Investors' attention is turned to woes of the US banking sector following a 60% plunge in SVB Financial shares and subsequent sell-off in shares of other US banks. While this unquestionably is the main story of the day, if not week or month, investors may forget about another big event - release of US NFP data for February, scheduled for 1:30 pm GMT today. What market expects from today's release?

1:30 pm GMT - US, NFP report for February.

-

Non-farm payrolls. Expected: +205k. Previous: +517k (ADP: +242k)

-

Average earnings growth. Expected: 4.7% YoY. Previous: 4.4% YoY

-

Unemployment rate. Expected: 3.4%. Previous: 3.4%

Today's NFP release is one of the two pieces of key US data for Fed, which are still left for release ahead of the March 22, 2023 decision. The second one is US CPI print for February, scheduled for Tuesday, 1:30 pm GMT next week.

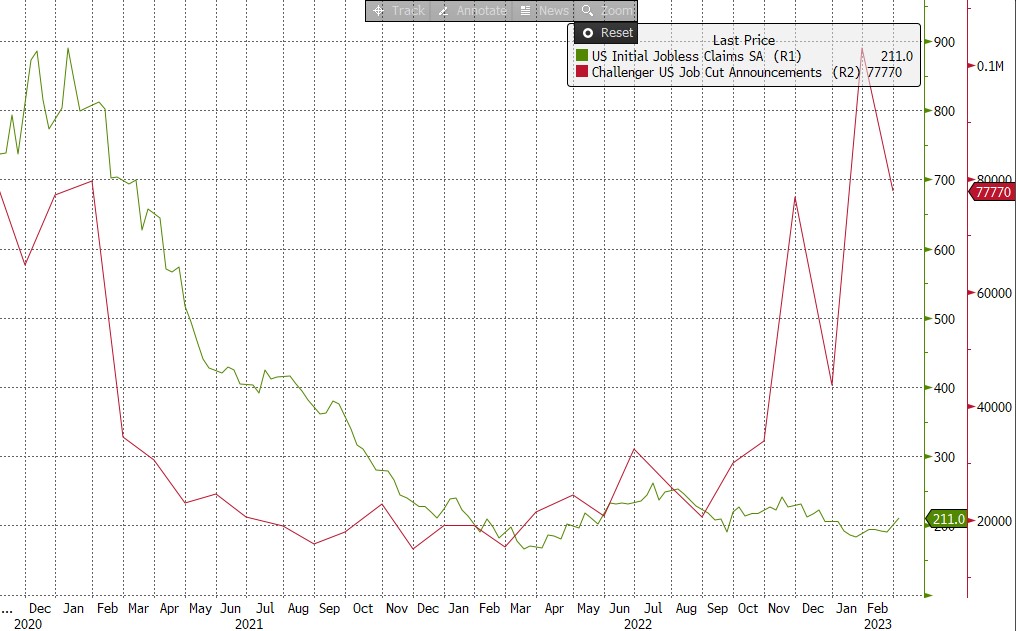

As far as the US labor market is concerned, it remains strong and tight. Jobless claims data that keeps coming in sub-200k proves it, as well as employment subindices in ISM data. On top of that, JOLTS data keeps pointing to an abundance of open positions. Powell was accused during recent hearings in Congress that he may trigger a spike in unemployment as he attempts to get control over the inflation. However, Powell sees a chance for inflation to be brought down while retaining low unemployment. On the other hand, when we take a look at details of the Challenger report we can see that planned lay-offs are on the rise.

Jobless claims remain at low levels, which hints at a strong jobs market in the United States. On the other hand, the Challenger report shows that job cut announcements are on the rise. Source: Bloomberg, XTB

Jobless claims remain at low levels, which hints at a strong jobs market in the United States. On the other hand, the Challenger report shows that job cut announcements are on the rise. Source: Bloomberg, XTB

