A higher-than-expected US CPI report for March triggered a big reaction in the markets. This was another hawkish surprise in a row, with monthly headline and core CPI continuing at a pace of 0.4% MoM. Having said that, it was another hit to market expectations for quicker rate cuts. Money markets are now seeing just 20% chance of Fed delivering the first rate cut at June meeting. Those odds stood at close to 60% before today's inflation release. Right now, money markets price in the first full rate cut for September meeting and less than two full 25 basis point rate cuts by the end of this year.

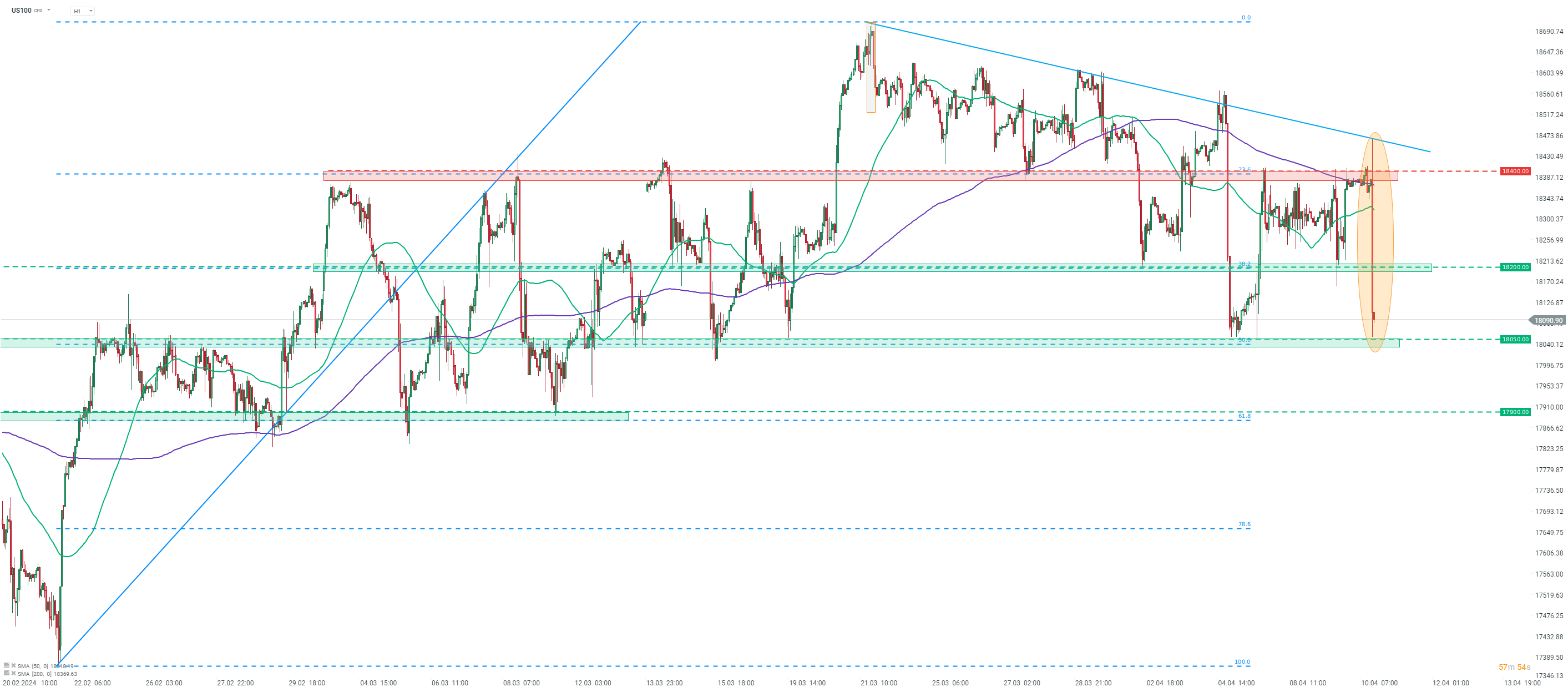

Nasdaq-100 futures (US100) as well as other US indices plunged following CPI release. Taking a look at US100 chart at H1 interval, we can see that the index plunged from the 18,400 pts area, marked with 23.6% retracement of the recent upward impulse, previous price reactions and 200-hour moving average (purple line). Index slumped below 18,200 pts support zone and painted a daily low in the 18,050 pts area, near Friday's lows.

Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers