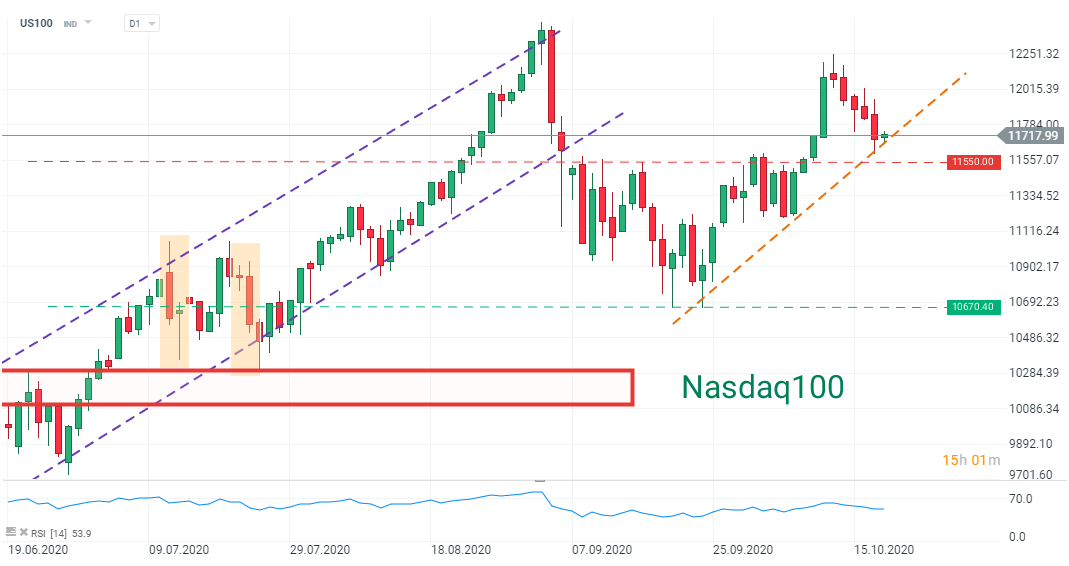

Global markets started Monday trading in upbeat moods but this positive sentiment quickly evaporated as mounting COVID cases once again stopped buyers. Furthermore, iPhone12 has been receiving mixed opinions and that’s been weighing on Apple (AAPL.US) stock and thus on the US100 index.

The index saw 5 days of consecutive declines although this sell-off was relatively mild. A lot seems to be at stake – the last time such streak happened was February and on the day number six the US100 slid some 5%! Meanwhile, the index is still in upwards trend, currently testing the trendline and being close to a solid support 10550 level that used to be a strong resistance but was broken earlier in October. Investors are awaiting quarterly reports from Netflix (NFLX.US) today after the US close and Tesla (TSLA.US) tomorrow and these reports can determine the direction for the US100.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?