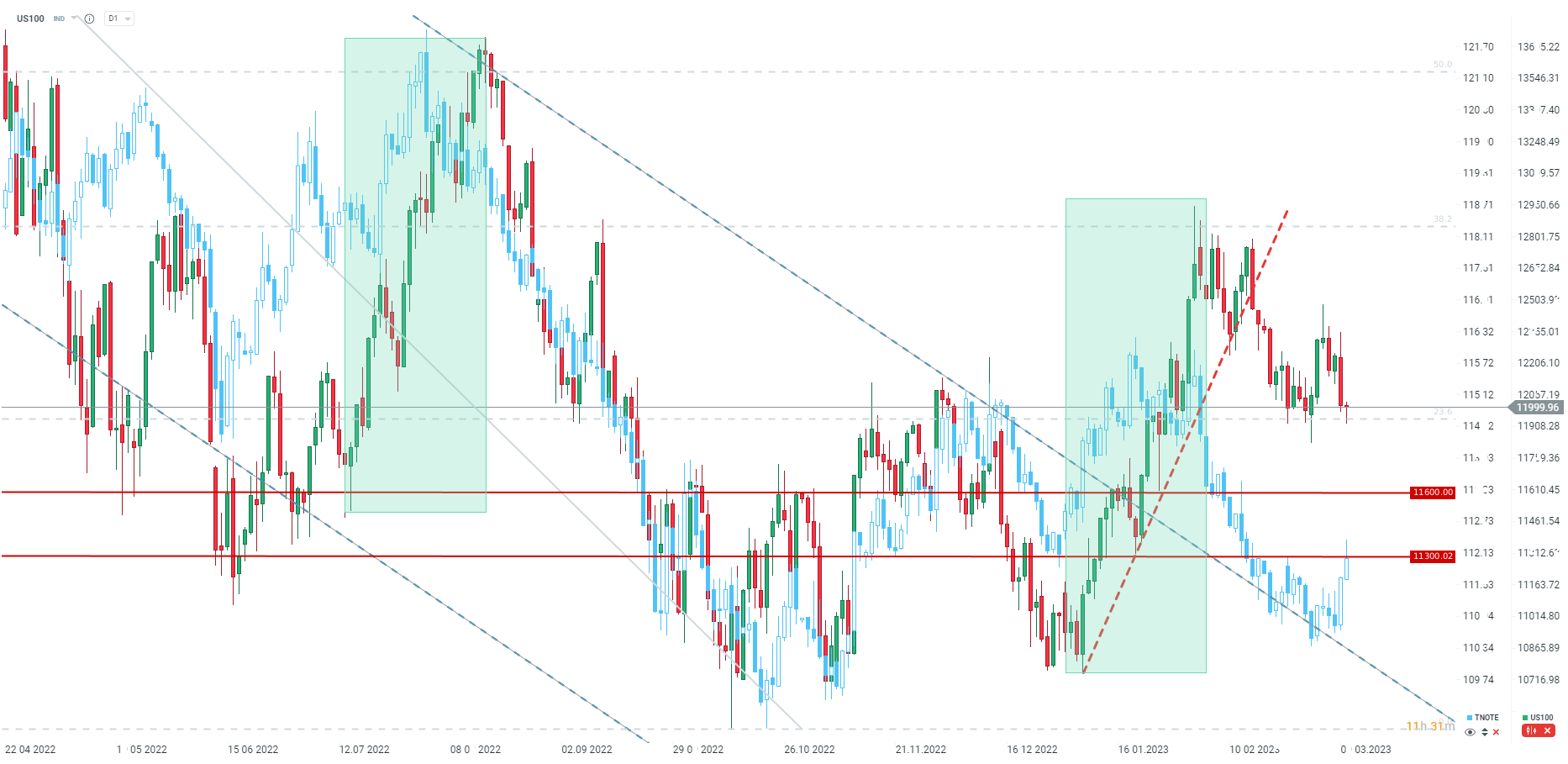

US100

Market is seeing a chance for a 50 basis point rate hike at the FOMC meeting in March. In our opinion, the chance for such a move is if the NFP once again surprises with as strong reading as it was the case in January. Also, inflation data scheduled for next week would likely have to rise or drop less than market expects. Should we see moderate NFP and CPI releases, and SVB case does not turn out to be 'black swan' event, a 25 bp rate hike could be decision FOMC makes in less than 2 weeks from now.

US100 will attempt to defend 23.6% retracement and climb back above 12,000 pts. Failure to do so could see index drop to as low as 11,600-11,700 pts, what would help close divergence with TNOTE.

Source: xStation5

Daily summary: Wall Street tries to stop the sell-off 📌Gold down 1.8%, Bitcoin loses 4.5%

US Earnings Season Summary 🗽What the Latest FactSet Data Shows

3 markets to watch next week (14.11.2025)

US Open: US100 initiates rebound attempt 🗽Micron shares near ATH📈