon, as the Fed had indicated at its previous meeting (minutes) that it would likely begin tapering soon. The pace of balance sheet reduction through Treasuries will be $25 billion, which is less than the $30 billion that had been expected (the pace is still $60 billion per month until June 1).

However, the key takeaway for the market is the statement that the Fed sees no progress on inflation and that it is not appropriate to consider rate cuts until the data justifies it. This news is negative for the stock market. In addition, today's ISM manufacturing data was also negative for the stock market as it showed worse prospect for the economy and higher price pressure.

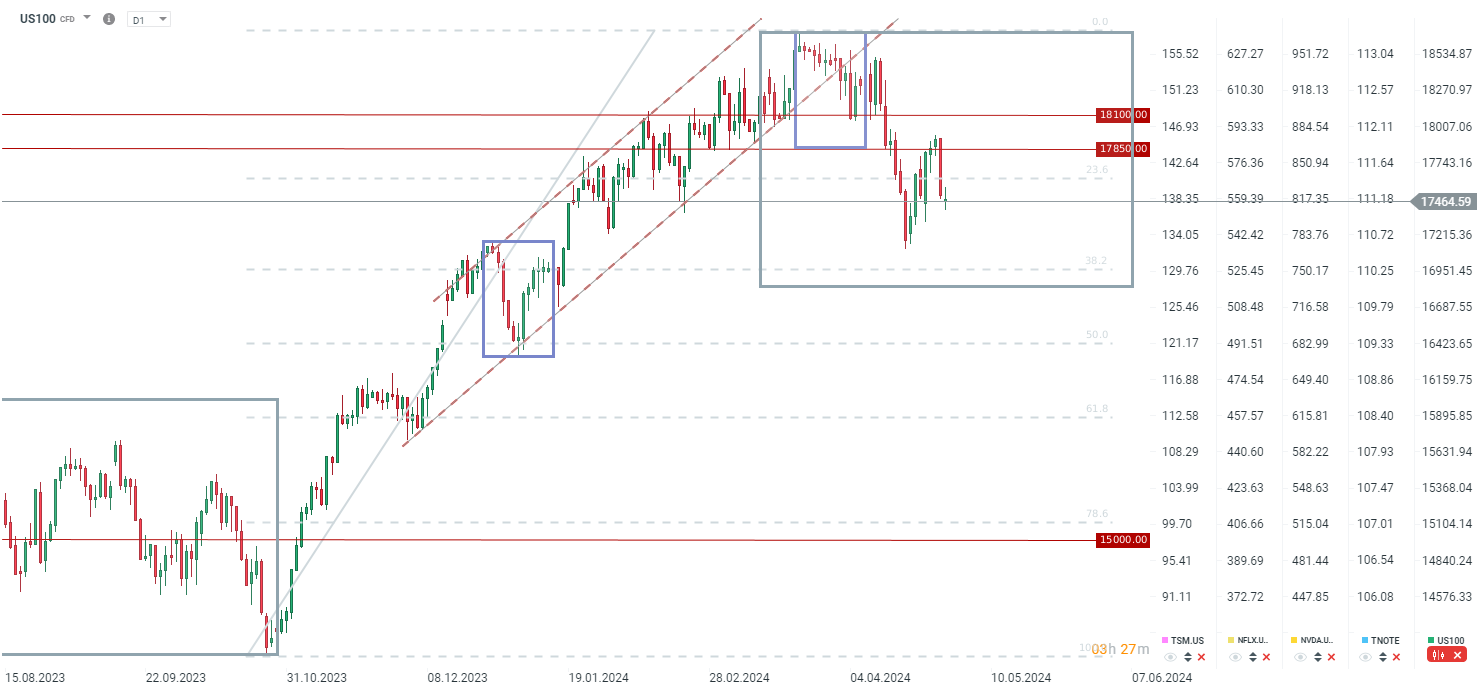

US100 jumped to around 17,500 points quickly, after the decision was released, but it fell back to pre-decision levels a few minutes later, remaining under pressure after yesterday's sharp declines. It is worth noting that chip-related stocks, such as SMCI (-14%) and AMD (-7%), which reported earnings yesterday, are down sharply.

Daily summary: Banks and tech drag indices up 🏭US industry stays strong

Three Markets to Watch Next Week (16.01.2026)

US OPEN: Bank and fund earnings support valuations.

MIDDAY WRAP: Capital flows into European technology stocks 💸🔎